Genworth's CEO Aims for 2025 Long-Term Care Insurance Launch

What You Need to Know

Earnings were up in the first quarter.

The long-term care insurance business reported a small profit.

An increase in mortality had mixed effects.

Genworth Financial hopes its CareScout subsidiary will begin issuing new long-term care insurance policies in about a year.

For now, CareScout is company that’s creating a network of long-term care services providers that have agreed to accept rates set out in a provider contract. The goal is to help people who need care find affordable, high-quality care more easily.

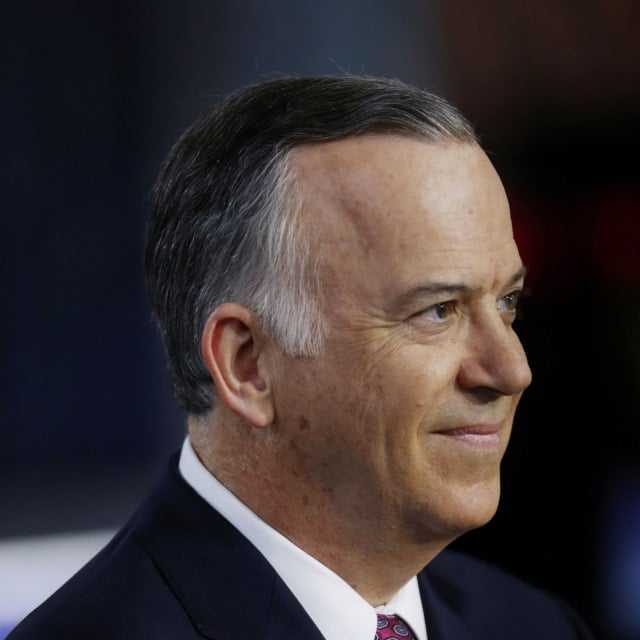

Tom McInerney, Genworth’s CEO, said Thursday during a conference call with securities analysts that CareScout will be the home for the new LTCI business Genworth is planning.

“We now expect to complete this foundational work by the end of the year, with a goal of formally offering a first insurance product in early 2025,” McInerney said during the call.

Genworth held the call to go over its first-quarter earnings.

What it means: The U.S. stand-alone long-term care insurance market could be continuing to creep back to life.

Genworth: Genworth started off as an insurance arm of General Electric’s GE Capital. It was once a major issuer of life insurance and annuities and a creator of the modern U.S. long-term care insurance market.

It gets most of its new sales from its Enact Holdings mortgage insurance subsidiary. It still has some life insurance policies and annuities in force, and it continues to provide long-term care insurance for about 1 million people.

Like most other LTCI issuers, Genworth got many assumptions about how the product work wrong. It has been working to stabilize the products’ prices by asking state insurance regulators for rate increases.

Genworth says that its other operations are separate from the LTCI business and that it does not intend to add capital to the current LTCI business. Any new LTCI business would be separate from the current LTCI business and likely would rely on support from a strong reinsurer.

The earnings: Genworth reported $169 million in net income for the first quarter on $1.9 billion in revenue, up with $154 in net income on $1.9 billion in revenue for the first quarter of 2023.

The long-term care insurance business posted $3 million in adjusted operating income on $1.1 billion in revenue, compared with $23 million in adjusted operating income on $1.1 billion in revenue in the year-earlier quarter.