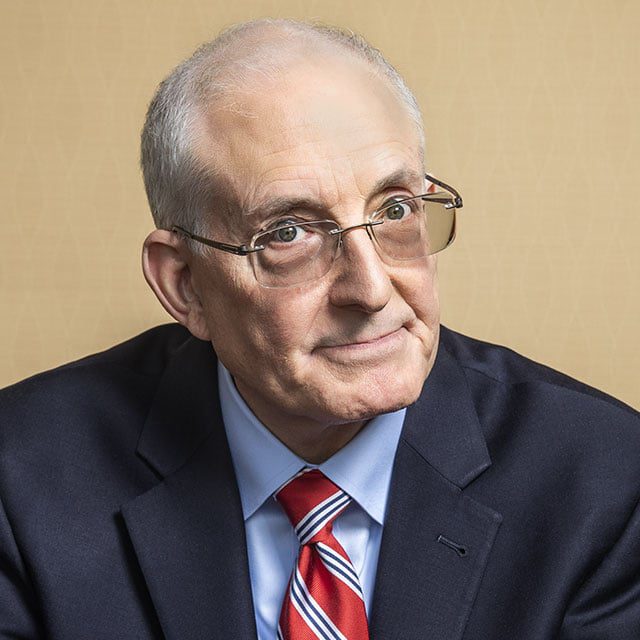

Ed Slott: Yes, IRA Rollovers Are Advice Under New DOL Fiduciary Rule

What You Need to Know

That means advisors must know the tax rules for each rollover option, the IRA expert tells ThinkAdvisor.

Advisor recommendations on IRA rollover transactions are fiduciary advice under the Labor Department’s proposed new fiduciary rule, and “would fall within the scope of investment advice,” according to Ed Slott of Ed Slott & Co.

IRA rollovers “will continue to be ’among the most, if not the most, important financial decisions that plan participants and beneficiaries, and IRA owners and beneficiaries are called upon to make,’” Slott told ThinkAdvisor Tuesday in an email exchange, citing the text of Labor’s proposed rule, released Tuesday morning.

Labor, Slott said, “is putting rollover advice right up there with investment advice.”

Labor’s proposal is officially called the Retirement Security Rule: Definition of an Investment Advice Fiduciary.

Taxes Are Key

Labor’s new rules “mean that advisors need to know the tax rules on each option when rolling over 401(k) plan funds to an IRA, or when not to do the rollover, or when to take a lump-sum distribution, which for example means being educated on the NUA (net unrealized appreciation) tax rules when there is appreciated stock in the 401(k) that may qualify for the NUA tax break,” Slott warned.

“An advisor who rolls those funds over to an IRA without analyzing the NUA option could end up losing that tax break, because they were just not aware of it,” Slott relayed.