How to Get Life Insurance or Mortgage Protection if you have Diabetes?

Can someone with Diabetes get life insurance or mortgage protection in Ireland?

Here’s an email from a worried client. Does it sound familiar?

Hello Nick, I have type 1 diabetes and I can’t get life/mortgage cover because of my hb1ac reading (over 8). I’m a healthy, non-smoker and wondering if you can help me get cover. Ta, Rory

Getting life insurance or mortgage protection if you have Diabetes is possible, but you will pay a higher premium.

Here are the bones of a recent case where we managed to get a lower price for our client. The best quote he had received as a diabetes patient elsewhere had a +250% increase.

Male – 40 years of age – Diagnosed at age 26 – Latest blood pressure 131/77 – Latest cholesterol 4.06 – Latest Hb1Ac reading 80 – no other health issues.

Our insurer offered to cover him with a loading of 150% (without the need for a medical report which can slow things down considerably). Instead, our client completed our diabetes questionnaire in great detail and supplied a letter from his consultant.

What are the chances of mortgage protection with Diabetes?

The likelihood of getting life insurance or mortgage protection with Type 1 diabetes depends on:

your age

age at diagnosis (if diagnosed as a child, you would pay a higher premium)

level of control (your hb1ac reading is SO important, over 9.0 / 75, and you’ll struggle to get cover)

the presence of complications and other risk factors (e.g. smoking, cholesterol, blood pressure, BMI)

Usually, the premium increase is 150%+.

e.g. If a non-diabetic can get cover for €20, you will pay €45 per month for the same cover.

What about serious illness cover for Diabetics?

Unlikely I’m afraid, unless your control has been exemplary over a long period, but you can get cancer only cover)

Is it the same for income protection for someone with Diabetes?

Afraid so, a life insurance company won’t offer income protection insurance to someone with T1 Diabetes.

In the very best cases, someone with Type 2 diabetes can get income protection assuming.

no further cardiovascular risk factors being in play,

non-smoker,

older age now, good control of HbA1c (<55)

What is the application process for someone with Diabetes?

Complete our diabetes questionnaire

We will discuss your case with all of our insurers, making sure you apply to the one that will offer you cover at the lowest price.

You complete the chosen insurer’s application form.

The life insurance company will then request a Private Medical Attendants Report from your doctor*

The underwriters will review your medical evidence and make a decision.

*If you can get a copy of your latest consultant report, we may be able to avoid the need for a medical report from your GP.

Conclusion – Life Insurance with Diabetes

It’s not difficult to get life insurance if you have Diabetes, but you will pay more.

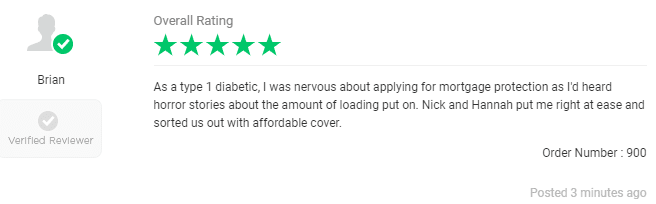

Although, I’m confident we can get you covered at a lower price than you’ll find elsewhere.

In the example above, I got indicative quotes of between €75 and €112 for my client. that’s a difference of €37 per month if you choose the wrong insurer (over a 30-year mortgage, it would cost you an extra €13,320!)

There’s nothing to stop you from applying to the six insurers operating in Ireland, or you can let us do the hard work for you.

Over to you…

If you have Diabetes and are concerned about your mortgage protection application, please get in touch.

Complete this diabetes questionnaire, and I’ll get right back to you.

Nick McGowan

lion.ie | making life insurance easier