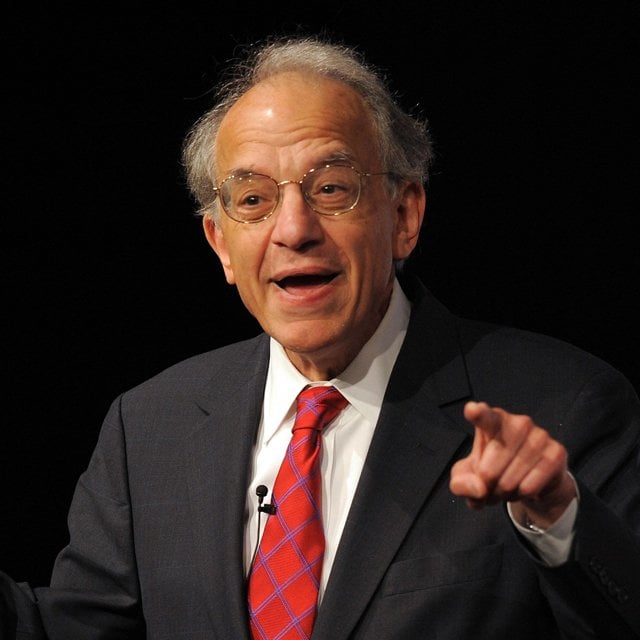

Jeremy Siegel 'Shocked' by Strong Jobs Numbers

At the same time that a strong labor market could push interest rates higher, Siegel added, “it also lowers the probability of a recession. So it is more likely that the earnings estimates are going to be realized than they were before.”

“Stock prices are a fight between the numerator, which is earnings, and the denominator, which is interest rates,” he said. “So the strong payroll report is wow, you know, we could have a strong consumer, we could have the GDP going up much more than the Fed expects, we could have earnings (for the S&P 500 index) really be realized instead of everyone saying, ‘Oh it’s going to go down to $200 or $180.’”

The payroll report indicated the numerator went up, while the Fed might also raise interest rates more aggressively, Siegel noted. “You saw almost a standoff on the stock market,” he said.

He predicted that the PCE report this Friday “will be hot” and that market analysts will say inflation isn’t under control and interest rates are going up. But gas and oil prices, apartment rentals and the Case-Shiller home price index are showing continued disinflation that doesn’t show up in lagging inflation indicators, he said.

“We know that Powell is now acknowledging that [the PCE and CPI] contain lagged data,” Siegel added. “Remember, the Fed only started tightening 11 months ago. To start panicking because (inflation is) not down to 2% in 11 months, I think, is not waiting for the cumulative effect of monetary policy that Powell and the Fed itself has admitted is yet to be felt.”

(Photo: Bloomberg)