DOL Releases New Fiduciary Rule

What You Need to Know

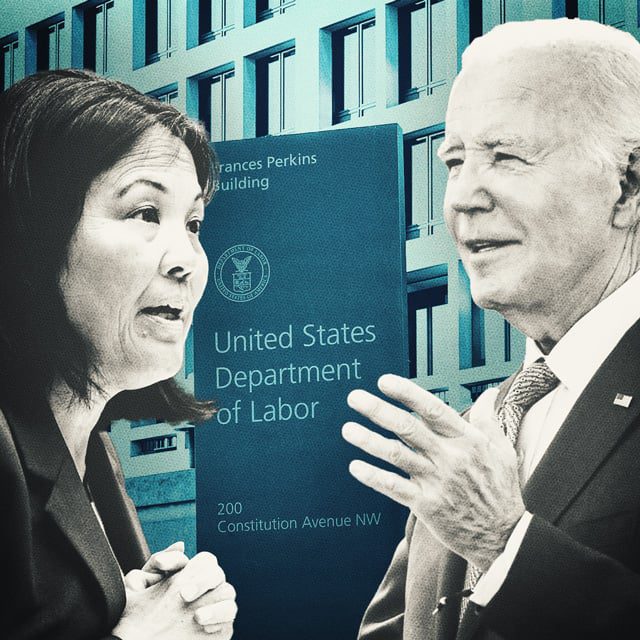

Biden administration officials said the latest fiduciary plan aims to close loopholes and require financial advisors to provide retirement advice in the best interest of investors.

The Department of Labor also is publishing proposed amendments to Prohibited Transaction Exemption 2020-02 and to several other existing administrative exemptions.

The Labor Department released Tuesday morning its new fiduciary rule proposal, the Retirement Security Rule: Definition of an Investment Advice Fiduciary.

President Joe Biden said Tuesday afternoon at the White House that with the new fiduciary rule, his administration “is taking on what we call junk fees.” These junk fees, Biden explained, “are hidden charges that companies sneak into your bill and make you pay more, just because they can.”

Today, “we’re taking additional action to eliminate junk fees in retirement savings,” the president continued.

Focus on Payouts

The administration’s central concern, Biden said, is that while “most financial advisors give their clients good advice at a fair price and are honest with them, … that’s not always the case. Some advisors and brokers steer their clients toward certain investments, not because they’re in the best interest of the client, but because it means the best payout for the broker.”

“I get it,” he added. “I understand it. But I want you to understand [that] we’re watching.”

Biden administration officials explained late Wednesday during a call with reporters that the latest fiduciary plan aims to close loopholes and require financial advisors to provide retirement advice in the best interest of investors.

The plan seeks to amend the regulation defining when a person renders “investment advice for a fee or other compensation, direct or indirect” with respect to any moneys or other property of an employee benefit plan, for purposes of the definition of a “fiduciary” in the Employee Retirement Income Security Act of 1974.

The proposal also would amend the parallel regulation defining for purposes of Title II of ERISA, a “fiduciary” of a plan defined in Internal Revenue Code section 4975, including an individual retirement account, according to Labor.

PTE Updates

In Tuesday’s Federal Register, Labor also is publishing proposed amendments to Prohibited Transaction Exemption 2020-02 (Improving Investment Advice for Workers & Retirees) and to several other existing administrative exemptions from the prohibited transaction rules applicable to fiduciaries under Title I and Title II of ERISA.

The plan amends Prohibited Transaction Exemptions 84-24, applying to annuities, as well as 2020-02, concerning rollover advice, and other PTEs.