Income Protection for Construction Workers

Income Protection for Construction Workers

Ever worked on a site in frosty weather, shards of ice clinging precariously to your high-vis jacket?

It’s a scene all too familiar to construction workers across Ireland.

Welcome to the harsh realities of working in an industry where one misstep can snatch that hard-earned salary out of your grasp in a heartbeat.

If you’re navigating heavy machinery and heights, the term ‘Occupational Hazard’ takes a whole new meaning.

In fact, 794 construction-related accidents were reported last year.

That’s a big number, isn’t it?

So, the question is – in a game where your income could easily go ‘out of service’ with you, are you financially ready if it does happen?

Understanding Income Protection Insurance for Construction Workers

Definition of income protection insurance

Why construction workers need income protection insurance?

How income protection insurance works for construction workers?

Definition of income protection insurance

Income protection (IP), a less familiar term for many, is as a safety harness for your paycheck.

Imagine a scenario where you’re unable to work due to illness or injury.

If this happens, IP steps in to replace a part of your income, enabling you to maintain you (and your family’s) current lifestyle while you focus on getting better.

Essentially, it’s a financial buffer that protects you if you’re unable to earn your regular income.

IP is limited just to sickness and injury. It doesn’t cover job loss or unemployment.

Why construction workers need income protection insurance?

Now, let’s focus on why income protection insurance is specifically crucial for construction workers.

In the world of construction, even minor incidents could lead to a significant time off withoout an income.

Often workers find themselves in roles that demand intensive manual labor and carry an inherent risk of injuries that could put them out of work for a long, long time.

Factors like adverse weather conditions, working with heavy machinery, or site accidents heighten this risk significantly.

Even ailments unrelated to work, like severe illness or chronic conditions, could limit your ability to work.

If you are unfortunate enough to have an accident or a long term illness then income protection insurance is as a financial lifesaver.

It replaces your income providing peace of mind that your and your family’s financial needs are covered.

How income protection insurance works for construction workers?

Now that you understand how important it is, let’s examine how income protection insurance works for those in construction.

The whole process starts with you making a claim once you’ve been off work due to illness or injury for an agreed period, referred to as the deferment period.

The length of the deferment period varies based on your policy but typically ranges between 1-12 months.

Once you have served this deferred period, you start receiving monthly payouts from your insurance provider.

You can insurer up yo 75% of your income before tax, ensuring you have a substantial backup to meet your living costs effectively.

It’s crucial to note that these payments continue until you can get back to work or until the end of your policy term (generally age 65) whichever comes first.

In summary, income protection insurers your paycheque and lifestyle allowing workers to focus on recovery without worrying too much about their financial situation.

The Benefits of Income Protection in the Construction Industry

Income protection provides financial security in case of illness or injury.

It covers the cost of rehabilitation and recovery.

Workers and their families enjoy peace of mind, knowing they’re protected.

Financial Security during Illness or Injury

Perhaps the most compelling benefit of income protection for construction workers is the promise of financial security when health issues arise.

It’s no secret that construction is a physically demanding gig.

Consequently, the risk of job-related injuries is always looming.

Income protection serves as a reliable safety net, ensuring that you continue to receive a percentage of your earnings if you’re unable to work due to illness or injury.

Bills get paid so a health issue doesn’t become a financial crisis.

Coverage for Rehabilitation and Recovery Costs

Not less important are the unforeseen expenses associated with rehabilitation and recovery.

Construction injuries can be severe, often requiring extensive and costly rehabilitation or even a prolonged period of recovery.

In such cases, income protection policies kick in, offering coverage for these costs.

Remember, you won’t be left to bear these costs alone.

This financial assistance can mean the difference between a smooth recovery and an uphill struggle.

Peace of Mind for You and Your Family

Imagine the reassurance brought by the knowledge that your income is secure, regardless of work-related injuries or illnesses?

It’s a comfort that not only benefits you but their family too.

Income protection provides this peace of mind.

It means that you can focus entirely on recovery, rather than worrying about a potential financial catastrophe.

This freedom from financial stress is invaluable for your mental health and overall wellbeing.

Income protection is not just an insurance policy; it’s a reflection of the value that we place on your job and your income.

Afterall, your income is your most important asset.

How to Choose the Right Income Protection Plan

Identify the essential factors in choosing an income protection plan

Compare income protection plans available in Ireland

Find the best income protection plan for construction workers

Factors to Consider When Choosing an Income Protection Plan

With numerous income protection plans available, making the right choice might seem daunting.

However, an understanding of key factors can significantly simplify the process:

Your advisor can help you figure out the numbers for you by reviewing your current sick pay entitlements, your access to other avenue of income and your appetite for risk.

Some people are happy with a long 52 week deferred period, other choose 4 weeks!

This refers to the length of time for which benefits will be paid, do you see yourself retiring at 55 or 70?

If you’d like some help with the numbers, please complete this questionnaire.

Last, review the cost of the plan. The monthly or annual premium should be affordable without compromising on necessary coverages.

Comparison of Different Income Protection Plans Available in Ireland

Ireland’s income protection market offers diverse plans, each designed to meet your needs

Assume a scenario where we contrast two possible plans; one offering a shorter deferred period but with increased premiums, the other providing lower cost income protection with a higher deferred period.

Both have their merits and drawbacks.

Hence, understanding your financial budget and risk appeitite can help you decide on the right type of policy for you.

Remember, an income protection plan shouldn’t add financial stress.

It should alleviate it.

You want to have enough cover but not with a monthly payment that makes you wince!

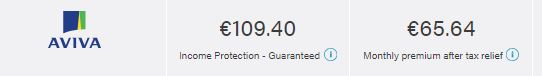

Here is a quote for a 35 year old Quantity Surveyor earning €80,000 with a 26 week deferred period:

Quote Type: Income Protection

First Person: Non-Smoker, born on 17/12/1987

Cover Amount: €48,560 per year until age 65.

Occupation Class: Quantity Surveyor (Class 1)

Deferred Period: 26 weeks

Premium: €77 per month

€46 after tax relief

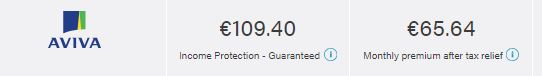

Compare this with a 13 week deferred period:

Quote Type: Income Protection

First Person: Non-Smoker, born on 17/12/1987

Cover Amount: €48,560 per year until age 65.

Occupation Class: Quantity Surveyor (Class 1)

Deferred Period: 13 weeks

Tips for Finding the Best Income Protection Plan for Construction Workers

Check what your sick pay entitlements are through your employer.

Fingers crossed you discover you already have income protection.

If not full IP, hopefully you have some long term sick pay.

If you have neither, well, you should really consider putting income protection in place.

Overall, the key isn’t merely finding an income protection plan but instead, in securing a plan that fits your unique needs.

Can all Construction Workers get Income Protection?

Here’s a list of the types of workers we have helped:

Building Contractor

Buildings Inspector

Chargehand

Drill Operator

Electrician

Escalator Erector

Floor Layer

Floor Tiler

Foreperson

Fork Lift Driver

Labourer

Quantity Surveyor

Signal Person

Shop Fitter

Steel Erector

Structural Engineer

Conclusion

“Money Well-Spent: Safeguarding Your Earnings”

Income protection, understanding the construction industry’s risks, discerning suitable insurance policies, and union-driven benefits.

All these have one target – ensuring your hard-earned money stays with you, even if the unexpected strikes.

Remember, the time to act is now, not when you find yourself unable to work because on a work related accident.

Start by researching suitable insurance providers and plans.

Discuss available union benefits.

Secure your income, don’t leave it to chance.

If you need some help, please complete this questionnaire.

Thanks for reading

Nick