How Advisors Build Retirement Income Portfolios, in 7 Charts

This suggests as expertise in retirement income planning increases, these numbers could further increase.

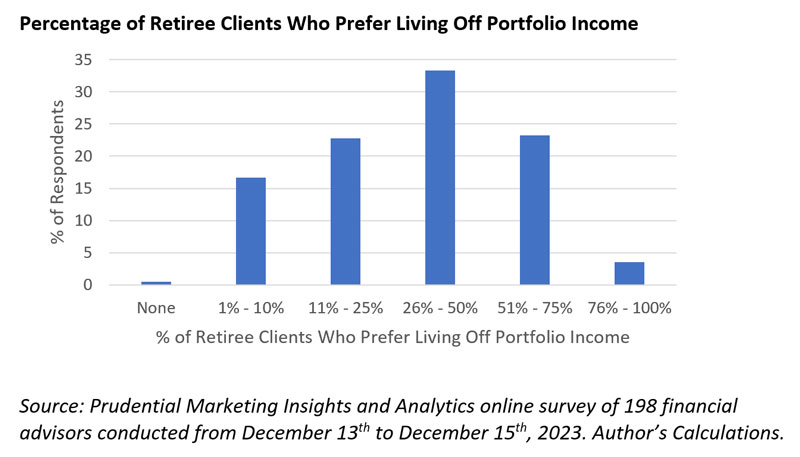

2. Retired clients prefer to live off portfolio income.

Another question asked: “… Approximately what percent of your retiree clients prefer living off portfolio income?” While there is clearly a diversity of responses, overall it appears about 50% of retiree clients prefer to live off of income.

This suggests advisors need to be capable of building portfolios that have an income focus. These portfolios can be very different than the more traditional perspective using mean variance optimization (MVO), which focuses on total return (a combination of income return and price return).

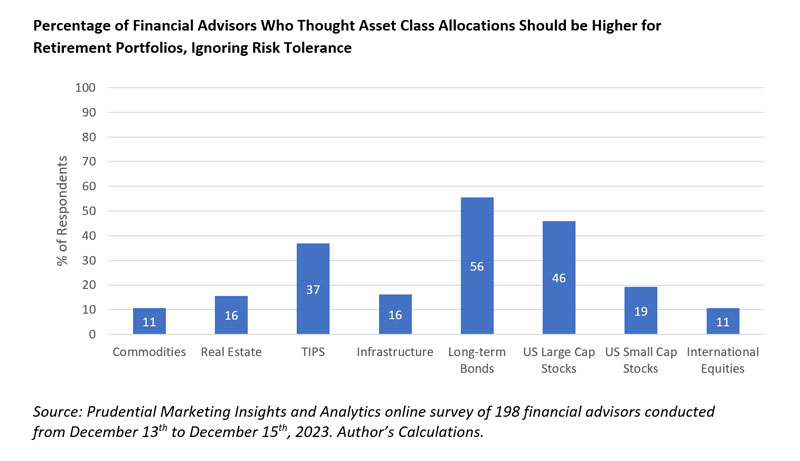

3. Perspectives on using asset classes in retirement portfolios vary notably.

The question asked: “Ignoring risk tolerance, what role do you think the following asset classes should play in portfolios for retirees (versus non-retirees)?”

The graphic includes the percentage of respondents who thought allocations should be somewhat higher or much higher. Financial advisor respondents were most interested in allocation to long-term bonds, U.S. large-cap equities, and Treasury inflation-protected securities.

Interest in TIPS and long-term bonds grew considerably as knowledge of retirement income planning increased. For example, only 17% and 33% advisors who were not very knowledge thought allocations to TIPS and long-term bonds should increase in retirement portfolios, respectively, versus 41% and 58% among those who were very knowledgeable, respectively.

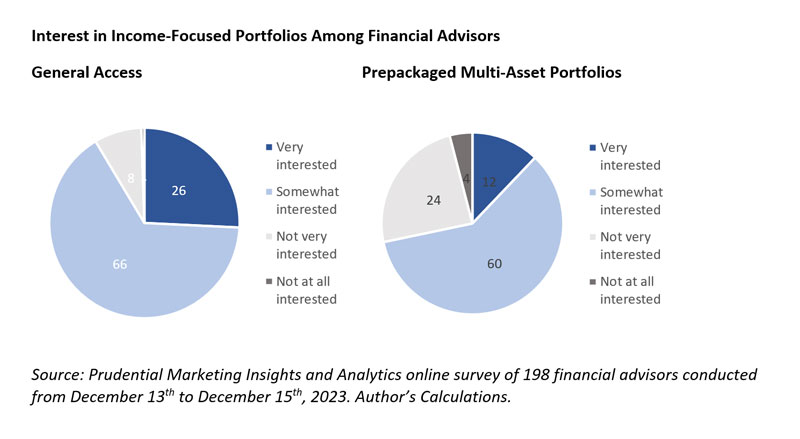

4. Interest in income-focused portfolios is relatively high.

One question focused generally on gaining “access to more income-focused portfolios” and another “using a multi-asset (prepackaged) portfolio strategy…” Both suggest a relatively high level of interest, although there is clearly more interest in general access.

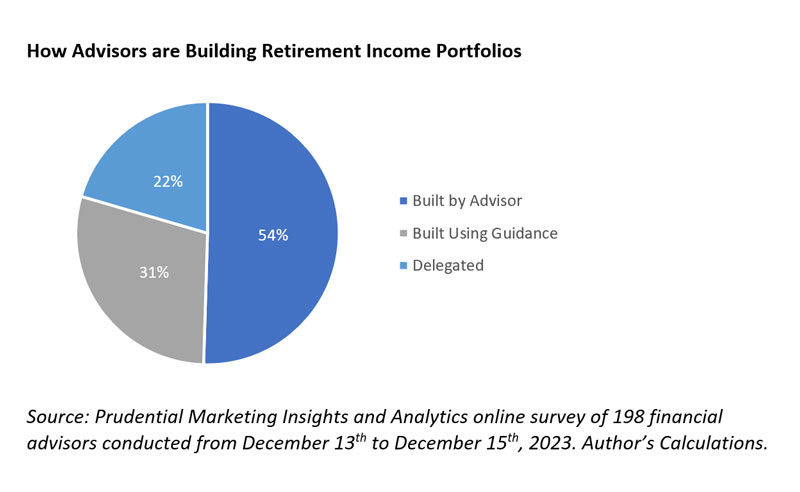

5. Advisors are mostly building retirement portfolios themselves.

Another question focuses on whether advisors are building portfolios using their own research, built using models or guidance from third parties, or some type of third-party allocation (i.e., delegated). Financial advisors who were not very knowledgeable about retirement income planning were much more likely to delegate portfolio construction (at 32%) and the least likely to build their own portfolio (36%).

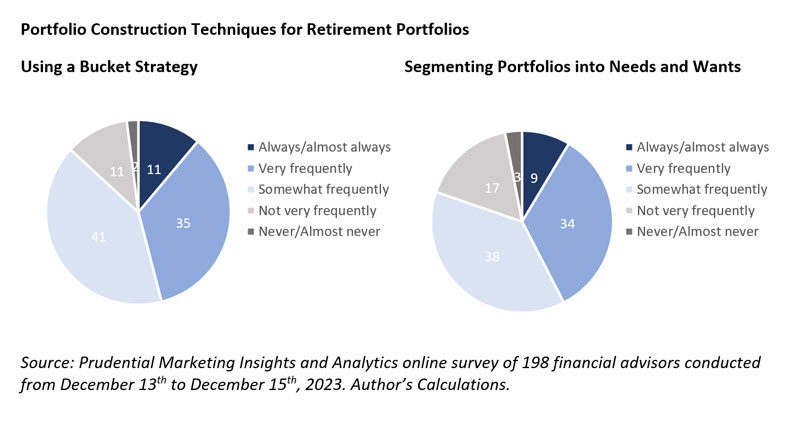

6. Retirement portfolios are targeted toward the goal.

One question focused on the frequency of using a bucket strategy in retirement portfolios, and another asked about segmenting the portfolio by investing more conservatively for more essential expenses and taking greater risk to fund more discretionary expenses (i.e., separate needs and wants portfolios).

Bucket approaches were slightly more common, but responses suggest advisors are actively using portfolio management approaches with retirees that are targeted specifically around the goal (either time frame or spending flexibility).

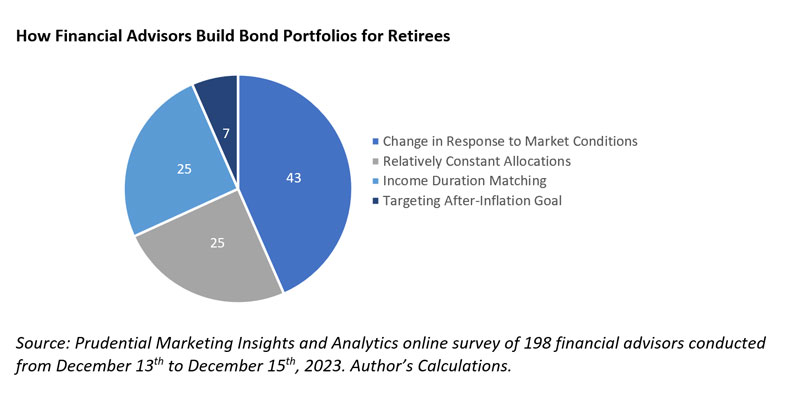

7. Advisors are relatively tactical with bond allocations.

A question asks how the advisor builds a bond portfolio strategy for a retiree. Almost half of respondents (43%) said they changed duration and credit risk in response to market conditions.

Responses were relatively consistent by retirement income knowledge level, suggesting financial advisors are relatively tactical with bond allocations for retirees.