Goldman Sachs, Morgan Stanley Face Off on Musk Bid for Twitter

What You Need to Know

Morgan Stanley is advising Musk on the $43 billion offer, while Twitter has enlisted the help of Goldman Sachs.

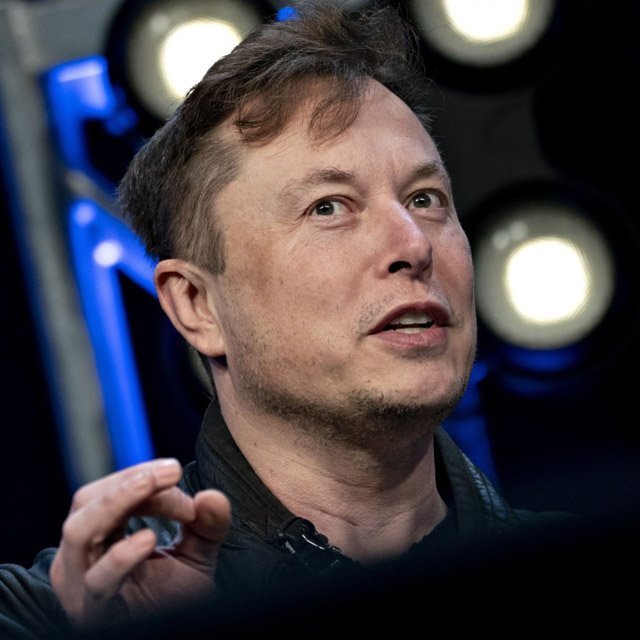

Elon Musk’s unsolicited $43 billion offer for Twitter Inc. sets up a showdown between two of Wall Street’s biggest advisory shops, which could result in lucrative payouts for both if the biggest hostile takeover in years is successful.

Morgan Stanley is advising Musk, according to a filing Thursday, while Twitter has enlisted the help of Goldman Sachs Group Inc. as it considers how to respond to Musk’s hostile bid, according to people familiar with the matter.

The pair often tussle for the top billing in the M&A rankings, with Goldman currently in the No. 1 spot, according to data compiled by Bloomberg.

To be sure, a big chunk of any bank fees hinge on the deal panning out, which is uncertain. Musk said on Thursday he’s “not sure” he’ll “actually be able to acquire” Twitter and he has a Plan B if Twitter’s board rejects his offer, without offering details.

Though they’ll be sitting opposite each other in any negotiations, Morgan Stanley and Goldman each have a relationship with Musk that stretches back more than a decade. Both New York-based investment banks underwrote Tesla’s 2010 initial public offering: Goldman got the coveted lead left role, while Morgan Stanley was listed second on the prospectus.

Musk also turned to the pair of banks in 2018, during his failed attempt to take Tesla private. He worked with Goldman, according to a tweet at the time. He later brought on Morgan Stanley to help advise him personally on the potential buyout that never materialized.

This time round, Goldman, a longtime Twitter adviser, is likely to have been conflicted from advising Musk due to its recent roles for the social-media company. The bank worked with Twitter in 2020 on an investment from Silver Lake, as well as on a board settlement with Elliott Investment Management.

That means that, for now at least, Morgan Stanley gets sole billing alongside Musk. The bank has fielded a team of its top technology bankers, led by Michael Grimes, to assist the billionaire, said people familiar with the matter, who asked not to be identified because the matter is private.

Representatives for Morgan Stanley and Goldman declined to comment on their involvement.

In a coup for Old Wall Street, no boutique investment banks appear to be involved, though both bidders and targets often add advisers as transactions drag on. Bulge-bracket banks like Morgan Stanley and Goldman have increasingly been competing for market share with independent advisory firms such as Allen & Co., Lazard Ltd and Centerview Partners.