Five Reasons Why You Need Life Insurance (and one reason you don’t)

Life insurance used to be for the wealthy.

Many of us ‘regular’ folk’s parents ain’t never had no need for no life insurance (gone kinda deep south there for some reason)

Maybe your old man never saw the point or the old dear said it was a waste of valuable money.

Notions, like.

It’s far from life insurance you were born young Seán, the car isn’t even insured and that’s useful.

However, these days, because it’s so affordable, life insurance is no longer a luxury.

It’s a necessity.

What’s the Reason for Life Insurance?

So why do you need life insurance?

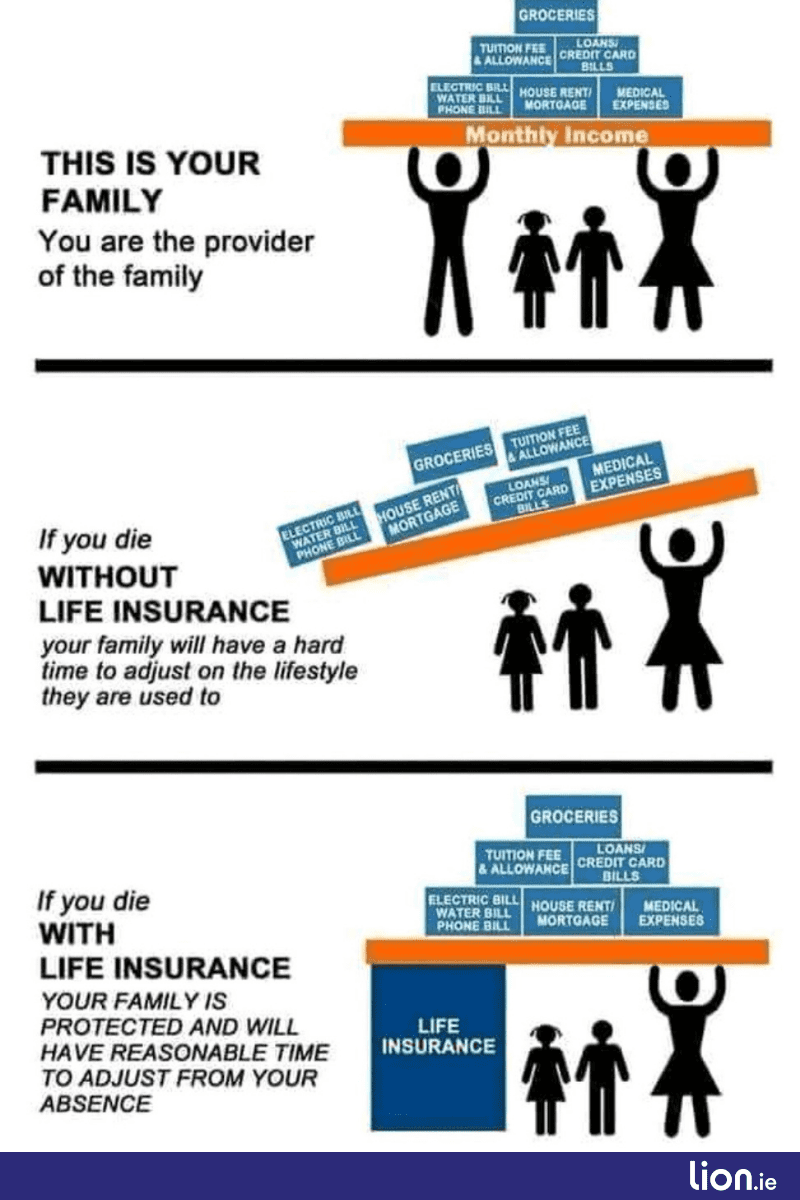

Well, there are many reasons why life insurance is vital – from replacing the income of the deceased to paying off debts or in particular the mortgage.

Remember you don’t actually own your home, you’re really only renting it from the bank until the mortgage is paid off.

It can feel morbid; I get it.

No one wants to talk about death, but as they say, there are only two certainties in life: death and taxis.

So let’s focus on the certainties and make sure you’re as prepared as you can be for the day you meet your maker.

So without further ado, and because everyone loves a listicle, let’s motor:

1. Protecting Your Loved Ones Financially (aka avoiding death bed regret)

Death bed regret describes that time in life when you’re lying in bed, knowing you’re on the way out and you’re contemplating your life.

I should have asked her out

I shouldn’t have gone out with him

I should have told my boss to shove his job up his arse.

I definitely shouldn’t have jumped out of a plane this morning.

Oh no, I should have bought life insurance, my family are screwed now 😩

Yep, that last one is the real kicker.

Imagine holding your partner’s hand and telling them everything is going to be OK when you know it’s not.

But imagine holding your partner’s hand knowing they would get a cool million as soon as you exit stage left.

You’d leave this green earth in a much better mood.

Life isn’t cheap and the way inflation is cracking the whip it’s only going to get more expensive for those you leave behind

Life insurance is their cushion from the blow. Leaving your loved ones with a little nest egg that can go towards anything from funeral and medical costs or just for the day-to-day bills. No one wants to have to worry about whether their family will be able to financially survive.

Life insurance will give you that much-needed relief that at least bills will be paid, food will fill the fridge and financial stresses will be avoided.

It really is buying your own peace of mind, who needs yoga – just buy some life insurance.

2. Paying Off Debt

Now don’t get offended here, we’ll preface this by saying we don’t assume that you’re up to your eyeballs in debt but we all have a lil’ sumin sumin bought on credit.

Your car, last year’s Christmas gifts, or maybe even your phone bill.

Unfortunately, some of these debts will outlast us.

And we’re pretttty sure if they could chase us to the afterlife, they’d probably give that a good whirl too.

So this can mean that your loved ones will be landed with any outstanding debts thus adding more financial stress to what will already be a time full of grief for them.

Christ, death is grim, isn’t it? Not for you, you’ll be sitting on a cloud playing the harp but for those, you leave behind 💔

Life insurance leaves them cold hard cash to pay off those debts and avoid a disaster like losing the family home if they fall into mortgage arrears.

Look we’re not trying to scare you but this kind of stuff happens all the time, it sucks big time but it does.

3. Securing Your Children’s Futures

Education here in Ireland isn’t nearly as pricey as in some countries. *ahem* America we’re looking at you but it’s not without its costly moments.

Book rentals, uniform fees, school trips and that’s before they even get to third-level education.

Free education, my arse.

And look, I know you’re planning to be around to pay the bills, but nothing is certain so life insurance could be the difference between little Siobhan or Seamus getting their degree from University College Dublin or the University of Hard Knocks.

They could get a scholarship…well Siobhan could, Seamus, well, hmmm, you know yourself – get life insurance quick.

4. Protecting Your Income If You Fall Ill

Okay, okay. We’ve covered some of the more serious ‘death himself is at your door’ reasons you need life insurance but it’s not all about the big payout after you die. Life insurance can still help you while you’re still alive and kicking.

Running with a rather self-explanatory name Income Protection is a form of life insurance but is better described as lifestyle insurance as it keeps you in the manner to which you are accustomed should catastrophe strike.

If you find yourself in a situation where you can’t do your own job due to illness, disability, or even some unfortunate accident. This understated insurance will help replace up to 75% of your income. So, while you focus on getting better or finding a different job, you won’t have to worry about whether the lights are staying on.

But this cover can get pricey if your job is high risk. So what do you then?

That’s where Serious Illness Cover swoops in like Superman after a morning of CrossFit.

If income protection is stretching your budget far too thin then serious illness cover could be right up your street.

5. Peace Of Mind

Okay, this reason seems a bit lah-dee-dah and I have mentioned it already but peace of mind is nothing to be scoffed at. When it comes to the end of your life who knows what will happen. What curveballs with be thrown into the path of the people you leave behind.

Having some sort of life insurance just helps you breathe that little sigh of relief knowing that if something should happen you haven’t left everyone in the financial lurch.

Now you’re probably thinking ‘Ah, look it, I’m only 23, I’ve a lock of years in me yet. And we don’t mean to get all doom and gloom on you friends but life is a series of twists and turns and you don’t see what’s coming next whether you’re 23 or 53.

Still not convinced. How about this!

You’re young, you have no health issues. Everything’s just dandy. We’ll let you in on a little secret.

Your life insurance will cheap as old chips.

Like stupid cheap, Icantbelieveitsnotbutter cheap, it’s a deal, it’s a steal, it’s the saleofthefackingcentury cheap.

At 23, €1,000,000 for 40 years comes in at €11 per week, and that’s fixed. So, in 30 years, when you’re 53, you’ll still only pay €11 per week for €1m cover.

In 30 years, €11 might buy you a bag of Taytos.

Everyone should take out a million bucks worth of cover in their 20s.

Why?

Well, more bang for your buck, and hey, the worst that can happen is that you’ve over-prepared for an unfortunate turn of events. If we had any say we’d you tell there’s no such thing as over-prepared, we’d call that smart or simply preparing.

As that grumpy hoor from Cork is always saying “fail to prepare, prepare to fail, ya langer like”.

👋 to all Corkonians reading

Now I know the title of this post promised you the one reason why you probably DON’T need to fork out the euros for a little bit of life insurance cover.

If your partner is very old and very rich and you have a penchant for leaving marbles scattered precariously at the top of the stairs, you’re all set.

Otherwise, get a life (insurance policy)!

What next?

Easy peasy, complete this financial questionnaire, spill the beans about where you are in life and I’ll take a look, recommend the cover you need, give you some options, send you some quotes and as my friend Ciaran used to say “the job is oxo”.

I look forward to hearing from you real soon.

Alternatively, if you want to shoot the breeze first, you can schedule a call back here.

Thanks for reading

Nick

05793 20836

nick @ lion dot ie