First Republic, PacWest Lead Bank Bounce From SVB Rout

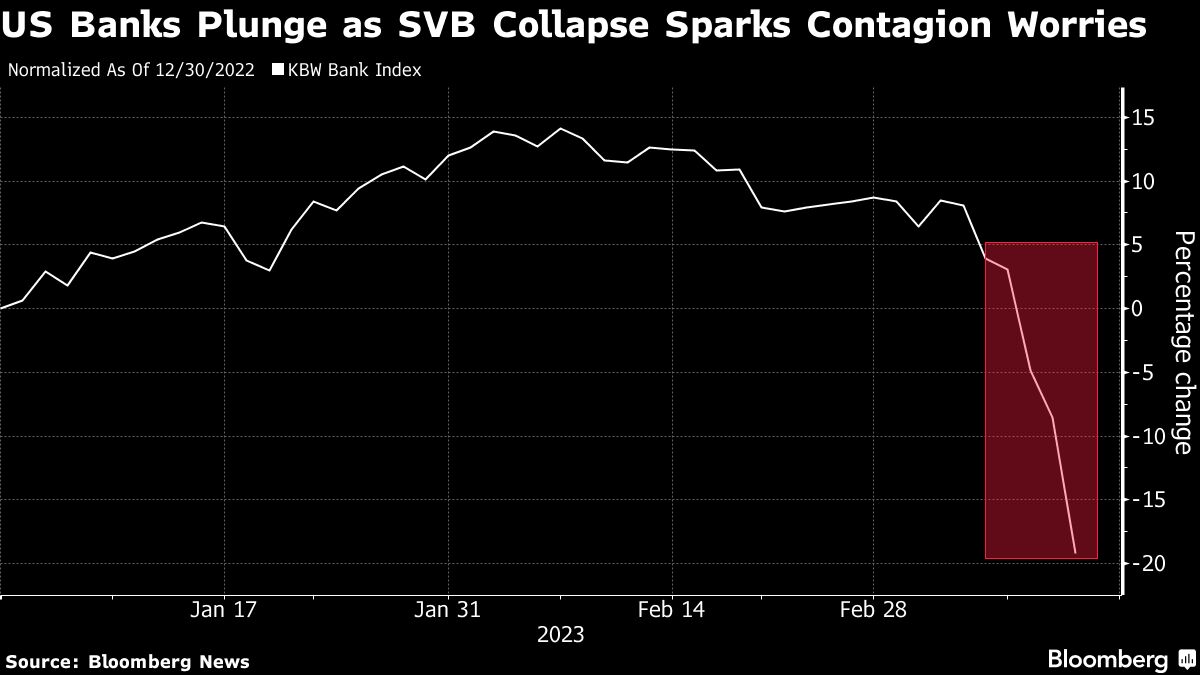

Regional U.S. bank stocks rallied on Tuesday, clawing back some losses from the selloff seen in the wake of Silicon Valley Bank’s collapse, as concerns about wider contagion in the financial system eased.

First Republic Bank jumped as much as 63% for its sharpest intraday gain ever, following a record Monday drop, while PacWest Bancorp surged 64% and Western Alliance Bancorp rose 53%.

Bigger lenders such as Bank of America Corp. and Citigroup Inc. also advanced. Meanwhile, Charles Schwab Corp. rallied as much as 18%.

Regional bank stocks “represent one of the best risk/reward in many years” in the wake of the rout, Baird analyst David George wrote in a Tuesday note. “Extreme fear and negative sentiment” have been driving the selloff, but “we believe the risk of contagion is generally low and believe investors should take advantage of weakness to add exposure to the group.”

While Tuesday morning’s bounce is helping stocks pare the recent carnage, they’re still far below levels from a week ago. First Republic would need a 268% rally to reach its closing level from a week ago, and PacWest would need to jump 174%.

“Once we move away from initial shock rather than painting everyone with the same brush, there is a tendency to scrutinize the models a bit more, the banks’ deposit bases and access to liquidity,” said Gary Schlossberg, global strategist at Wells Fargo Investment Institute. “There has been no foot-dragging by the government, we could even see more steps down the road to stabilize the system.”

The selloff will “certainly be contained,” if there is a suggestion that Fed policy is shifting a bit, he added.

Regulators stepped in with extraordinary measures, introducing a backstop for banks to protect the whole nation’s deposits, after the swift demise of three banks. Regional banks suffered the most on fears of a customer exodus to bigger lenders, perceived as safer for deposits.