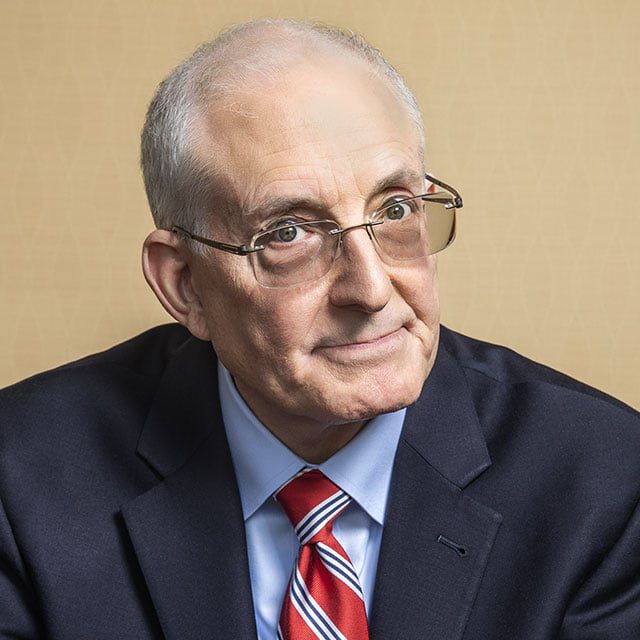

Ed Slott: Final RMD Regs Create an 'Unnecessary Complication'

What You Need to Know

The IRS has made it official: Retirement account beneficiaries subject to the 10-year rule must take annual RMDs if the account owner started them.

It’s now up to Congress to fix it — or to choose not to.

While the final regs are complicated, in practical terms most beneficiaries aren’t calculating RMDs, Slott says.

The IRS’ final rules on required minimum distributions for beneficiaries under the 10-year rule, released Thursday, have created ”an unnecessary complication” that only Congress can fix, according to IRA and tax expert Ed Slott of Ed Slott & Co.

The bottom line: the IRS “is sticking to the annual RMD requirement under the 10-year rule for beneficiaries who inherit from IRA owners who died after beginning RMDs,” Slott told ThinkAdvisor Monday in an email.

As usual, “Congress should have been more clear in writing the law,” he said. “To add to the problem, IRS waived these RMDs for the last 4 years (2021-2024) due to the complexity.”

With the just-released final regs, “the IRS is interpreting what they thought Congress intended regarding the 10-year rule, even though it seemed to me the law did imply a clean 10 years without annual RMDs, but maybe they didn’t intend that,” Slott said in separate comments by phone.

Now the ball is in Congress’ court to fix it. “It’s messy for beneficiaries and advisors to try and figure this out,” Slott said.

The final regulations reflect changes made by the Setting Every Community Up for Retirement Enhancement (Secure) and Secure 2.0 Acts affecting retirement plan participants, IRA owners and their beneficiaries.

“Now beneficiaries have to begin calculating their annual RMDs by going back to when there RMDs would have begun (in the year after death, but only if death was in 2020 or later),” Slott said. “In addition, advisors are asking if the back 4 years RMDs that were waived will now have to be made up — IRS says they don’t, so that’s good.”

Further, Slott said, “the 10-year period does not change, even though some of the prior year RMDs were waived.”