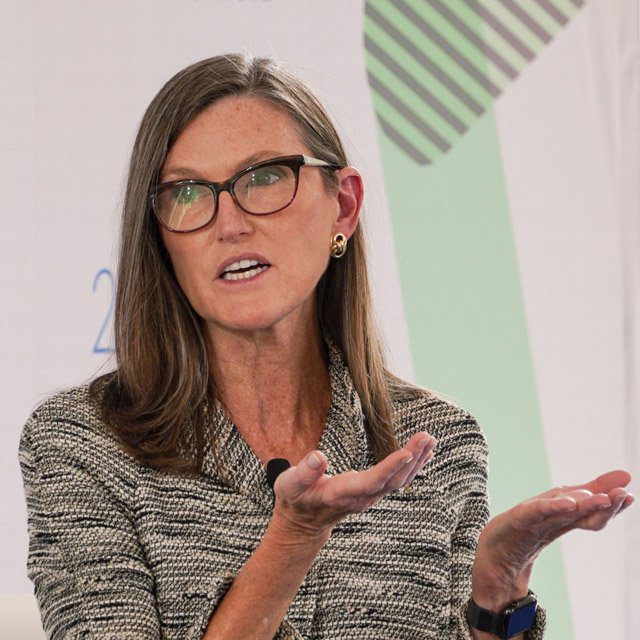

Cathie Wood's ARKK Sees Biggest Monthly Outflow in Nearly a Year

What You Need to Know

The $8 billion Ark Innovation ETF (ticker ARKK) saw $803 million rush out in August.

Investor loyalty may now be reaching a limit, with the ETF down 60% this year, compared with the S&P 500 Index’s 18% drop.

Cathie Wood’s fans turned tail last month, pulling out the most money from her flagship fund in nearly a year as it continues to flounder.

The $8 billion Ark Innovation ETF (ticker ARKK) saw $803 million rush out in August, the biggest monthly outflow since last September, according to data compiled by Bloomberg. The exchange-traded fund saw daily inflows in only six days last month.

The surge of outflows underscores a stark shift of sentiment, after money flowed in for much of this year even as the innovation-themed fund plummeted.

Investor loyalty may now be reaching a limit, with the ETF down 60% this year, compared with the S&P 500 Index’s 18% drop, and prospects dim for a revival anytime soon.

“Ultimately, performance is king,” said Nate Geraci, president of The ETF Store, an advisory firm. “No matter how much conviction a manager has and how closely they stick to their beliefs, if the performance isn’t there, ultimately the outflows will follow.”

ARKK flow data arrives with a one-day time lag, meaning the monthly data represent the period from the last trading day of the previous month to the second-to-last day of the current month. For example, the August period represents flows from July 29 to August 30.

Wood and her team have kept to their theme of disruptive technology while managing ARKK. That had helped assets in the fund stay sticky earlier in the year, since investors knew what to expect with ARKK, Geraci said.

But Wood’s picks have also contributed to the fund’s continued underperformance, as red-hot inflation and monetary tightening batter growth stocks.

ARKK last month snapped up shares of Zoom Video Communications Inc. as the video-conferencing company plunged to pre-pandemic levels. The fund has also been buying Ginkgo Bioworks Holdings Inc., which has fallen 69% this year.