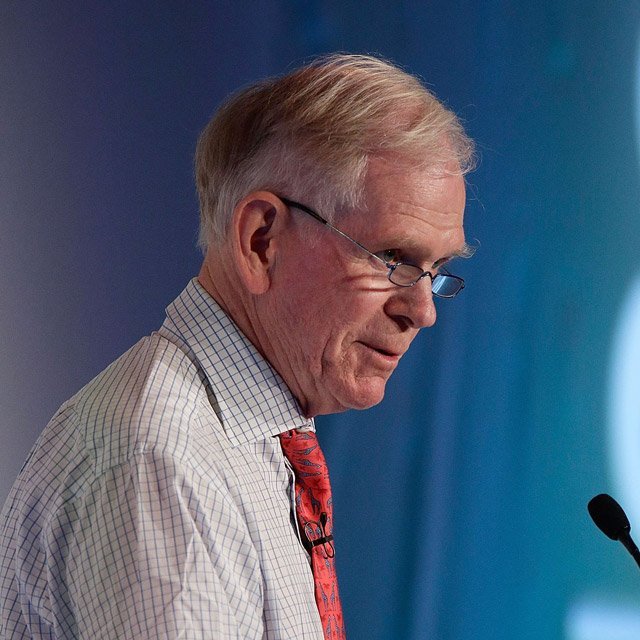

Jeremy Grantham: War in Ukraine Means 'Risk Profile for Everybody Has Gone Up'

Russia’s invasion of Ukraine means that “the risk profile for everybody has gone up because you can’t rule out the Russians being a bit crazy and irrational.

“[President Vladimir] Putin is a borderline psychotic,” legendary value investor Jeremy Grantham, co-founder of the investment and asset management firm Grantham Mayo & van Otterloo, tells ThinkAdvisor in an interview.

“War is a complicated event and full of unintended consequences,” he warns.

Grantham is now uncertain of much of the scenario he posited in January — that is, the market’s “super bubble” is steadily deflating and, in a matter of months, bursting.

“The flight path is not as certain as it was a month ago,” says Grantham, 83, in the interview.

“There’s never been a war thrown in the middle of a major bubble like this,” he says, adding that he needs a little time to “work out the implications.”

A month ago, he was sure the broad market was nearing “giving up the ghost.”

“Now I have to put an asterisk against that,” Grantham says. “We have to be prepared for anything. The war bodes very badly for global growth and global trade, and for price increases.”

While he still argues that the bull market is in its final stage, the “Vampire Phase,” as he puts it, there is “a lot of abnormal support for the Vampire — a blood transfusion — all of it coming indirectly from the stimulus,” he says.

For one, though institutions are selling, “individuals are investing at a more rapid rate into the market decline than they were at the market rise, which is unheard of,” he maintains.

Grantham, who heads GMO, famously forecast the 1989 bubble in Japan, the technology meltdown of 2000 and the U.S. housing market bubble of 2007-2008, as well as calling the March 2009 bottom of the global financial crisis.

In the interview, he offers advice for financial advisors to help worried clients; where the investing opportunities are now; the “danger” of food shortages as a result of the war; why the U.S. is far behind other countries in climate change initiatives and other actions; and prospects for green investing.

ThinkAdvisor interviewed Grantham on March 21. He was speaking from Westport, Massachusetts.

“There’s serious stuff going on,” he noted, explaining it all and what it means for the market.

Here are highlights of our conversation:

THINKADVISOR: Are we still in the Vampire Phase of the bull market, as you called it in your January 20, 2022, paper?

You wrote [that] “you throw everything you have at it: You stab it with Covid, shoot it with the end of QE and the promise of higher rates, and you poison it with unexpected inflation … until, just as you’re beginning to think the thing is completely immortal, it finally … keels over and dies.”

JEREMY GRANTHAM: The day before [Russia’s] invasion [of Ukraine], I thought it looked about as certain as these things get in the market — that the vampire was circling downwards looking a little wounded and that the game was beginning to end.

I was feeling pretty confident that we were pecking our way nicely through the unraveling this year.

But when a war starts, everything is scrambled, and it multiplies all the uncertainties.

We were certainly in the Vampire Phase, but I’m humble enough to say that when a war of this magnitude occurs with ramifications that could extend beyond that, all bets are off.

What’s your forecast for the end of the war?

The outcomes stretch, all the way from, at the good end, regime change in Russia and everyone lives happily ever after to nuclear war at the other end — and everything in between.

This is serious stuff that’s going on.

The risk profile for everybody has gone up because you can’t rule out the Russians being a bit crazy and irrational. Putin is a borderline psychotic.

You can’t rule out their using a tactical nuclear weapon.

Is there still a super bubble, as you said in January?

Yes, and there was a nice, rhythmic deflating going on. But now you have to step back and say, a war is a complicated event, full of unintended consequences.

So I don’t feel as comfortable with the general disposition as I did the day before the invasion.

It felt uncannily like 2000, the last great super bubble.

I was looking forward to that continuing for a few months with the blue chips going down reluctantly or not at all, until, finally, sometime out, maybe in the fall, the broad market would give up the ghost, as it did in 2000.

Instead of that scenario, what do you see now?

It’s not clear. You shouldn’t kid yourself that you can know what’s going on. There’s a nice history of bubbles forming and breaking.

But there’s never been a war thrown in the middle of a major bubble like this.

So I reserve the right to take a while longer to think it through and work out the implications.

I’m sure the implications are bad for resources, and that means pressure for stagflation. It sucks the buying power from individuals. You have prices rising and buying falling, and that’s called stagflation.

I was pretty darn certain that we were in the late stages of a bubble breaking. Now I have to put an asterisk against that and say, if I had to guess, it will end up at the same place [though].

But I’ve learned the hard way that when you throw new things at the economy and stock market, unpredictable things happen. So there’s an irreducible increase in uncertainty.

What do you think will happen to the super bubble, then?

I feel it’s quite likely that this thing is going to get back on track and deflate, but I don’t know what the government will do. Perhaps they’ll have another major stimulus program.

You have to be prepared for anything. The market is in a bad place. And the war bodes very badly for global growth and global trade. It bodes badly for price rises.

That’s all fundamentally pretty grievous.

We’ve learned the hard way that fundamentals are one thing and the stock market and paper are another.

Do you foresee more stimulus coming?

If the government were to come out with another stimulus and drown us all with another wave of money, the market might have a major rally.

[But] I think they’re reasonably worried about inflation, so they’re probably not going to do that.

But how do you know they’re not going to do it? And in the end, you can’t get blood from a stone. If you have overpriced stocks, you get a dismal return, and we have overpriced stocks — and we will get a dismal return.