House Plans First Hearing on SVB, Signature Bank Failures

“Separately, GAO should examine the decisions and actions taken by the FDIC, the Fed, and the Secretary of the Treasury surrounding the recent bank failures, enhanced prudential standards, and systemic risks,” McHenry and Waters wrote.

Also on Monday, McHenry and Sen. Tim Scott, R-S.C., ranking member of the Senate Committee on Banking, Housing, and Urban Affairs, demanded information from the Federal Reserve and the FDIC regarding their regulatory activities with respect to the two banks “for the two years leading up” to the collapse.

The lawmakers also requested that the Fed and FDIC “preserve all records, future and existing, related to this matter.”

“Our oversight responsibilities to the American people require that we evaluate the root causes of these bank failures as well as the failures of U.S. regulatory agencies to prevent these collapses from occurring,” McHenry and Scott wrote. “These responsibilities include obtaining full information about what appears to be glaring bank mismanagement, fundamental lack of prudence in bank risk and balance sheet management, and regulators’ lack of basic supervision and enforcement of safety and soundness rules, regulations, and principles.”

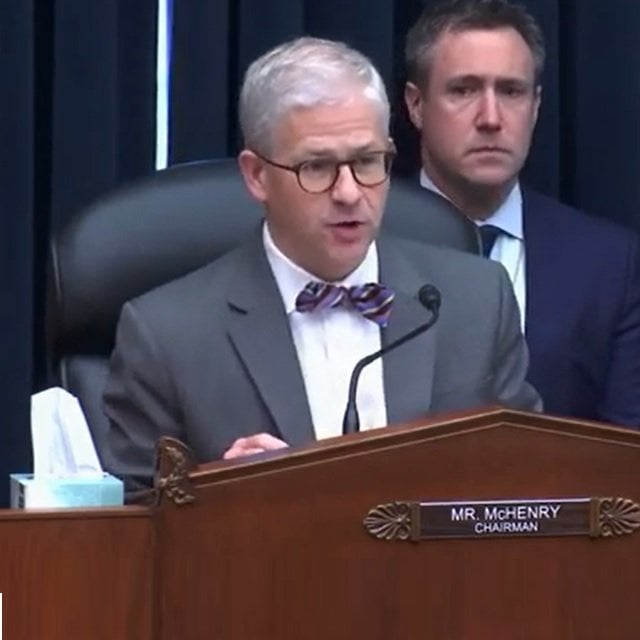

House Financial Services Committee Chair Patrick McHenry, R-N.C. (Photo: House)