Lawmakers Try Again on Medicare End-of-Life Planning Benefit

What You Need to Know

Mark Warner, Susan Collins and Earl Blumenauer have been working on similar legislation for more than 10 years.

Medicare Part B has been paying for end-of-life planning since 2016.

Researchers found that, in 2017, fewer than 3% of Medicare enrollees used the benefit.

Members of Congress hope to sell more Medicare enrollees on the idea of getting help with end-of-life planning — but they have not included financial planners, long-term care insurance agents or other financial professionals on the list of providers who can bill Medicare for delivering the planning services.

Sens. Mark Warner, D-Va., and Susan Collins, R-Maine, joined to introduce S. 4873, the Improving Access to Advance Care Planning Act bill, earlier this month.

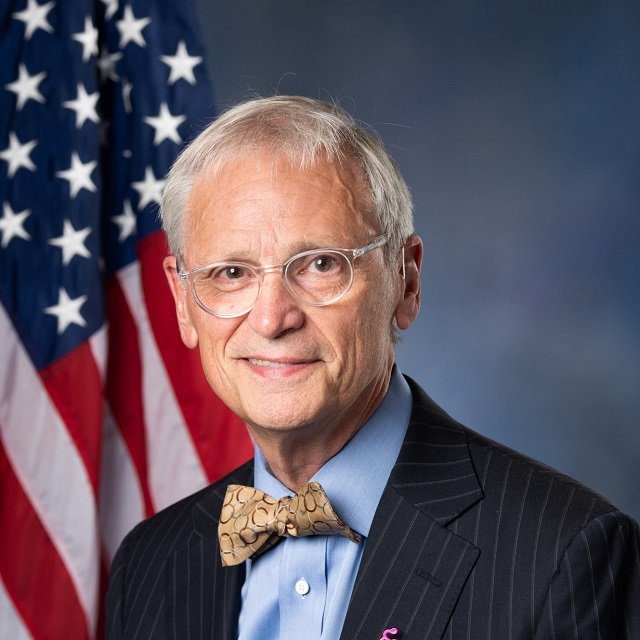

Rep. Earl Blumenauer, D-Ore., is introducing a similar bill, H.R. 8840, in the House.

The bills would pay for the kinds of discussions about care and legal documents that tend to occur around the end of a patient’s life.

What It Means

Blumenauer said when he introduced H.R. 8840 that expanding the use of advance care planning is a good way to improve the quality of end-of-life care while lowering the cost.

“When more than 90% of health care expenditures are spent on treating chronic conditions, it’s clear that we shouldn’t spend money on unwanted care and instead empower patients and families to think about these decisions before it’s too late,” Blumenauer said.

The Context

Blumenauer, Warner and Collins have all been sponsoring and co-sponsoring end-of-life planning legislation since 2009, and Blumenauer came close to getting an advance care planning provision included in the Affordable Care Act.

Opponents blocked that by accusing supporters of the provision of favoring “death panels.”

The Medicare Part B outpatient and physician services program began covering end-of-life planning in 2016.

Researchers reported last year that, in 2017, fewer than 3% of fee-for-service Medicare enrollees, and fewer than 8% of the fee-for-service Medicare enrollees who died within the calendar year, had used the end-of-life planning benefit.

The current benefit pays 100% of the cost of planning that takes place during an annual wellness visit checkup, but it covers only 80% of the cost of advance care planning that takes place at other times.

That means a patient with “original Medicare” who has no Medicare supplement insurance, or who has not yet exhausted the deductible, might have to pay some cash out of pocket for advance planning session.

Expanding Advance Care Planning

At press time, the text of H.R. 8840 was not yet available.