Genworth Hopes to Stabilize Long-Term Care Business by 2026

What You Need to Know

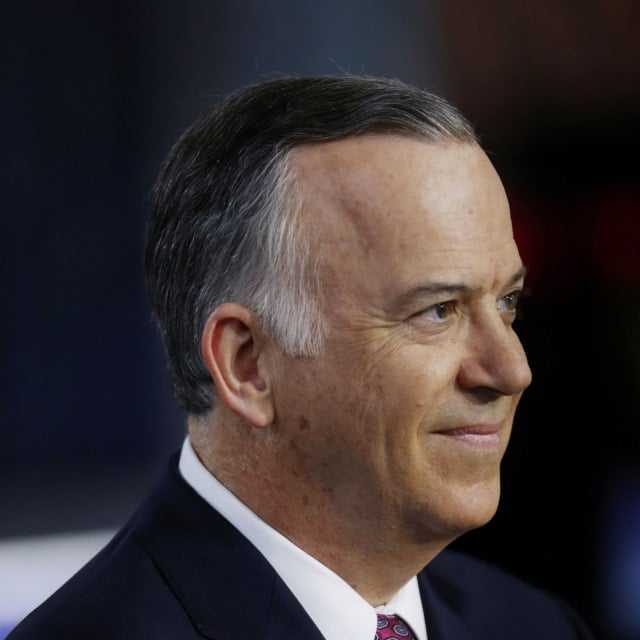

Tom McInerney, the CEO, sees long-term care insurance sales resuming by the end of this year.

A key capital health indicator at the long-term care insurance business improved.

The CareScout long-term care provider network now has relationships with 125 providers.

Genworth Financial executives believe they are close to making the company’s old long-term care insurance business sustainable, and they are still planning a return to the long-term care insurance sales market.

Tom McInerney, the Richmond, Virginia-based company’s chief executive officer, today told securities analysts that Genworth has received state regulator approvals for $28 billion of the $33 billion in LTCI premium increases and LTCI policy benefits reductions needed to make the LTCI business stable.

“It’s been a long-term effort,” McInerney said. “My view is that we’re getting near the end.”

The old Genworth LTCI business could be breaking even by 2026, the company’s new CareScout Services long-term care provider network is doing business in 20 states, and plans are underway for the company to issue new long-term care insurance policies by the end of this year, McInerney said.

What it means: Clients might soon be asking you whether getting long-term care services through CareScout makes sense and what you think of Genworth’s new LTCI policies.

The earnings: Genworth executives talked about their plans during a conference call the company held to go over results for the fourth quarter of 2023.

The company was once a major writer of life insurance, annuities and private mortgage insurance, and it was one of the pillars of the long-term care insurance market.

Genworth suffered from severely inaccurate LTCI pricing assumptions and ended up suspending new sales of life, annuity and LTCI products. It gets most of its new sales from the mortgage insurance business, which is now known as Enact.

Genworth reported a $183 million net loss for the quarter on $1.9 billion in revenue, compared with $408 million in net income on $1.9 billion in revenue for the fourth quarter of 2022.

The LTCI business recorded a $151 million adjusted operating loss on $1.2 billion in revenue, compared with $204 million in adjusted operating income a year earlier.

Net results reflected challenges for the LTCI business and the rest of Genworth.

Enact is performing well but is facing the effects of higher interest rates on home sales and home buyers’ need for mortgage insurance.

Genworth has adjusted life insurance assumptions to reflect a belief that mortality will continue to be higher than it was before 2020, when the COVID-19 pandemic started, and to reflect new research on how likely the holders of universal life policies with secondary guarantees, or ULSG policies, are to keep policies.

Jerome Upton, Genworth’s chief financial officer, noted that the assumption change for ULSG policies is similar to what some other insurers have recorded but smaller, because Genworth’s block of ULSG policies is relatively small.

Challenges for the LTCI business include the effects of changes in the assumptions used to set reserves and the fact that many longtime holders are getting old enough to use their long-term care benefits.

The statutory financial results that insurance regulators use were stronger than the U.S. generally accepted accounting principles results that investors typically use, and the “risk-based capital ratio,” or financial health indicator, at the LTCI business increased to 303%, from 291% at the end of September, Upton said.