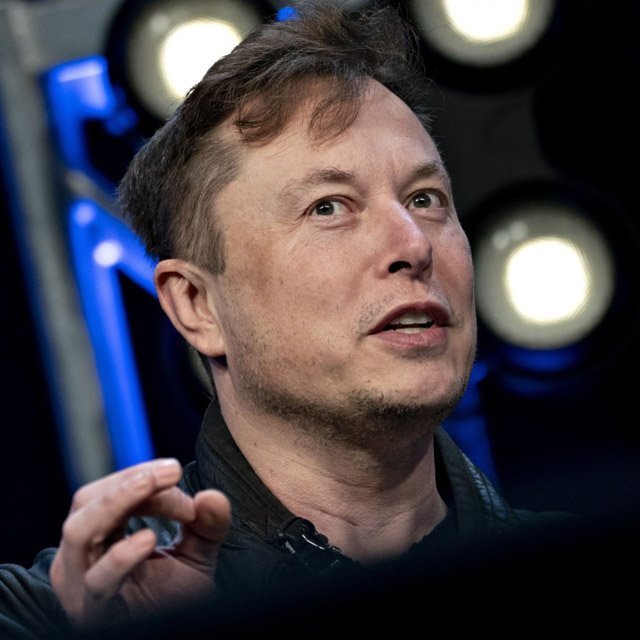

Elon Musk's Untaxed Wealth Is Helping to Finance His Twitter Buyout

What You Need to Know

He is borrowing against his highly appreciated Tesla shares to get cash without having to sell and pay taxes.

Biden’s tax plan would be a large blow to someone like Musk who has the potential for large gains.

A new tax on billionaires is unlikely to become law anytime soon with razor-thin margins in the U.S. Senate.

Elon Musk could have a silent partner in his $44 billion deal to buy Twitter Inc.: the U.S. tax code.

The head of Tesla Inc. and SpaceX announced Monday an agreement to take Twitter private for $54.20 a share, pledging to equity finance $21 billion himself and use a $12.5 billion loan with his Tesla shares as collateral.

Banks are committing another $13 billion in debt financing. Critics, including Senator Elizabeth Warren, say he is only able to do that because of lax taxation of billionaires.

“If you look at Musk’s ‘income’ as defined by our tax code, you see that the guy is really rich, but not rich enough to buy Twitter,” Steve Wamhoff, the director of federal tax policy at the left-leaning Institute on Taxation and Economic Policy, said.

“When you look at a more complete definition of his income — including the parts that are not included as taxable income under our tax rules and thus not taxed — then you start to see how the guy can buy Twitter,” Wamhoff explained.

Musk is using a tried-and-true strategy favored by many American billionaires who have amassed highly appreciated stock — borrowing against those assets to get cash without having to sell and pay taxes. Musk has a margin loan against some of his Tesla holdings for $12.5 billion of the deal.

The details of how Musk plans to come up with another $21 billion aren’t yet clear in the financing agreement. He could sell Tesla or other stock, which would incur a significant tax bill.

It’s possible he could fund some of that by borrowing against his stakes in SpaceX and the Boring Co. further using the IRS rules to tap tax-free cash.

His Net Worth

Musk is worth $257.4 billion, according to the Bloomberg Billionaires Index. Much of that fortune is held in Tesla and SpaceX stock, which can grow indefinitely untaxed.

For any loans against his assets, Musk also gets a tax write-off for the interest on that debt. Musk faced a multi-billion dollar tax bill last year after selling a portion of his Tesla shares.

“Elon Musk has very valuable Tesla stock, which he does not want to sell and pay a tax. And so he can borrow against that stock without selling it,” Steve Rosenthal, a senior fellow at the left-leaning Urban-Brookings Tax Policy Center, said. “Borrowing does not create any income in our system because the borrowing is offset by the obligation to repay.”