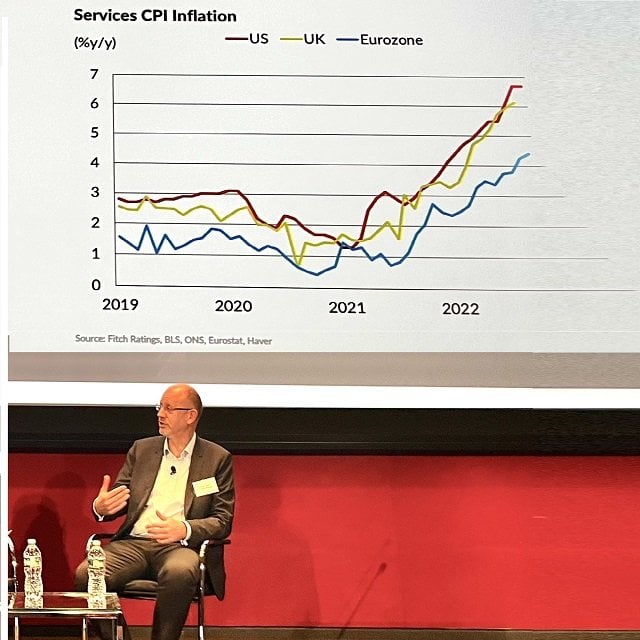

Life Insurers Should Get Used to an Inflationary World: Fitch Economist

Brian Coulton has looked at the economic weather for Fitch Ratings insurance analysts, and he sees interest rates staying high throughout 2023.

The Chicago-based firm’s chief economist gave his forecast today, at a Fitch insurance conference in New York.

Coulton predicted that the Federal Reserve Board will push up the main benchmark rate it controls over 5%, from about 4% today, in an effort to stop inflation from getting out of hand. He expects rate increases to lead to a mild recession in the United States.

What It Means

Fitch uses Coulton’s economic forecasts when it rates the strength of life insurers and other companies. That means his ideas can influence how life insurers invest their assets, what they sell your clients, and how much they charge your clients.

His views could hurt clients who borrow money to buy houses or stock, but they could help clients who buy traditional fixed annuities, indexed universal life insurance and non-variable indexed annuities, by increasing what life insurers earn on their own newly invested money.

The Change

Interest rates fell around 2001 in response to the Sept. 11, 2001, terrorist attacks and the bursting of an internet stock bubble. Rates then fell again, to near zero, after the 2007-2009 Great Recession.

The Federal Reserve Board and other central banks once feared deflation more than inflation, but, now, since product prices, and wages, have surged in the wake of the COVID-19 pandemic stimulus infusion, they are more afraid of letting rising prices get out of hand, Coulton said.

Given that backdrop, “I don’t see how we go back to ‘lower for longer,’” he said. “I think we’re going back to an inflationary world.”

What Insurers See

Mark Abbott, a senior vice president at Athene, said he believes that the United States could avoid a recession, but that he agrees with Coulton that the Fed will continue to focus on fighting inflation.