Kotlikoff Joins Laffey Presidential Campaign as Chief Economic Advisor

“But we’re generally very closely aligned,” Kotlikoff says. “Indeed, I’m very proud to serve as Steve’s economics advisor.”

The Laffey campaign says voters are looking for candidates with sound economic policies and the experience to navigate the complexities of the challenges facing the country. The campaign has already released a comprehensive economic plan that features policy proposals related to Social Security, the Federal Reserve, energy issues and infrastructure.

The Plan for Social Security

Based on the campaign’s website, Laffey’s proposals to address Social Security’s funding woes are based in the plan Kotlikoff has been advocating for years. The basic idea is to reset the retirement contract that America makes with its citizens. The plan includes scrapping Social Security and starting a fundamentally new system based on government-managed individual investment accounts.

To do that, Kotlikoff recommends freezing the current Social Security accounts of those, for example, currently at age 40. When these workers retire, they would get Social Security benefits based on their earnings up to age 40.

Kotlikoff’s plan would generally require workers to put 10% of their pay into their personal retirement account, generally to be matched by employers. The government would make progressive matching contributions on behalf of the poor or unemployed, he says.

These accounts would then be government-invested “by a computer in a global index fund of stocks, bonds and real estate investment trusts” of major markets. Everyone would get the same rate of return, and the government would guarantee a return on contributions.

Between ages 57 and 67, each birth cohort’s balances would be used to purchase Treasury inflation-protected securities (TIPS). In turn, each cohort’s TIPS assets would be used to pay for inflation-indexed life annuities that begin at 62 and are fully phased in by 67.

If a person dies before 67, their heirs receive the balance not yet converted to TIPS.

“In short, our politicians have constructed a fiscal monster,” Kotlikoff recently told ThinkAdvisor. “Its economic damage can’t be eliminated piecemeal, for a simple reason. Each of our fiscal system’s programs contribute to all or most of the system’s problems. … In short, all aspects of the system need to be reformed in unison.”

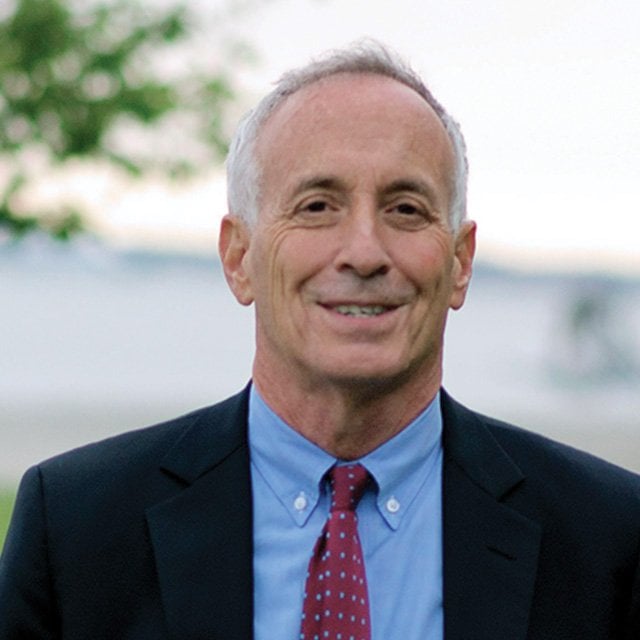

(Pictured: Economist Laurence Kotlikoff)