Dreaming of home ownership? Make it a reality with an FHSA

Canadians saving for their first home have another option—the First Home Savings Account (FHSA)—a registered plan that allows for tax deductible contributions along with tax-free growth and withdrawals¹ to buy or build your first home.2

What is an FHSA?

Introduced in 2023, an FHSA enables first-time home buyers who are qualifying individuals³, to contribute up to $40,000 towards the purchase of their first home if they are a resident of Canada, subject to conditions. An FHSA features the opportunity for tax-free growth like an RRSP (Registered Retirement Savings Plan) and TFSA (Tax-Free Savings Account), combined with the tax deductible contributions of an RRSP and the tax-free withdrawals of a TFSA. Qualifying withdrawals from an FHSA used to purchase a qualifying home are tax-free.

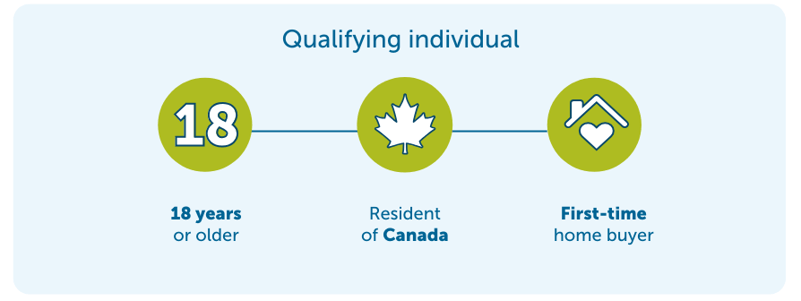

Who qualifies to open an FHSA?

You must be 18 years or older4 to open an FHSA.5

You must be a first-time home buyer who has not lived in a qualifying home3 that was either fully or jointly owned by you, or with a spouse or common-law partner, as your principal place of residence in the calendar year you open your FHSA or in the previous four calendar years.

You must be a resident of Canada.

Once you meet all conditions, you will be considered a qualifying individual.

![]()

Saving for your first home with an Empire Life FHSA can provide tax-free savings and withdrawals, with valuable insurance guarantees, that can help make homeownership a reality.

Building towards your dream home

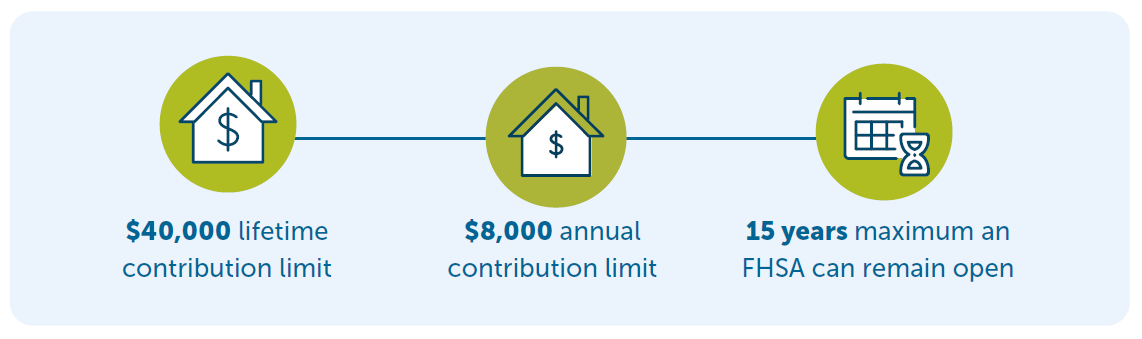

You can contribute up to a maximum of $8,000 per year until you reach $40,000. You can keep an FHSA open for a maximum of 15 years or until you reach age 71, whichever is sooner. Unlike an RRSP or TFSA, contribution room only starts to accumulate once an FHSA has been opened.

If you hold multiple FHSAs, your combined contributions must not exceed your participation room.3 Your contributions can be deposits into your FHSA or a direct transfer from your Registered Retirement Savings Plan (RRSP). If you don’t contribute the maximum FHSA amount in one year, you can carry over the unused participation room into the next year.3

![]() Timing is the key to success

Timing is the key to success

When do you want to purchase your first home? Consider the date, the annual amount you want to contribute, and how many years you plan to save for. Then work back to determine the date you should open your FHSA—remember you can only keep your FHSA open for 15 years.

When you’re ready to buy your first home

You’ve worked hard to save for your first home and now the time has come! A qualifying withdrawal from your FHSA is tax-free. You can make either a single withdrawal or a series of withdrawals, but all the following conditions must be met:

You must have a written agreement to buy or build a qualifying home.6, 7

You must not have acquired the qualifying home more than 30 days before making the withdrawal.

Work with your advisor to complete the necessary forms (RC725 Request to Make a Qualifying Withdrawal from your FHSA).

If you make a withdrawal from your FHSA and all the conditions are not met, it will be treated as a taxable withdrawal.

Other things to know about an FHSA

What happens if you overcontribute?

If you overcontribute to an FHSA you generally will have to pay a 1% tax per month, on the highest excess amount in the month, until the excess is eliminated. If the excess isn’t removed by a qualifying withdrawal or transfer to your RRSP, it will be reduced or eliminated by your new FHSA participation room on January 1 of the following year.

Closing an FHSA

Your maximum participation period begins when you open your first FHSA. You need to close all your FHSAs or transfer your FHSA assets to your RRSP or your Registered Retirement Income Fund (RRIF), on a tax-deferred basis, before your maximum participation period ends.

Tax and your FHSA

You are responsible for keeping track of all activity in your FHSA(s), but the issuer will give you a T4FHSA slip that shows the transactions you made in the year. There are instructions on the slip that will tell you how to report the amounts on your income tax and benefit return.

![]() To find out if an Empire Life First Home Savings Account is right for you, speak with your advisor or visit empire.ca/FHSA

To find out if an Empire Life First Home Savings Account is right for you, speak with your advisor or visit empire.ca/FHSA

![]() Download the PDF

Download the PDF

1 Must be a qualifying withdrawal.

² Must be a qualifying home.

³ For further information concerning FHSAs, please go to https://www.canada.ca and search for “First Home Savings Account”.

4 19 years old if that is the legal age to enter a contract in your province or territory.

5 You must also be 71 years or younger as of December 31 of the year you open an FHSA.

6 You must occupy or intend to occupy the qualifying home as your principal place of residence within one year after buying or building it.

7 The home must be acquired or the construction completion date of the qualifying home must be before October 1 of the year following the date of the withdrawal.

Segregated Fund contracts are issued by The Empire Life Insurance Company (“Empire Life”).

A description of the key features of the individual variable insurance contract is contained in the Information Folder for the product being considered. Any amount that is allocated to a segregated fund is invested at the risk of the contract owner and may increase or decrease in value. All returns are calculated after taking expenses, management and administration fees into account.

The information in this document is for general information purposes only and is not to be construed as providing legal, tax, financial or professional advice. The Empire Life Insurance Company assumes no responsibility for any reliance made on or misuse or omissions of the information contained in this document. Please seek professional advice before making any decision.

® Registered trademark of The Empire Life Insurance Company.

June 2024