LIC’s New Plan Jeevan Kiran (Plan No. 870)

Jeevan Kiran is the New plan of the Life Insurance Corporation of India. Jeevan Kiran, Plan No. 870 is a Non-linked, Non-Participating, Individual, Savings, Life Insurance plan. This plan provides financial support to the family in case of unfortunate death of the life assured during the policy term and returns the total premiums paid if the life assured survives till the date of maturity. The unique Identification Number (UIN) of LIC’s Dhan Vriddhi is 512N353V01.

There are two different premium rates in LIC’s Jeevan Kiran, the first is Non-Smoker Rate, and another obviously Smoker Rate. Proposers choosing the Non-smoker rate will have to undergo an additional medical test ie Urinary Cotinine Test (UCT). Based on the findings of the UCT test, a Non-smoker or smoker rate will be offered by LIC. If the proposer opts to choose not to take the UCT test, then a smoker rate will be offered only.

Eligibility Conditions of LIC’s Jeevan Kiran

Eligibility Conditions and Restriction for LIC’s Jeevan Kiran

Eligibility Conditions and Restriction for LIC’s Jeevan Kiran

The maximum Basic Sum Assured allowed to each individual will be subject to an underwriting decision as per the Underwriting Policy of Life Insurance Corporation of India

The Basic Sum Assured shall be in the multiple of amounts specified below:

Basic Sum Assured multiple in LIC’s Jeevan Kiran

Basic Sum Assured multiple in LIC’s Jeevan Kiran

Date of Commencement of Risk:

The risk will commence immediately from the date of issuance of the policy.

Mode of Premium Payment:

Premiums can be paid either under Regular Premium or Single Premium payment options under this plan. In the case of Regular Premium payment, the premium can be paid regularly during the Policy Term with modes of premium payment yearly or half-yearly.

The minimum premium in a Single Premium policy is Rs. 30000, while the minimum premium in a Regular Premium policy is Rs. 3000. If the calculated premium is less than the mentioned amount then it can be by changing Basic Sum Assured or term.

Maturity Benefit in LIC’s Jeevan Kiran

When the life assured survives the stipulated maturity date, the insurer will pay the “Sum Assured on Maturity” provided the policy is in force, where the “Sum Assured on Maturity” equals the “Total Premiums Paid” for Regular Premium Payment policies, and the “Single Premium Paid” for Single Premium Payment policies. Where

In this definition, “Total Premiums Paid” refers to the total of all premiums received, excluding any extra premium, any rider premium, and any taxes.

In this case, “Single Premium Paid” refers to the single premium received and excludes any additional premiums, rider premiums, or taxes.

Death Benefit in LIC’s Jeevan Kiran

During the policy term after the commencement of risk but before the stipulated Date of Maturity, the death benefit shall be “Sum Assured on Death”, provided the policy is in force.

Under the Regular Premium Payment policy, “Sum Assured on Death” is defined as the highest of:

7 times of Annualized Premium; or

105% of “Total Premium Paid” upto the date of death; or

Basic Sum Assured.

For the Single Premium Payment policy, “Sum Assured on Death” is defined as the higher of:

125% of Single Premium; or

Basic Sum Assured.

Optional Rider Benefits in LIC’s Jeevan Kiran

The following riders are available under this plan for an additional premium:

Single Premium Payment: LIC’s Accidental Death and Disability Benefit Rider (UIN:512B209V02) is available under single premium payment. Although policyholders can opt for this rider at the inception (at the time of taking policy) only.

Regular Premium Payment: The policyholder can opt between either of the LIC’s Accidental Death and Disability Benefit Rider (UIN: 512B209V02) OR LIC’s Accident Benefit Rider (UIN: 512B203V03) under regular premium payment.

Riders are available only if the proposer is eligible for them as per the individual eligibility conditions of the particular rider.

Settlement Option in LIC’s Jeevan Kiran

Maturity Benefit settlement Option: An in-force or paid-up policy that offers the Settlement Option can allow Life Assured to receive the Maturity Benefit in installments over a period of five years rather than as a lump sum. Regardless of whether the policy pays out the full or part of the maturity proceeds, Life Assured may exercise this option. A Life Assured can choose a net claim amount (i.e. the amount they opt for) either as an absolute value or as a percentage of the total claim proceeds to be paid out.

Death Benefit settlement option: This is an option to receive Death Benefit in installments over a period of 5 years instead of a lump sum amount under an in-force as well as paid-up policy. This option can be exercised by the Life Assured, during his/her lifetime; for full or part of the Death benefits payable under the policy. The amount opted by the Life Assured (i.e. Net Claim Amount) can be either in absolute value or as a percentage of the total claim proceeds payable.

Rebate available in LIC’s Jeevan Kiran

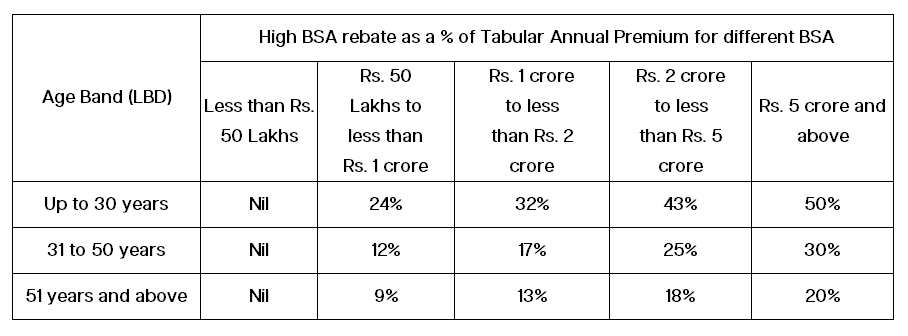

Under Regular Premium payment: The rebate for high Basic Sum Assured (BSA) as a % of Tabular Annual Premium is as under:

Rebate under the Regular Premium payment policy

Rebate under the Regular Premium payment policy

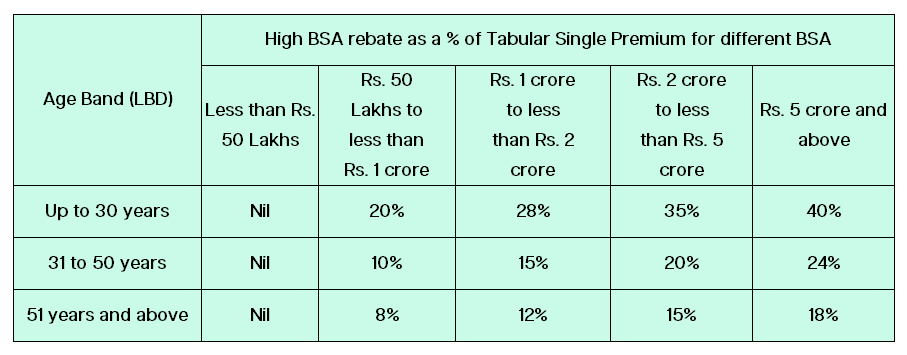

Under Single Premium: The rebate for high Basic Sum Assured as a % of Tabular Single Premium is as under:

Rebate under the Single Premium payment policy

Rebate under the Single Premium payment policy

Other Conditions in LIC’s Jeevan Kiran

Paid up: If the two full years of premium are paid then the policy will continue for the paid SA till maturity.

Surrender: Policy can be surrendered during the policy term if the full first two years of premium are paid in a regular premium payment policy. In a single premium policy, it can be surrendered at any time during the policy term.

Loan: A loan facility is not available in this policy.

Free Look Period: If a Policyholder is not satisfied with the “Terms and Conditions” of the policy, he/she may return the policy to the LIC of India stating the reasons for objections, within 30 days from the date of receipt of the electronic or physical mode of the Policy Document, whichever is earlier.

Nomination: Nomination by the holder of a policy of life assurance on his/her own life is required as per Section 39 of the Insurance Act, 1938, as amended from time to time.

Assignment: An assignment is allowed under the plan as per Section 38 of the Insurance Act, 1938, as amended from time to time.

Online Sale: The Jeevan Kiran policy is available for sale through the LIC portal also.

Backdating of the policy: The policies can be dated back within the same financial year but not before the Date of Introduction of this Plan.

Forfeiture in certain Events: In case it is found that any untrue or incorrect statement is contained in the proposal, personal statement, declaration, and connected documents or any material information is withheld, then and in every such case the policy shall be void and all claims to any benefit by virtue thereof shall be subject to the provisions of Section 45 of the Insurance Act, 1938 as amended from time to time.

If you have any other questions related to LIC servicing then just mail us at [email protected]. You can also comment below. Share if you liked this information useful because Sharing is caring!

Disclaimer: This blog post is written based on the information available. In case of any discrepancy or the wrong information, please contact any authorized LIC agent or the nearest LIC office for clarification.