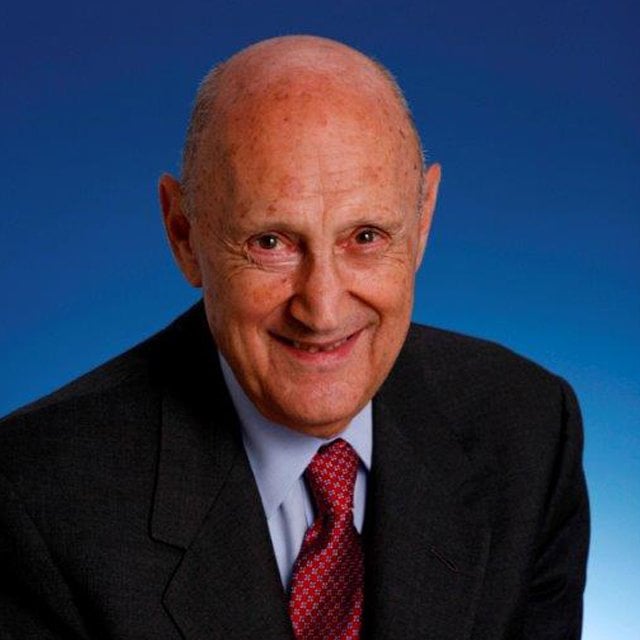

Burton Malkiel: The Unsexy Secret to Building Wealth

“A blindfolded chimpanzee throwing darts at the stock listings can select a portfolio that performs as well as those managed by experts.”

So wrote Burton Malkiel, professor emeritus of economics at Princeton University, in his 1973 classic “A Random Walk Down Wall Street.”

Today, that remains his considered opinion, as he tells ThinkAdvisor in an interview.

“The evidence is so clear that I believe that hypothesis even more strongly than I did 50 years ago because time after time the data proves it,” Malkiel says.

His mega-bestseller has had 15 editions, and on Jan. 3, W.W. Norton will publish the revised and updated 50th anniversary edition of “A Random Walk Down Wall Street: The Best Investment Guide That Money Can Buy.”

Malkiel’s main thesis still is: “The future is inherently unpredictable.” Therefore, regularly invest in broad-based index funds and stay far away from investment advisors, who have been proven wrong too many times, he says in the interview.

As for Malkiel’s own prediction for the stock market and economy, he forecasts that “growth of the economy is likely to be slower than in the past because of demographics.”

And “even though in the long run, common stocks have given 9% [returns], they will do less than that in the future. It’s going to be a very tough environment,” he says.

At 90, Malkiel is the chief investment officer of Wealthfront, a robo-advisor that invests in index funds.

That dovetails with the investment philosophy he’s been espousing for half a century now.

“Investing in a broad-based index fund” — typically thorough dollar cost averaging — “doesn’t sound too sexy, but it’s the secret to building wealth,” he insists.

The professor likes automated digital services because for one, they facilitate investing regularly.

“There are several aspects of investment management that an automated advisor can do more efficiently than a traditional face-to-face advisor,” he writes.

“My hope is that if you follow the rules in the book, you don’t need one,” he says in the interview.

Now a Princeton research associate, Malkiel is on the investment committee of advisory firm Rebalance and the advisory board of Research Affiliates.

He was a director of The Vanguard Group for 28 years.

He began his career as an investment banker at Smith Barney. In 1964, he received a doctorate from Princeton and joined the faculty.

He took brief stints away from Princeton as dean of the Yale School of Management after being a member of the Council of Economic Advisers during the Gerald Ford presidency.

Malkiel, who conceived the concept of an index fund before the first commercial fund existed, has no enthusiasm for most newer investing methodologies, certainly not as the basis of a retirement portfolio.

These include smart beta, factor investing and ESG investing, though they might be OK as an ”add-on,” he notes.

In the interview he opines on cryptocurrency (“avoid”) and nonfungible tokens (“absolutely crazy”).

The newest edition of “A Random Walk,” peppered with jokes and cartoons, is a comprehensive 432-page walk through market bubbles, behavioral finance, practical investing applications and more.

ThinkAdvisor interviewed Malkiel, who’s based in Princeton, New Jersey, and was speaking from his Florida winter home, by phone on Dec. 22.

A “gambling instinct,” as he self-describes, encourages the famed indexer to also invest in individual stocks, as well as play blackjack in Las Vegas.

Both endeavors are, he says, only for “fun.”

Here are highlights of our conversation:

THINKADVISOR: In the 50th anniversary edition of “A Random Walk Down Wall Street,” you write, as you did in the first edition, that even “a blindfolded chimpanzee throwing darts at the stock listings can select a portfolio that performs as well as those managed by the experts.”

Why do you still believe that?

BURTON MALKIEL: The evidence is so clear that I believe in that hypothesis even more than when I first wrote the book, even more strongly than I did 50 years ago because time after time the data proves it.

Every year it turns out that two-thirds of active managers are beaten by a broad-based index. The index I use is the S&P 1500.

The one-third that beats the average one year isn’t the same as the one-third that wins the next year.

So when you compound that and look over 10 years, you find that 90% of active managers do worse than an index.

I’m not saying there’s nobody who can outperform. Warren Buffett can, though recently, he hasn’t.

He’s said he’s directed that his estate be invested in an index fund.

What’s the main thrust of “A Random Walk”?

The idea is that there are so many things that happen in the world that you simply can’t predict. The future is inherently unpredictable.

The [essence] is to avoid mistakes by staying with a regular investment policy of savings and investing in a broad-based index fund.

That doesn’t sound too sexy, but it’s the secret to building wealth.

You write that Wall Street considers your book “an obscenity.” Why do you say that?

If you’re a money manager running an active fund and say [to a client], “You want to buy my fund because I can beat the market — and that’s why you’re paying me [high amount] to manage the fund,” and I come along saying, “The emperor has no clothes — you can’t beat the market,” [the money manager] won’t like it.

So in that sense, it’s an obscenity.

Why have you no faith in technical analysis, as you write?

The short answer is: It doesn’t work. There’s a little momentum in the market — I agree with that. But sometimes the momentum crashes in a heartbeat.

So technical analysis isn’t a dependable way of beating the market. My own work suggests that, while the market isn’t a perfect random walk, it’s very close to it.

You hold the position of chief investment officer of Wealthfront. What attracted you to work with an automated investment service, aka a robo-advisor?

In large part because Wealthfront is using index funds, which are exactly what I’ve recommended.

Investment advisors will charge people 1%, 2%, 3% to handle their portfolios, and there are some conflicts there.

I’m delighted to be associated with a company that [invests using] software and charges 25 basis points.

You didn’t write much in the new edition about financial advisors? How come?

I did, in a way, when I talked about Wealthfront [for example: “There are several aspects of investment management that an automated adviser can do more efficiently than a traditional face-to-face adviser.”].

My hope is that if you follow the rules in the book, you don’t need one.

You thought up the concept of the index fund even before an index fund existed for the public. Right?

Yes, indeed. I’m a skeptic. So when I was at Smith Barney, where I started my career, I wondered whether the emperor really had any clothes [because] data was beginning to be shown about stock market returns.

I looked at what the market averages were and at what active managers were doing, and I thought, “My God, the market is doing better than the active managers!”

That’s what [prompted] my idea. Three years after my book was published, Jack Bogle [Vanguard founder] started the first index fund [in 1976].

What’s your forecast for the stock market in the near future?

Valuations are certainly still high. I worry a lot about the fact that inflation has been very sticky, and I think it will continue to be sticky.

The growth of the economy is likely to be slower than it has been in the past, in part because of the demographics of the country.