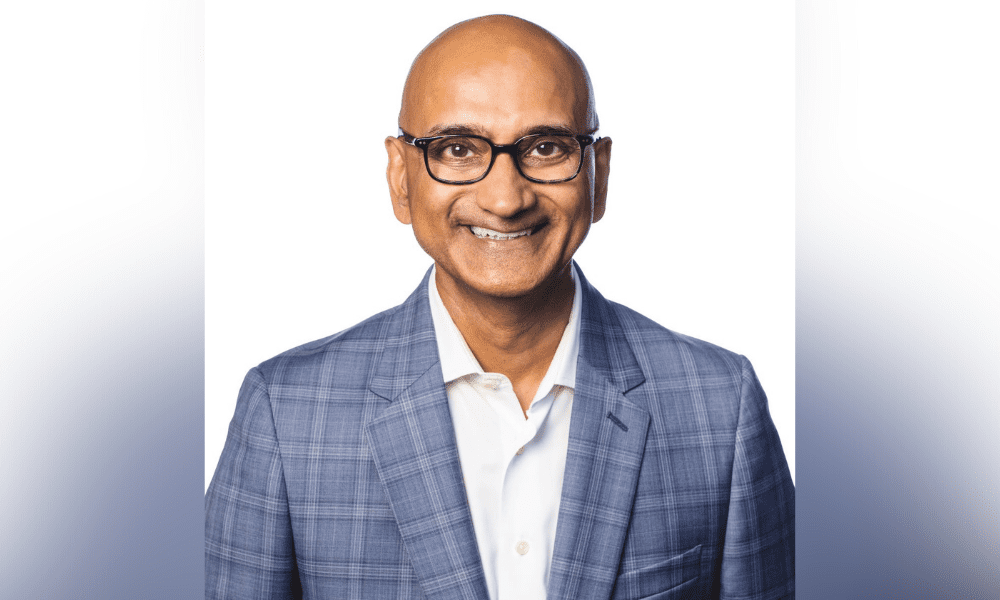

‘Business has been very good for us through this period,’ says Cult Wines CEO

Tiwari noted that despite the various recent drops, such as in the S&P 500 and TMX, and falling equity markets, wine has shown “some really decent returns”, which is good for business.

He noted that more advisors and high-net worth individuals are recognizing the benefits of alternative investments in their overall portfolios and questioning the traditional 60/40 approach, which hasn’t done well lately. So, more investors are prepared to consider assets like wine.

Read More: How your clients can benefit from a growing asset class | Wealth Professional

“Our net flows year to date are about 60% up year over year,” he said. “We’re also attracting new clients. Year to date, we’re up 20% in terms of the number of clients. We’re attracting new people to the asset class and new demographics as well. So, although times are tough for everybody from an inflation standpoint, and we all feel it when we go to the grocery store or pump, it’s been a good time for fine wine investment.”

Tiwari noted that Cult Wines now has more than $400 million in assets under management and a client base in the thousands, which is getting younger and more diverse as its business grows in both Canada and the U.S.