Life Insurance with High Blood Pressure in 2024

Complete this questionnaire and I’ll send you a quote taking your Blood Pressure into account.

Does Blood Pressure Affect Mortgage Protection?

You don’t smoke, you’re in good shape, exercise regularly, eat plenty of greens and you still suffer from high blood pressure or hypertension.

It doesn’t seem fair.

But if you have been diagnosed with hypertension, you can count yourself lucky in a weird way.

Why?

Because you can do something about it!

Because the condition is usually symptomless, most people have no idea they are at risk until it is too late.

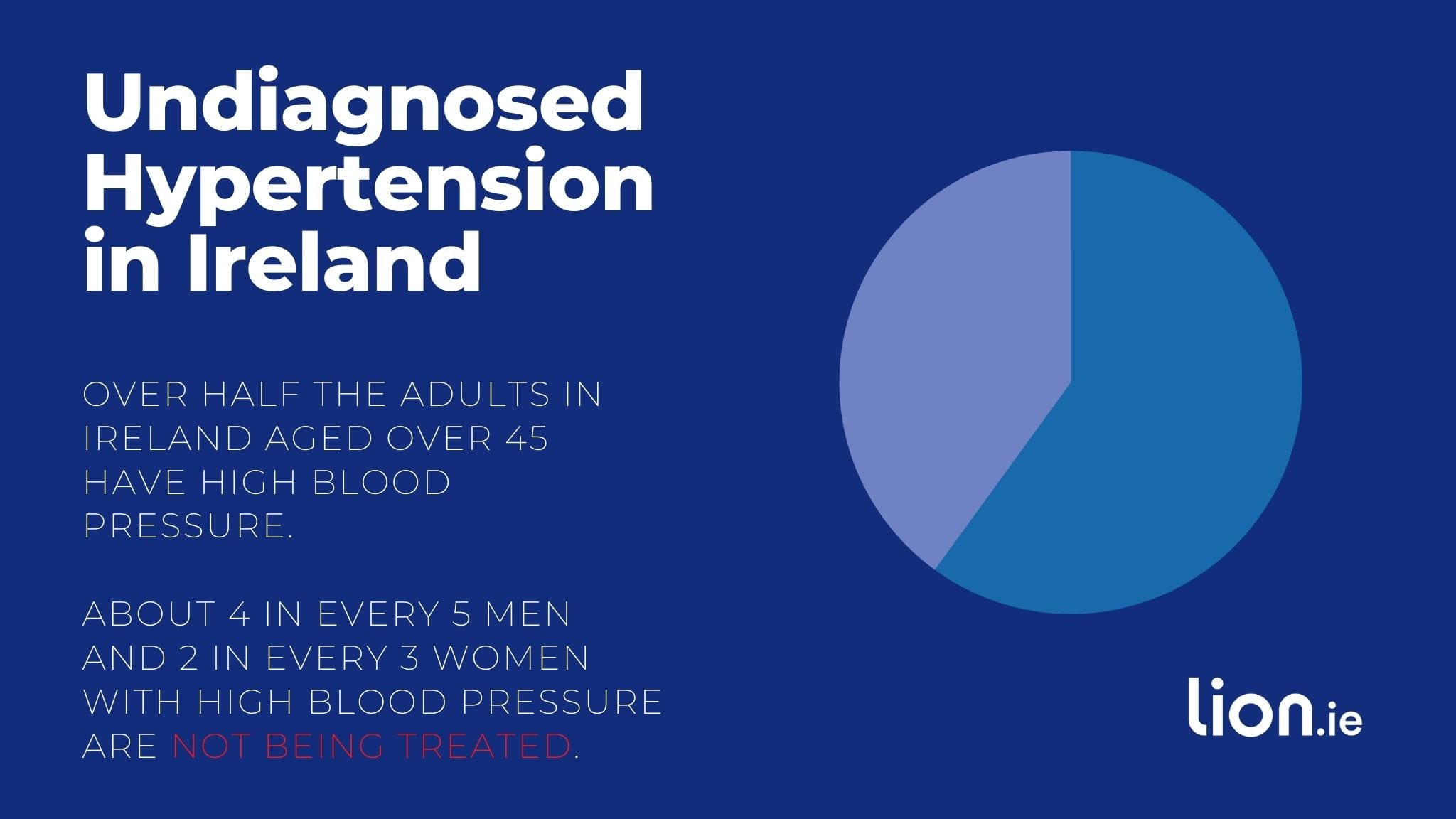

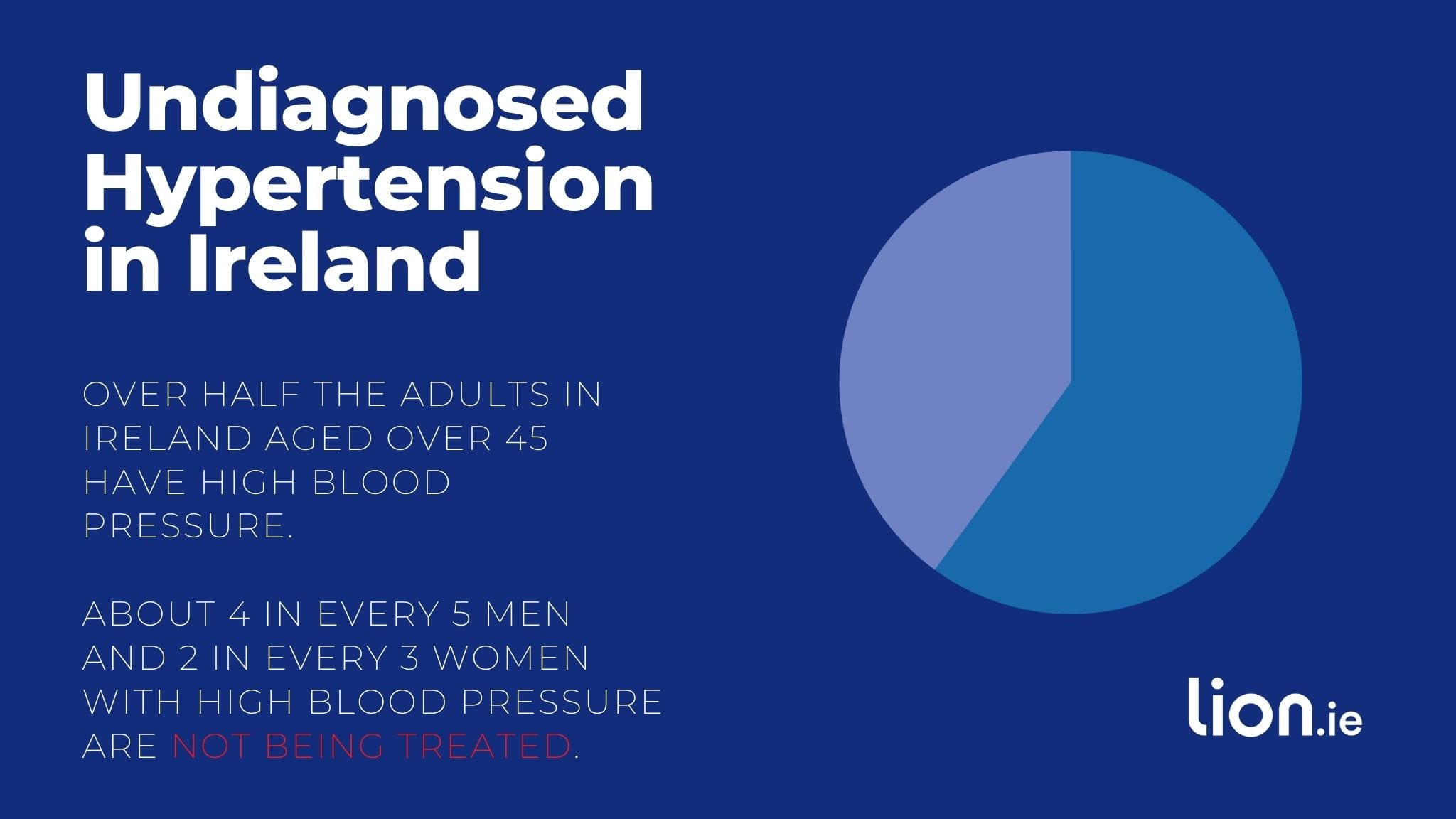

The Irish population has one of the highest rates of high blood pressure internationally, but the country ranks among the lowest in terms of diagnosis, treatment, and control of the condition

So you’re “lucky” even though you may not feel like that right now.

What is Blood Pressure?

Blood pressure is the amount of work your heart has to do to pump blood around the body.

High blood pressure (hypertension) means your blood pressure is consistently higher than it should be.

You can have high blood pressure for many years without any symptoms.

Even without symptoms, damage to blood vessels and your heart continues.

The higher your blood pressure, the greater your risk of heart attack or stroke.

What is Normal Blood Pressure?

Normal blood pressure is usually about 120 over 80.

The 120 represents the heart contracting, pushing the blood out; that’s the systolic pressure.

When your heart is at rest in between beats, that’s the diastolic pressure.

It’s the lower reading, or the 80 if your blood pressure is 120 over 80

What is High Blood Pressure?

Let’s start with the definition of high blood pressure (hypertension).

You’re said to have high blood pressure when your levels are above the normal range for your age and gender.

So you have high blood pressure if your reading is above 140/90 (e.g. 150/90, 160/80)

It’s the first number that’s more important.

Will Hypertension affect my Mortgage Protection application?

It depends on the type of high blood pressure you suffer with:

1. Primary hypertension occurs without a known cause and is treatable.

It accounts for 95% of all cases of high blood pressure.

2. Secondary hypertension occurs where there is a known cause (e.g. heart or kidney disease)

3. White coat/labile hypertension describes one-off elevations during a medical examination.

4. Gestational hypertension is common in pregnancy.

5. Malignant hypertension describes elevated blood pressure with severe organ and arterial abnormalities.

If you need mortgage protection and you suffer with high BP, underwriting will be interested to know:

Do any other health conditions exist?

Is your blood pressure under control for at least 6 months?

Do you smoke?

Are you overweight?

Is your cholesterol raised?

Are there any other risk factors – e.g. family history of early heart disease or diabetes?

If none of those factors applies to you, then you should get the normal price.

However, if you nod your head and answer yes to any of those questions, the life insurer will need more information from you.

This will take the form of a high blood pressure questionnaire.

If you can give up to date information on your meds and your most recent readings this should be enough for the insurers to make a decision.

Otherwise, the insurer will write to your doctor for a medical report.

How Much Extra Will You Pay?

You can get compare life insurance quotes on our quote machine.

If your blood pressure is managed and under control, you may get the price you see on the screen (or standard rates as we call it)

But, your quote could increase by 50 to 100% if your BP is outside the normal range with meds.

If there are contributing factors like high BMI, you will pay more.

What Does lion.ie Do?

We’re the experts when it comes to getting cover for clients with all sorts of health conditions.

So we know which insurer is most sympathetic to underwriting hypertension.

This means you’ll get life insurance at the lowest possible price with the least amount of hassle.

If you have a pre-existing condition, the first thing we do speak to our panel of underwriters anonymously.

Discussing your medical history helps us to identify the best company to apply to.

This also means you avoid applying to companies that will end up being too expensive or worse, refuse your application.

By completing our research thoroughly, we are able to save time and obtain the best possible terms for you with the least amount of hassle.

Over to you…

Are you worried about the price of your life insurance with high blood pressure?

Let me help get you the best coverage with the least amount of hassle.

Complete this blood pressure questionnaire, and I’ll be right back.

Or if you prefer the phone, please schedule a callback here.

Thanks for reading

Nick

Editor’s Note | We published this blog in 2016 and have updated it since.