GMO's $8B Fund Is Beating S&P 500

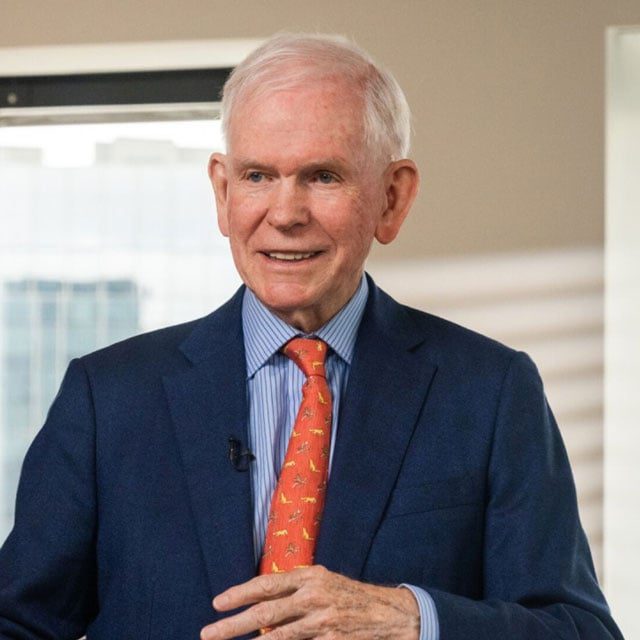

Jeremy Grantham is a famous bubble hunter, quick to point out speculative excess on Wall Street and beyond.

So it would seem like a surprise that the biggest mutual fund at his firm — GMO — is betting on many of the so-called Magnificent Seven tech stocks that have surged so much this year that they may look, well, a little bubbly.

But to Tom Hancock, manager of the $8 billion GMO Quality Mutual Fund, there’s no contradiction per se: Hancock’s just following the firm’s recipe for investing in companies with solid track records.

That’s driven the fund to an approximately 25% gain this year, outpacing the roughly 18% advance by the S&P 500 — even after it shied away from two of the benchmark’s biggest gainers, Nvidia Corp. and Tesla Inc.

The strategy is mirrored in the firm’s first ETF, the $17 million GMO U.S. Quality ETF that was launched last month.

“It’s funny — companies like Microsoft and Apple, you would think those would be super crowded companies but I actually don’t know that they are,” said Hancock, who has been the lead portfolio manager of the mutual fund since 2015 and with GMO since 1995. “We hold them. Obviously, we think the valuations are reasonable.”

The perspective may allay some worries that big tech stocks have run too far, with the recent leg up fueled by speculation the Federal Reserve will pull the economy to a soft landing and shift to cutting interest rates early next year.

The Nasdaq 100 Index, one proxy, is up 44% this year, mirroring the gain in 2020 when the Fed’s near-zero rates set off a trading frenzy.

Fund Focus

The GMO fund has a majority of its holdings — around 90% — in consumer staples, tech and health-care. It’s underweight on industrial and financial stocks, and, at least in the last four years, has avoided telecom, utilities and energy companies.