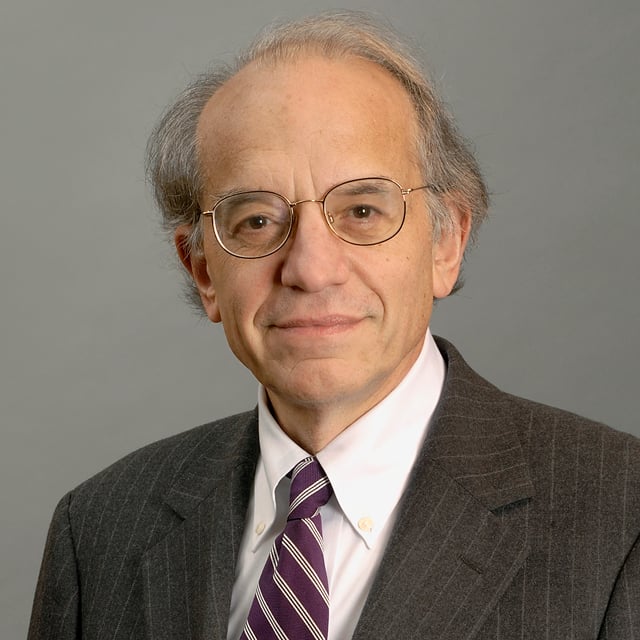

Jeremy Siegel: 'Under-Loved' Bull Market Could See Notable Gains

Siegel previously estimated the Fed’s neutral rate at around 3.5%, but the latest data, with an unexpectedly strong labor market indicating the Fed has made only modest progress toward cooling the economy, has pushed his estimate toward 3.75%, he noted. The central bank indicates a 2.9% rate.

“This recalibration of the neutral rate has direct implications for long-term bond yields. Historically, the 10-Year Treasury yield has traded about 100 basis points above the Fed Funds Rate, and even wider in non-recessionary periods.

“With the Fed Funds Rate likely settling around 3.75%, this puts the 10-Year yield on a trajectory toward 4.75%,” Siegel wrote.

While the presidential election remains close, betting markets are leaning toward a Donald Trump victory, according to the economist, who said a Kamala Harris victory wouldn’t disrupt financial markets if government control is split between the two major parties.

The prospect for extending Trump tax cuts in 2026 “is seen as a tailwind for equities,” Siegel wrote. “While the geopolitical risks remain, there’s a reasonable chance that markets will continue their bullish trajectory into year-end, especially if fears of a recession recede further.”