Brighthouse Financial: Further Growth Could Still Lie Ahead – Seeking Alpha

urbazon/E+ via Getty Images

Investment Thesis

While the effect of inflation on annuity demand remains uncertain, strong earnings growth across the Life segment could lead to further upside for the stock.

Brighthouse Financial (BHF) has seen a strong recovery in the past two years:

investing.com

As one of the largest providers of life insurance and annuities in the United States, demand for life insurance has risen significantly.

While the life insurance industry made payouts of $90 billion in 2020 (the highest in over 100 years), demand for life insurance also saw consumers buy over $3.3 trillion in life insurance coverage – which marks a historical record.

Notably, payouts from non-COVID deaths rose markedly in 2021 – thought to be as a result of delayed care for other ailments during lockdowns in 2020.

Taking the trends of both rise in policy demand and higher payouts across the life insurance sector – the purpose of this article is to determine whether Brighthouse Financial could still see upside from here.

Recent Performance

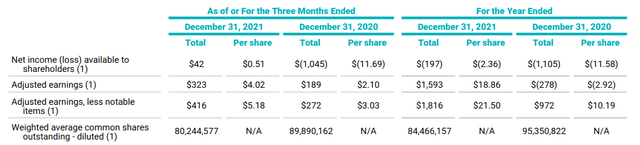

Looking at recent Q4 2021 results, we can see that after incurring a sharp earnings loss in 2020 – adjusted earnings showed a strong return to profitability on both a three-month and year-ended basis.

Brighthouse Financial: Fourth Quarter and Full Year 2021 Results

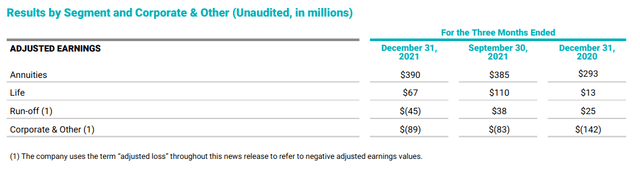

When looking at earnings by segment, we see that while Annuities accounts for the company’s largest segment – growth across the Life segment is up by a large margin compared to the same period in 2020:

Brighthouse Financial: Fourth Quarter and Full Year 2021 Results

The balance sheet of Brighthouse Financial also showed impressive results, with cash and cash equivalents up by nearly 9% from the previous year and long-term debt down by just over 8%.

Brighthouse Financial: Fourth Quarter and Full Year 2021 Results

From a financial standpoint, Brighthouse Financial has shown strong results and in spite of payouts remaining at higher than normal levels – the company has clearly managed to bolster earnings on the back of higher premium demand.

Looking Forward

Inflation has become an increasing concern over the past year, and this could stand to have an impact on the gains that the company has seen across annuities and life insurance so far.

Depending on the trajectory of equities going forward – we could see a situation whereby investors demand higher rates of return to protect against inflation risk.

In this regard, it is uncertain as to whether annuity demand will remain stable or could see a drop in demand going forward – as a significant determinant of this will depend on equity returns. Should equity growth continue to outpace inflation – then annuity payments could lose some appeal.

On the other hand, growth in the equity markets might prove to be relatively modest – which could be the case as investors take a risk-off approach.

For instance, the CBOE Volatility Index continues to remain higher than pre-2020 levels as the effects of the pandemic and broader inflation concerns continue to weigh on the markets:

investing.com

Under the scenario of modest growth in equities, then I would expect demand for annuities to be significant as investors demand at least some form of protection against inflation.

With that being said, the fact that Brighthouse Financial has seen strong growth across the Life segment is quite welcoming, as it allows the company to diversify earnings growth across this segment as opposed to being significantly dependent on that of Annuities.

In particular, SmartCare has been a big driver of the 98% year-over-year growth across life sales for the company. Going forward, I expect that such sales growth will begin to normalize as the effects of the pandemic start to fade and excess deaths start to decline once again. However, the fact that earnings across the segment as a whole are increasing in spite of a higher rate of payouts is quite encouraging.

Conclusion

To conclude, growth across the Life segment of Brighthouse Financial has been quite impressive and this allows the company to further diversify its earnings. While the effect of inflation on annuity demand is uncertain – earnings across this segment still continued to grow vibrantly over the past year.

In these regards, further upside for the stock could still be ahead.