Cathie Wood's Ark Shutters Transparency ETF in First Closure

The fund gained only $12 million in assets since inception, a fraction of the $9 billion in Wood’s flagship fund. It was a rare passive vehicle from Ark, whose active offerings boomed in popularity during the pandemic, with Wood hand-picking stocks that she saw as shaping the future of finance, healthcare and other industries.

“This seemed like an odd fit to me from the beginning,” said Nate Geraci, president of the ETF Store, an investment advisor. “Ark made their name by focusing on active management and disruptive innovation. The ARK Transparency ETF was at odds with that approach.”

The transparency fund’s price has dropped more than 30% since its debut in late December. It will no longer accept creation orders after Thursday and won’t accept redemption orders after July 26, the filing showed.

It’s been a difficult year for investors in growth strategies. Wood’s ARKK has plunged more than 50% as the Federal Reserve raises interest rates and fears of a recession grow. Since December, Ark has lost almost half of its assets under management.

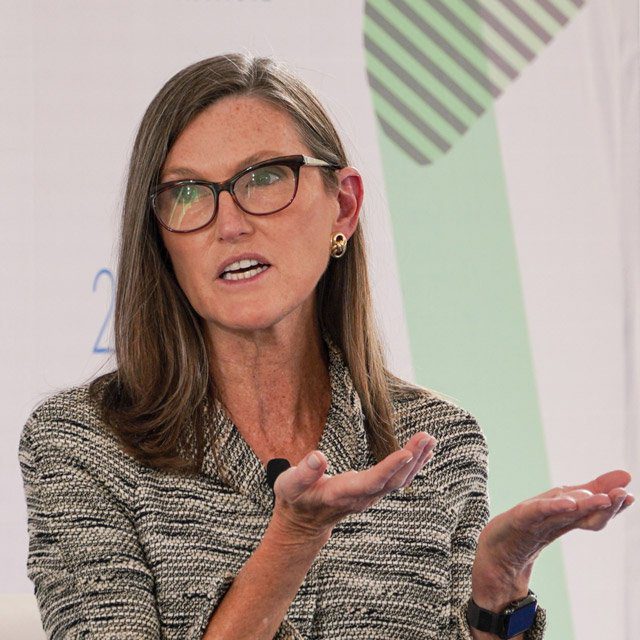

(Photographer: Kyle Grillot/Bloomberg)