Getting Mortgage (Protection) Ready in 2024

As you embark on the exciting journey absolute headmelt that is trying to buy a home in Ireland, there’s one thing that you can’t avoid – getting mortgage protection.

You see, in Ireland, mortgage protection is a mandatory requirement for getting a mortgage.

Not only does the bank get the deeds of your home as security, you also have to take out a life insurance policy to pay your mortgage should you shuffle off unexpectedly.

Sure isn’t it a great little country. 🙄

So, before you make that call to DNG Sherry-Lisney and make a ridiculous bid on a shoebox (that will soon be trumped by some other poor soul), let’s talk about why you should first line up your mortgage protection and what could potentially stand in your way.

Step 1: The Non-Negotiable – Mortgage Protection in Ireland

First things first, let’s get one thing straight – mortgage protection is mandatory in Ireland.

It’s not a choice; it’s a must-have.

Without mortgage protection, you won’t be able to secure a mortgage to buy your new home.

It’s as simple as that.

So, it’s not just another checkbox on your homeownership quest; it’s a legal requirement that covers the bank’s arse.

Before you start arranging salary certificates and getting your bank statements in order, make sure you can get life insurance for your mortgage.

Step 2: The Potential Hurdles

Now that you understand the importance of mortgage protection, let’s look at the main things that could stand in your way: health issues or outstanding medical appointments.

Health Issues:

If you have a pre-existing health condition or ongoing medical issues, you might be concerned about your chances of snagging mortgage protection.

While it’s true that some health conditions can cause the insurer to shake its heads and go “not today, pal”, it’s not always a dead end.

Different insurers have different underwriting criteria, and some may be more lenient or specialised in handling your health history.

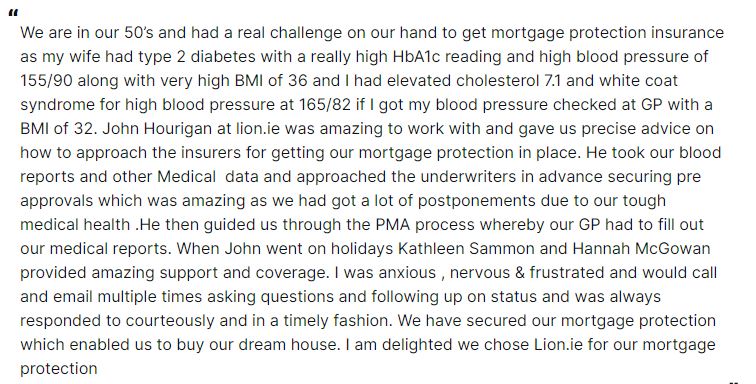

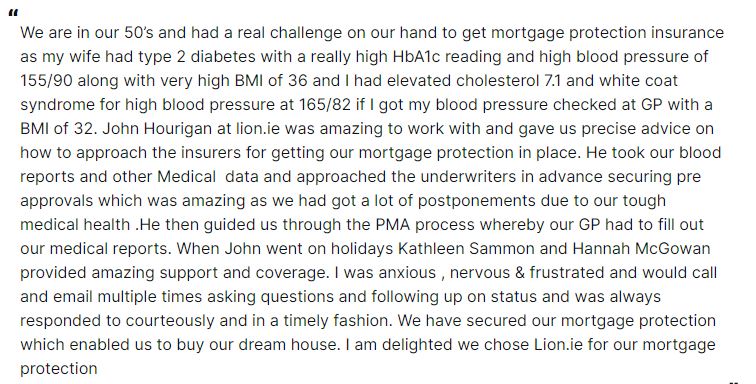

Don’t assume you can’t get mortgage protection; instead, find a specialist advisor (I’ve heard those guys at lion.ie are legends) who can find you the right insurer for your unique situation.

Because you are unique and don’t let anyone tell you otherwise! 👊

Read: Overweight for Mortgage Protection

Outstanding Medical Appointments:

This is the one that catches most people unawares.

It usually happens like this.

You go to the GP for a pain in your tummy.

The GP gives you antacids.

They don’t work.

The GP refers you for a colonoscopy.

12 months later, you’re still waiting to be called.

You forget all about it until you apply for mortgage protection and you notice one of the questions on the application form is:

Do you have any upcoming investigations or have you been referred for an investigation that has yet to take place?

😫

You might think, “ah sure that was ages ago, I’ll just say no”.

Say no, and you’ll get mortgage protection cover but you’ll also be dabbling in what the insurers call “non-disclosure“, more commonly known as lying.

If there’s ever a claim in the future, the insurer can shout NON DISCLOSURE and refuse to pay out.

So what can you do?

If the appointment is no longer necessary and your GP is willing to confirm this, happy days – you should be able to get cover.

However, if the GP feels it is still required, then you will have to go ahead and complete the referral.

Going private can be expensive but may be the only way to get cover if you need it before you are due to buy your home.

But please, be transparent about your situation and communicate with your insurer or broker. They can guide you on the best course of action and help you navigate any potential roadblocks.

The last thing any of us want is for your GP to mention something you didn’t tell us or the insurer upfront because this will put the insurer on alert, they’ll wonder “what else are they hiding” making it more difficult for you to get cover.

READ: Getting Cover with a History of Abnormal Smears.

Step 3: Get Some Help!

Trying to navigate the world of mortgage protection, especially with health-related concerns, can be overwhelming.

That’s where we come in.

We’re well-versed in getting mortgage protection where others have said no.

We know which insurer is most sympathetic for your health issue giving you the best chance of getting mortgage protection with the least amount of hassle.

Step 4: Nail Down Those New Year’s Resolutions

So what else can you do to get Mortgage (Protection) Ready in 2024?

Resolution 1: Shedding a Few Pounds

One of the common New Year’s resolutions is getting in shape and losing a few pounds.

You might wonder, “How does that relate to my mortgage?”

Well, here’s the connection – your BMI (Body Mass Index).

Maintaining a healthy BMI can lower the cost of your mortgage protection.

If you BMI is over 32, you will pay more for your cover.

Resolution 2: Quitting the Vapes

If you’ve resolved to kick the vaping habit in the New Year, you’re making a great choice not only for your health but also for your mortgage protection.

Why?

Because once you’re off them for 12 months, you can proudly declare yourself a non-smoker.

Being a smoker doubles the price of your mortgage protection.

So quitting is win-win – better health and more moolah in your póca.

Resolution 3 : Giving up the Booze

Reducing or quitting the gargle not only benefits your overall health but can also positively affect your blood pressure.

High blood pressure can increase the cost of or even result in you not being able to get mortgage protection (especially if you’re a young man)

So, if you’ve resolved to cut down on the booze, you’re on the right track to easily getting mortgage protection.

Resolution 4: No Gambling Receipts in Your Bank Account

It’s not going to improve your chances of mortgage protection but it will help your mortgage application so nother resolution worth sticking to is cutting back on or quitting gambling.

Lenders scrutinise your bank account for signs of financial responsibility.

If they spot regular gambling receipts, it might raise red flags and impact your mortgage approval.

Resolution 5: Financial Discipline

Lastly, a resolution that can work wonders for your mortgage readiness is practicing financial discipline.

Setting a budget, paying bills on time, and managing your finances responsibly will demonstrate your financial reliability to the lenders giving them greater confidence in your ability to handle a mortgage.

Over to you

So, as you gear up to become a homeowner in 2024, make sure you’ve ticked the box on mortgage protection.

Don’t let health concerns or outstanding medical appointments stop you; if you’re stuck, get in touch.

We’re here to help!

Here’s to your future home sweet home sold by DNG Sherry-Lisney and a mortgage protection policy arranged by us.

Complete this short questionnaire if you’d like to get the ball rolling.

Thanks for reading

Nick