Companies should tailor CX Strategy not only to their customers’ needs, but also to their own size and industry

New Aite-Novarica Group report presents high-level themes of financial institutions and insurers about CX practices within their organizations

Boston, MA (June 9, 2022) – There is widespread consensus about the importance of customer experience (CX) but little agreement as to how it should be organized, implemented, measured, and improved. Budgets and headcounts have increased in many cases, but specific strategies for deploying these resources and investing in capabilities seem to be inconsistent and face challenges in communication, measurement, organization, and governance.

In a new Impact Report, The Current State of CX Strategy: Three Governing Themes for Approaching CX, research and advisory firm Aite-Novarica Group presents high-level themes that emerged from a recent Aite Novarica Group survey of financial institutions and insurers about CX practices along three main paths: what kind of contact points consumers have with brands (contact-based CX), organizational intentions vs. actions and execution, and the effect of company size and industry type.

“Organizations should look at CX from the customer’s standpoint,” said Reut Samra, Strategic Advisor at Aite-Novarica Group and author of the new report. “For the customers, how a product is being marketed, how an agent or advisor is contacting them, and how the digital channels are designed, is all one. Customers do not know, and should not care, which department/team is contacting them—everything represents the face of the company and should be consistent and clear.”

Click here to access the report.

Report Preview

The current state of customer experience in the financial services and insurance industries is defined by contradiction. There is widespread consensus about the importance of CX but little agreement as to how it should be organized, implemented, measured, and improved. Budgets and headcounts have increased in many cases, but specific strategies for deploying these resources and investing in capabilities seem to be inconsistent and beset by challenges in communication, measurement, organization, and governance.

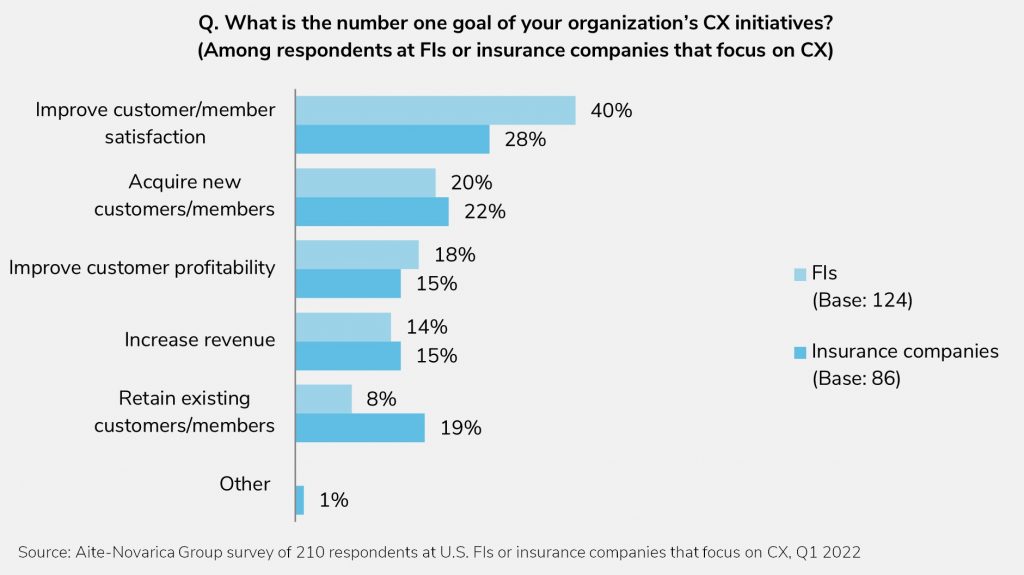

This report explores these challenges along three main paths: what kind of contact points consumers have with brands (contact-based CX), organizational intentions vs. actions and execution, and the effect of company size and industry type. Based on Aite-Novarica Group’s Q1 2022 quantitative study of 210 insurance and financial services professionals who have insight into CX strategy, the report explores important differences between industries, organizational models, communication channels, and CX capabilities.

This 45-page Impact Report contains 32 figures. Clients of Aite-Novarica Group’s Customer Experience service can download this report and the corresponding charts.

Click here to access the report.

About Aite-Novarica Group

Aite-Novarica Group is an advisory firm providing mission-critical insights on technology, regulations, strategy, and operations to hundreds of banks, insurers, payments providers, and investment firms—as well as the technology and service providers that support them. Comprising former senior technology, strategy, and operations executives as well as experienced researchers and consultants, our experts provide actionable advice to our client base, leveraging deep insights developed via our extensive network of clients and other industry contacts. For more information, visit aite-novarica.com.

Source: Aite-Novarica Group

Tags: Aite-Novarica Group, customer experience (CX), report, strategy