Call for Glass-Steagall Revival Grows as Bank Failures Mount

An attack on part of the Gramm-Leach-Bliley Financial Services Modernization Act of 1999 is making a comeback, just as a wave of bank failures is focusing new attention on how federal regulators financial institution meltdowns.

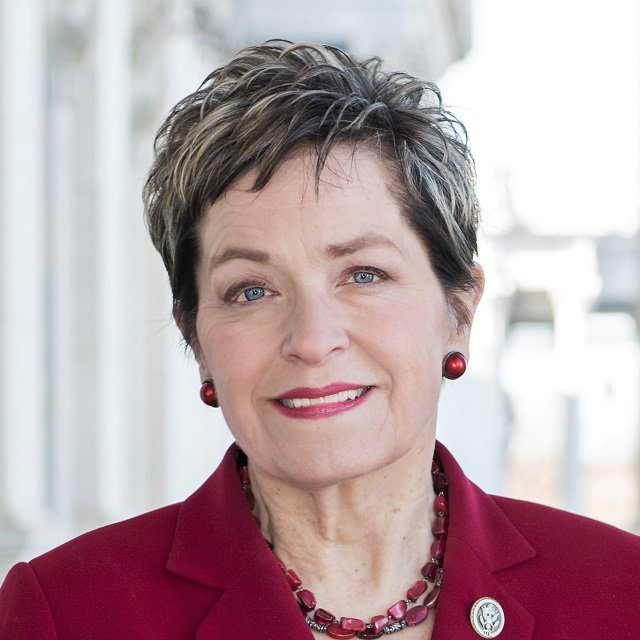

Rep. Marcy Kaptur, D-Ohio, introduced H.R. 2714, a version of the Return to Prudent Banking Act bill, for the 118th Congress.

The bill, which has 11 Democratic co-sponsors, would bring back the old, pre-1999 Glass-Steagall Act limits on what federally insured banks could do, prohibiting them from having anything to do with securities underwriting or distribution or having ties to investment advisors or broker-dealers.

What It Means

If H.R. 2714 passed, it could end bank distribution of variable annuities and mutual funds, as well as bank involvement in investment banking.

The History

H.R. 2714 is a successor to bills Kaptur began introducing in 2009.

Sen. Elizabeth Warren, D-Mass., has persuaded colleagues — including Republicans — to co-sponsor versions of a similar bill, the 21st Century Glass-Steagall Act bill, since 2013.