Can I Get Life Insurance with a Pre-Existing Health Condition?

In the interest of your already frazzled nerves: yes, it is possible to get Life Insurance with a pre-existing health condition here in Ireland.

The fact you’ve typed a question that led you to this blog means you’re probably having a good long think about getting Life Insurance with whatever pre-existing condition you have.

I won’t soften the blow here: it’s harder than getting Life Insurance if you were in full health.

If you think about it, it makes sense.

Life Insurance with Underlying Health Issues

One of the questions I get around these here parts is, “how does Life Insurance work?”

It’s a fair question.

If you’re investing a chunk of your cash, you’ll want to know where it’s going and what you’re getting for it.

Despite how the insurers dress it up, Life Insurance isn’t that complicated.

You buy a policy that covers you for a certain amount of time.

If you pass away in that period without breaking the conditions of your policy (like lying on your application), your family will receive an agreed monthly payment or a lump sum of money (depending on how you set up your policy).

Tell the truth, pay your premiums, and your policy will pay out to your family in the event of your death.

How Does Your Health Impact the Possibility and Cost of Life Insurance?

Enter: The Underwriter (who may or may not sound like a bad boy WWE wrestler from the ‘90s).

Underwriters are the folks who do the sums on every insurance application.

They consider factors such as health, family history, age, and occupation before accepting, postponing, or declining your application.

If they offer cover, they may add a loading if you have a health issue.

Likewise, your premium will be higher than normal if you have a dangerous hobby or job.

In short, the higher the risk they think of you claiming, the more expensive your cover will be.

But there’s a kicker: some insurers will charge more than others.

Scoundrels.

Blaggards.

Thieves.

Call them what you will, but if you have a family (especially if you have young kids), Life Insurance is an unfortunate necessity.

It’s up there with Wi-Fi and food.

Does that mean you have to roll over and accept whatever price the insurer gives you?

No, no, it does not.

What is a Pre-Existing Condition?

The 42 most common pre-existing conditions and chronic illnesses our clients need advice on include

Cancer

Diabetes

Inflammatory Bowel Diseases (Ulcerative Colitis and Crohn’s Disease)

Heart Attack

Kidney Disease (Chronic and Polycystic)

Mental Health Issues

Multiple Sclerosis

Weight Issues (under and overweight)

If you have a pre-existing condition, the underwriters will need more information on your health to decide whether to offer cover or not.

In general, they need to know:

Name of the condition

Date of diagnosis

Current symptoms

Has a cause been identified

Current treatment

Time off work?

Details of any investigations carried out.

Discharged from follow-up?

If you’d like me to check whether you can get cover, please complete this short questionnaire, and I’ll be right back.

How to Get Life Insurance with a Pre-Existing Condition

Now, I’m not going to tell you that you 100 per cent will be able to get Life Insurance.

Sometimes, the risk is too high for the insurer, and they’ll say no or postpone your application.

It depends on the type of Life Insurance you need, the illness we’re talking about and how severe the symptoms are.

The date of diagnosis is also key.

If it’s a recent diagnosis, the insurer will likely sit on the fence and take a wait and see approach.

Once the insurer knows the score, for example, how you’re reacting to treatment, they’ll be in a better position to offer cover.

Insurance underwriters love stability. They don’t like seeing results bouncing around outside of the normal range.

They may need a PMAR (medical report) from your GP to make a decision, and you may have to do a medical screening (common for high BMI)

The nurse medical screening isn’t as scary as it sounds—they measure you and take blood, and if you’re lucky, you may get to pee in a cup.

Nice.

Do The Same Rules Apply to All Types of Insurance?

Negative Ghostrider.

The type of cover you need will have an impact .

For example, if you have MS or Type 1 Diabetes, you won’t be able to get Serious Illness Coverage or Income Protection, but Life Insurance should be fine.

Not fair, I know – but them’s the rules.

There’s one last ‘not fair’ to get through.

What the Hell is a Loading?

An increase in your premium is called the loading.

If the loading is above the risk limits of the insurer, they may refuse to offer cover or they may remove the conversion option.

And What the Blazes is a Conversion Option?

Easy there, tiger.

Conversion is an add-on that lets you get another policy when your one runs out without supplying medical information, which is dead handy.

Some insurers will remove this option if they add any type of loading to your policy.

Zurich is fairer and will offer the conversion if the loading is less than 75% extra.

If you can’t get a conversion, your best bet is to apply for the longest term you can get.

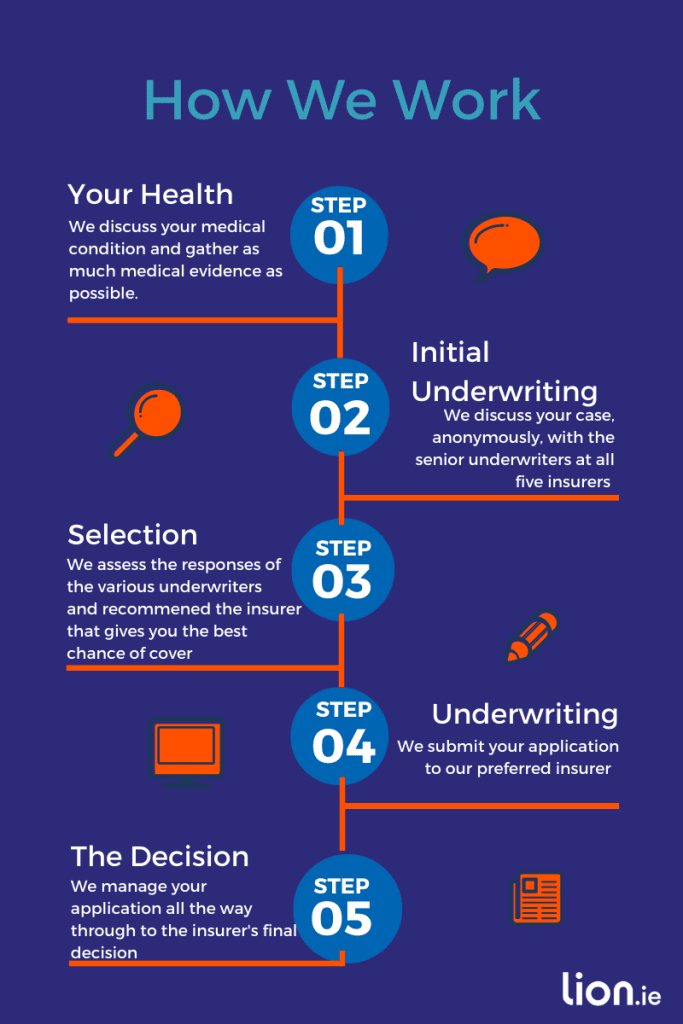

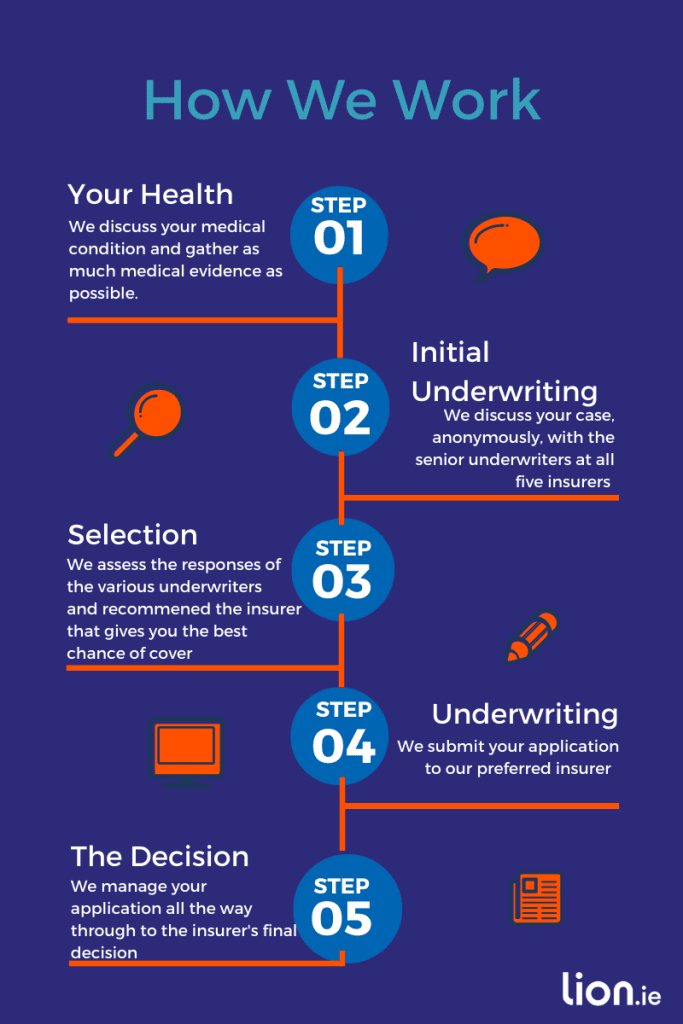

Why a Savvy Broker is Your Secret Weapon

Information is your secret weapon for getting a good deal on Life Insurance if you’ve got a pre-existing condition.

It’d be handy if they taught you all this stuff in school (instead, you get hours spent writing three-page essays about soil biomes).

Much like taxes, insurance is one of those things most people are familiar with, but they don’t know much about how it works – and they could be losing a chunk of change because of it.

Now, you could learn every last thing about insurance or work with a broker (like me) who deals with ALL of the Life Insurance providers and knows them like the back of my hand.

I’ve been doing this stuff for aaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaages and aaaaaaaaaaaaaaaaaaaaaaaaaaaages.

So it’s in your best interest to approach a broker before you go near any insurers.

I can’t stress how important this is.

If you approach a broker after you’ve been declined, postponed or had your premium increased, then you have a problem, as you’ll face this question on all subsequent applications:

‘Have you ever been declined, postponed or accepted on special terms by any insurer for life, specified illness or income protection cover?’

You’ll have to answer yes, and a “yes” raises a red flag.

The next underwriter will scratch their head, stare at their screen and think, “hmmm, why did the other insurer refuse to offer cover; what am I missing here?”

A previous refusal makes it more difficult for you to get cover at the standard price.

But all is not lost if you have been declined or refused at another insurer.

You see each underwriting department will take a different view of your medical condition.

For example:

Insurer A may decline you for poorly controlled Diabetes, while B may accept you with a loading (increased premium).

Insurer B may decline you because of your BMI, while C may accept you with a loading.

A specialist broker will know which insurer will be most sympathetic to your pre-existing illness – giving you the best chance of getting affordable coverage with the least hassle.

Specialist Life Insurance FAQ

We’ve gathered some common questions on getting life insurance with an illness.

Here goes…

Can I get life insurance with an illness?

The short answer is a resounding YES!

It’s rare for all 5 insurers to decline an application.

Even if one or two insurers decline, getting cover is still possible.

Read more about life insurance with medical issues.

Will I need to do a load of medical tests?

No.

9 out of 10 specialist life insurance applications are approved without needing a life insurance medical exam.

You will need to go through the normal underwriting procedure:

application form

health questionnaires

medical report from your GP (depending on the severity of your condition)

How long will it take?

The biggest delay is waiting for your GP to send back the report.

If your GP is efficient and completes the PMAR in timely fashion, you could have a decision within a week or two.

How much is life insurance for a medical condition?

It will cost more than someone who doesn’t have any health conditions.

Pretty obvious I know but it’s impossible to be more accurate.

All health conditions carry different loadings.

Your condition might be mild, moderate or severe.

The more severe, the higher your final premium will be.

You can get a standard life insurance quote using our quote machine but to give an accurate quote, I’ll need more details on your health issue:

Over to you…

If you have a pre-existing condition and are worried it may affect your cover, please complete this short questionnaire so we can start the process:

Our initial discussions with the various underwriters will be on a no-name basis

I’m on 05793 20836 if you’d prefer a quick chat first.

Thanks for reading

Nick

Editor’s Note | We first published this blog in 2018 and have regularly updated it.