Fed Seen Aggressively Hiking to 5%, Triggering Global Recession

– Anna Wong, chief US economist

The economists see the Fed as potentially overtightening: The median economist would set a peak target rate at 4.75%, and 75% of the economists said there’s a greater risk that the central bank will raise rates too much and cause unnecessary pain as opposed to not raising enough and failing to contain inflation.

“Monetary-policy lags are still underestimated,” said Thomas Costerg, senior U.S. economist at Pictet Wealth Management. “The full effect of current tightening may not be felt until mid-2023. By then, it could be too late. The risk of a policy mistake is high.”

There could be economic spillover too to global markets, as two-thirds expect a global recession in the next two years.

While the median of economists is looking for a 50 basis-point increase in December, it’s a close call, with almost a third penciling in a 75 basis-point hike.

The rate path that economists expect is similar to the one foreseen by markets. Investors fully expect a 75 basis-point increase on Wednesday, are leaning toward a 50 basis-point hike in December and look for rates peaking around 4.8%.

If the Fed does deliver another 75 basis-point move next week, the combined increase of 375 basis points since March would represent the steepest rise in Fed rates since the 1980s when Volcker was chairman and battling sky-high inflation.

“With the Fed facing the choice of either doing too much or too little, the members will likely opt to do too much,” said Joel Naroff, president of Naroff Economics LLC, with the goal being to avoid the persistence of inflation Volcker confronted from the 1970s.

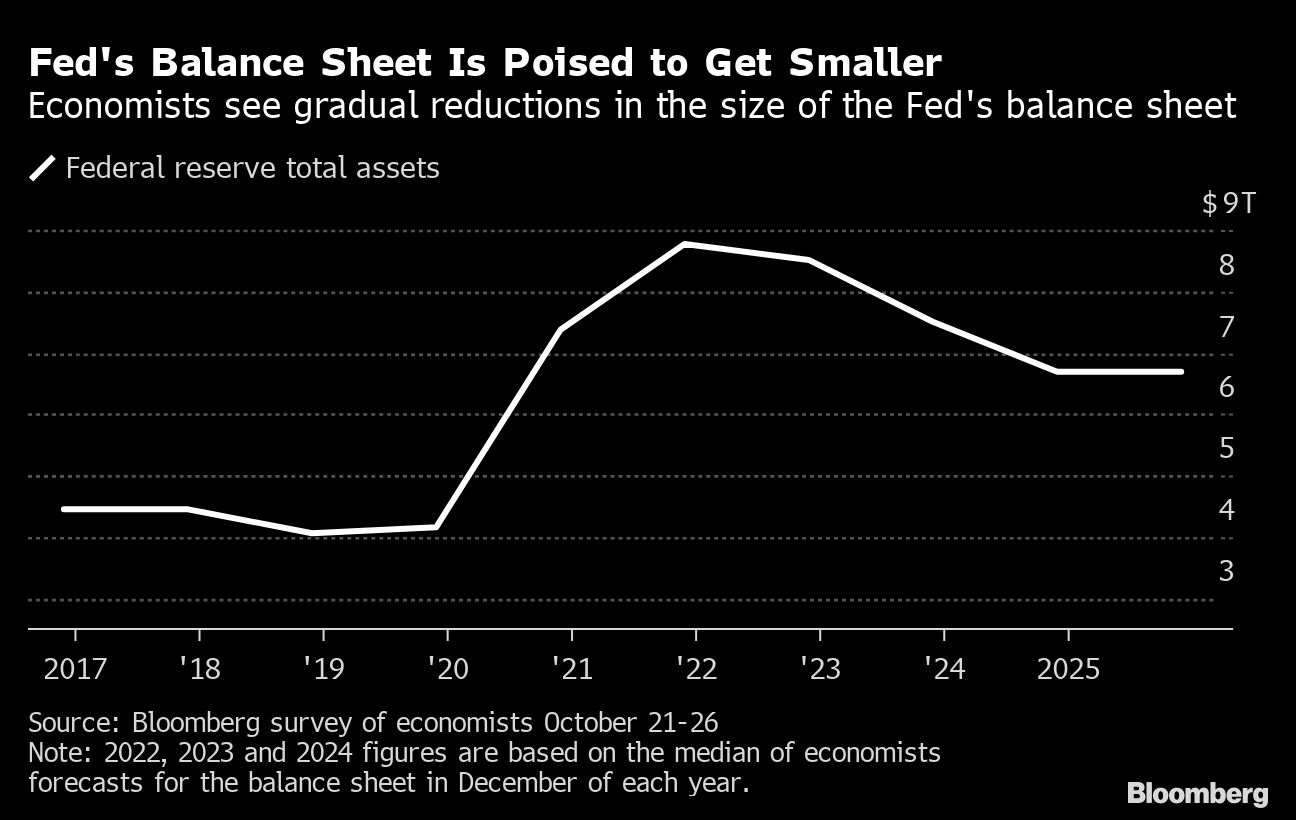

The economists expect the Fed to continue its announced reductions in its balance sheet, which started this June with the runoff of maturing securities. The Fed is reducing assets by up to $1.1 trillion a year. Economists project that will bring the balance sheet to $8.5 trillion by year end, dropping to $6.7 trillion in December 2024.

There’s a close split on whether the Fed will move to selling mortgage-backed securities as part of the reductions, with 57% expecting the move and no consensus on the timing.

The FOMC statement is expected to retain its language giving guidance on interest rates that pledges ongoing increases, without specificity on the size of the adjustments, though a quarter are looking for softer language signaling smaller hikes.

Nearly a third of economists expect a dissent at the meeting, which would be the third of 2022. Kansas City Fed President Esther George dissented in June in favor of a smaller hike, warning that too-abrupt changes in interest rates could undermine the ability of the Fed to achieve its planned rate path. St. Louis Fed President James Bullard dissented in March as a hawk.

Beyond slowing rate hikes, the economists see the Fed eventually reversing course in response to lower growth and inflation. Most see a small first rate reduction in 2023’s second half, with bigger cuts in 2024.

(Credit: Konstantin Hermann/Adobe Stock)