Jeremy Siegel: Bar 'Extremely High' for Another Fed Rate Hike

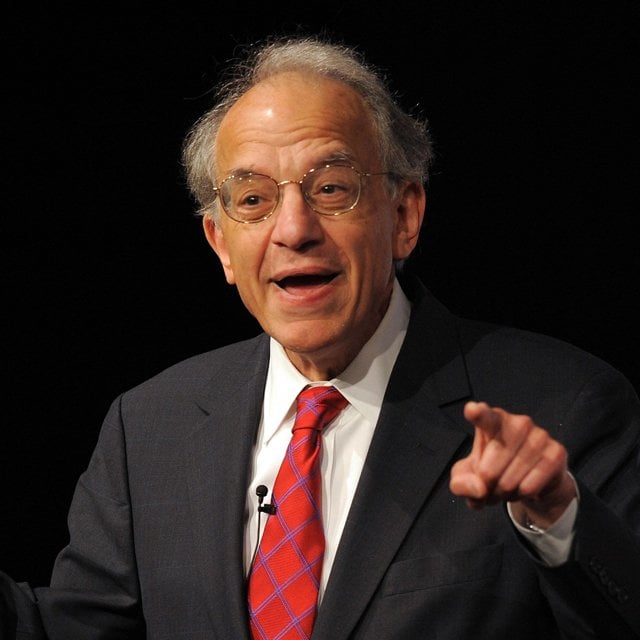

The bar is set “extremely high” for the Federal Reserve to raise interest rates again after its recent 25-basis-point hike, Wharton School economist Jeremy Siegel said Monday on CNBC’s “Squawk Box.”

Siegel, a professor emeritus of finance at Wharton and WisdomTree senior investment strategy advisor, said three unlikely economic scenarios would need to happen for the Fed to raise rates again soon.

April’s Consumer Price Index inflation data, to be released Wednesday, would have to come in “much hotter than expected,” and the May employment report similarly would need to be “very hot,” he said. The CPI data for May, to be released as the Fed starts its next meeting in June, also would need to be much hotter than expected, the economist said.

Siegel sees an extremely low probability that all three events would occur, and if they did, the Fed might add another 25 basis points to its benchmark interest rate, he said.

“I think they’re going to wait a long time and actually start reducing rates later,” Siegel predicted.

The Fed has raised interest rates by a cumulative 500 basis points (or 5%) since March 2022 to wrestle inflation down to the bank’s 2% target; that includes last week’s 25-basis-point increase, which pushed the benchmark interest rate range to 5% to 5.25%.