How the Ramsey vs. 'Supernerds' 4% Spat Helps Retirees

What You Need to Know

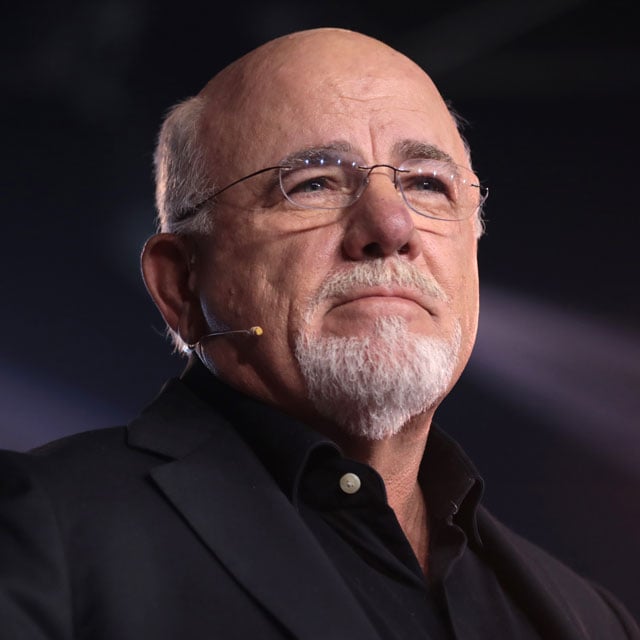

Dave Ramsey sparked a big debate by arguing that retirees should invest and spend much more aggressively than researchers suggest.

Some well-known financial planners criticized the national personality’s argument for 8% withdrawals and a 100% stock allocation.

Income experts hope that the ongoing debate will focus attention on the complex and evolving issues tied to retirement spending.

Dave Ramsey has done financial advisors a favor by bashing the conclusions of several retirement experts about “safe” withdrawal rates in his recent podcast, two veteran financial planners say — by drawing attention to the need for tailored approaches for clients.

During a recent podcast, Ramsey — a popular and at-times provocative national financial planning personality — blasted retirement spending researchers for being “supernerds” and “goobers” who “live in their mother’s basement with a calculator.”

Ramsey went on to argue that the industry’s traditional 4% withdrawal rule (and more recent income planning strategies that utilize dynamic guardrails to control spending) is overly conservative, and it fails to fully leverage the power of the stock market.

Rather than depending on carefully calculated spending strategies that are revisited and adjusted over time, he suggests a 100% stock portfolio and 8% annual withdrawals.

The assertion may fly in the face of the typical fiduciary financial professional’s perspective, but it also provides financial advisors with an entry point for deeper planning conversations with their clients and prospects.

That is, advisors can demonstrate exactly what Ramsey fails to discuss about sequence of returns risk, the growing challenges of longevity and the dangers that are presented by relying on overly bullish market predictions.

This was the consensus of a number of respected financial planning experts who were all asked this week to weigh in on the Ramsey vs. “Supernerds” debate, including Bryn Mawr Trust’s Jamie Hopkins and Morningstar’s John Rekenthaler.

While he understands his industry colleagues’ skepticism about Ramsey’s 8% spending argument, Hopkins tells ThinkAdvisor he is actually much less skeptical than others may be, and he cites his deep engagement with the latest planning research as the cause.

As Hopkins explains, the real reason there can be so much debate about retirement spending strategies is that there is “actually no single right answer on this topic, and the spending question is more of a true debate versus a question of what is right or wrong.”

Ramsey’s Views & Trio’s Response

Ramsey, for his part, argued that the safe spending figure is actually around 7% or 8%, a viewpoint based in large part on his simultaneous assertion that many retirees would be better off with a 100% stock allocation as opposed to a traditional 60-40 or even 50-50 mix of stocks and bonds.

Both the traditional 4% withdrawal rule and more recent spending guardrails frameworks use these “safer” asset allocations, and Ramsey further argued that such a “pessimistic” investing and spending approach could lead many people to believe that they can never afford to retire.

Taking to LinkedIn, Wade Pfau, a well-known retirement researcher, suggested that Ramsey’s perspective may sound rational to the typical novice investor, but the reality is that he is speaking from the position of a “total returns extremist.”

“If that’s your thing, then more power to you,” Pfau wrote. “But he is suggesting a very risky approach to retirement income, and not all his listeners will understand the risks they are taking with an 8% withdrawal on a 100% stocks portfolio.”

Beyond his comments on social media, Pfau was one of a trio of self-professed supernerds who responded to Ramsey’s call-out in a widely circulated ThinkAdvisor commentary piece. In it, Pfau argues alongside Michael Finke and David Blanchett that Ramsey’s position dangerously overlooks that the sequence of returns risk is real — and it’s a big part of what makes retirement income different from pre-retirement wealth accumulation.

What Planners Are Saying

Among the dozens who responded to the “supernerds” kerfuffle on social media this week was Roger Whitney, a certified financial planner and founder of the Rock Retirement Club.

“I’ve met [the supernerds] and think they are intelligent, wonderful people,” Whitney wrote. “The debate is, what is a safe withdrawal rate? 8% over 4%? This is an academic question.”

As Whitney and many others emphasize, sound retirement planning isn’t based on any single metric, whether that is a safe withdrawal rate or any other figure.

“No one creates a plan and sticks to it throughout retirement,” Whitney argues. “Goals and markets are messy. Heck, life is always messy. The one constant I’ve seen in walking with retirees is CHANGE. Some are predictable, but most are not!”

Whitney adds that the “supernerds” are correct in advocating for flexibility and some measure of caution in the income planning process, given just how high the stakes are for any given individual or couple. Failure, in this planning context, can mean that aging Americans run out of money to fund their lifestyle at a very vulnerable time in life, when returning to work or reducing spending can be difficult or impossible.

“Changes in goals, circumstances, markets, interest rates, etc., all happen randomly,” Whitney warns. “Ultimately, it doesn’t matter whether a retiree starts with an 8% or 4% withdrawal rate. What matters most is having a sound process faithfully followed to make little adjustments as life unfolds. The uncomfortable truth is there is no answer.”

More Skeptical View

A similar point of view was shared by Morningstar’s John Rekenthaler, director of research, in an in-depth response posted to the firm’s website and in supplementary comments shared with ThinkAdvisor.

“This is not much of a ‘debate,’” Rekenthaler suggests. “As my article states, Ramsey’s argument is based on the doubly false assumptions that stocks reliably return 11% to 12%, and that only average returns matter for portfolios that are funding withdrawals. In fact, as we all know, stocks have prolonged stretches where they make much less than that, and volatility strongly damages the ability of portfolios to survive under such circumstances.”