Donating Life Insurance to Charity: Your Guide

Gift of life insurance to charity: Background

Many Canadians choose to support causes that are important to them by donating life insurance to charities of their choice. What most people do not realize is that there are special insurance solutions that allow you to significantly increase the amount of your donation while paying the same amount.

Today, we look at how such insurance products work, what they cost, and the size of donations they can generate for the charities of your choice. If any of these insurance products interest you and you want to maximize your contribution to your chosen charity, our experienced advisors are here to help you with these products – just complete a form on this page.

Donate life insurance policy to charity: Background

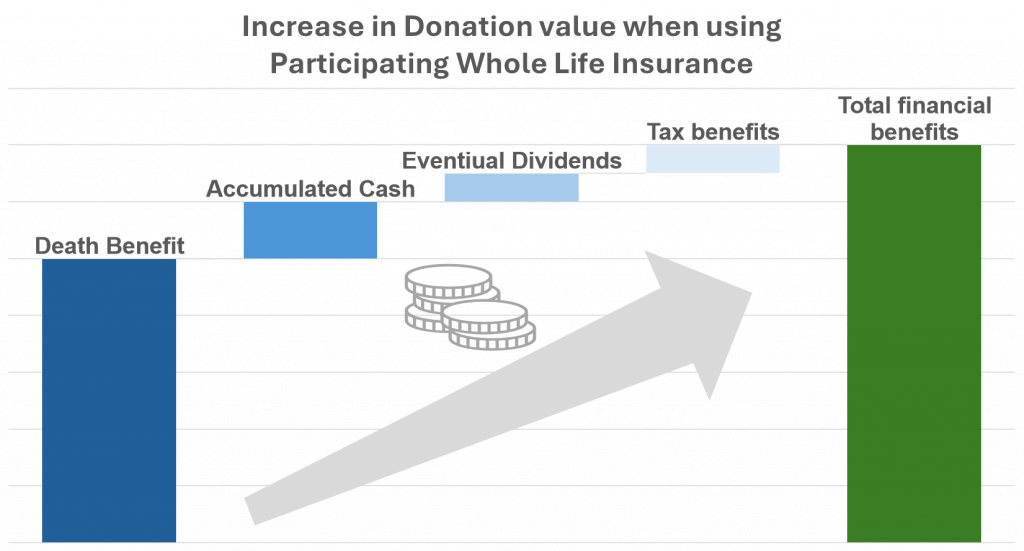

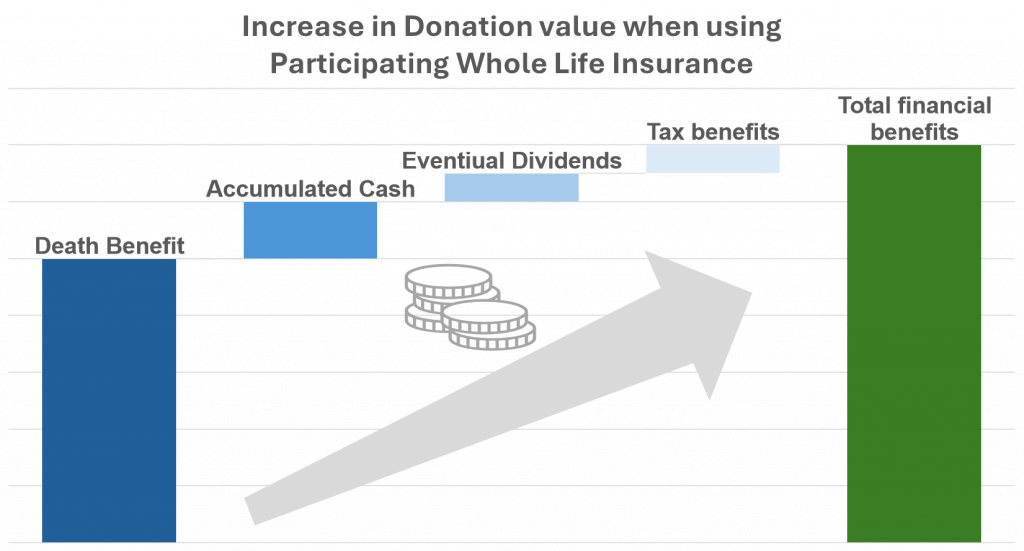

Life insurance offers a simple and cost-effective method to make a substantial charitable donation without affecting your family’s inheritance. This approach enhances the size of your charitable gift. Generally, a participating whole life insurance policy is utilized for this purpose. Such a policy can increase the value for its beneficiary, the charity, in four distinct ways (see the picture below):

A whole life insurance policy has a cash accumulation component that increases over time.Participating life insurance means that from time to time, a beneficiary can receive dividend payouts based on the performance of the insurance company.Life insurance ensures that once you pass away, a beneficiary (in this case, a charity of your choice) will receive a claim payout.There are tax benefits in the form of a tax receipt, either for premiums paid (if a charity owns the policy) or for the death benefit (for your estate beneficiaries).

These four features make life insurance a very appealing option for charitable donations. It is important to note that your charitable gift does not affect the inheritance intended for your family. Since there is no need to allocate a portion of your estate for charity, the entire estate remains available for your family’s benefit.

Naming a charity as beneficiary of life insurance: How many donations can you generate

Let’s compare two scenarios: in the first, Lucy donates $50 per month directly to her chosen charity over a period of 20 years. In the second, Lucy opts to purchase a life insurance policy, designating her chosen charity as the beneficiary to receive the proceeds.

Simply donationsDonation via a life insurance policyMonthly contribution of $50Period of contribution: 20 yearsMonthly premiums of $50Premium payment option of 20 yearsParticipating whole life insurance with guaranteed death benefit and cash valuesTotal donation value:$12,000Total donation value:$102,089

The modelling above is completed based on Equimax® participating whole life insurance from Equitable Life.

Additional info: Equimax Estate Builder 20 pay, paid-up additions dividend option. Assumes female, non-smoker, age 35. Example of the death benefit amount payable at age 85. Total death benefit values are for illustration purposes only. Illustrated values are based on rates in effect as of August 12, 2023 and the dividend scale as of the rates effective date remaining unchanged for the life of the policy.

Naming a charity as beneficiary of life insurance: Two options

It is important to note that charitable giving through life insurance can be accomplished in two primary ways detailed in the table below

OptionsPolicy ownerDetailsTax benefitsOption 1YouYou pay the premiums and designate the charity as the beneficiary. By retaining ownership, you retain the ability to change the beneficiary in the future if you choose.Your estate will receive a tax receipt when the death benefit is paid out.Option 2CharityYou pay the premiums and designate the charity as the owner of the policy. In this case, the charity has access to the cash value in the policy and is assured of receiving a substantial future donation when the death benefit is paid.The charity will issue you an annual tax receipt for the premiums paid.

Charitable donation of life insurance policy: What companies offer such policies.

There are several companies that offer special life insurance products designed for charitable donations. We want to highlight two of them that are available on the market.

My Par Gift from Canada Life: This type of life insurance is a participating whole life insurance policy that requires a single premium payment. Once the policy is active, it is controlled by a charity. The charity has the option to purchase additional insurance coverage, potentially raising the policy’s cash value and death benefit. Alternatively, they can receive the annual dividends in cash.

My Par Gift from Canada Life: This type of life insurance is a participating whole life insurance policy that requires a single premium payment. Once the policy is active, it is controlled by a charity. The charity has the option to purchase additional insurance coverage, potentially raising the policy’s cash value and death benefit. Alternatively, they can receive the annual dividends in cash.

Equimax participating whole life insurance provides a guaranteed death benefit4, premiums and cash values. Shorter premium payment options of 10 or 20 years are available.5 It is an easy, hands-off approach to creating a legacy. Equitable Generations product provides life insurance protection and more hands-on involvement to maximize tax-advantaged investment growth within the plan.6 You select from a range of investment options based on your risk tolerance and have the option to fund the plan with a single lump sum payment

Equimax participating whole life insurance provides a guaranteed death benefit4, premiums and cash values. Shorter premium payment options of 10 or 20 years are available.5 It is an easy, hands-off approach to creating a legacy. Equitable Generations product provides life insurance protection and more hands-on involvement to maximize tax-advantaged investment growth within the plan.6 You select from a range of investment options based on your risk tolerance and have the option to fund the plan with a single lump sum payment

Our licensed life insurance brokers are highly knowledgeable about life insurance products designed for charitable donations. If you have a specific charity in mind and wish to make a difference, we would be delighted to assist you in selecting the best life insurance product. Simply complete the form above, and we will provide you with the necessary guidance, with no obligations.