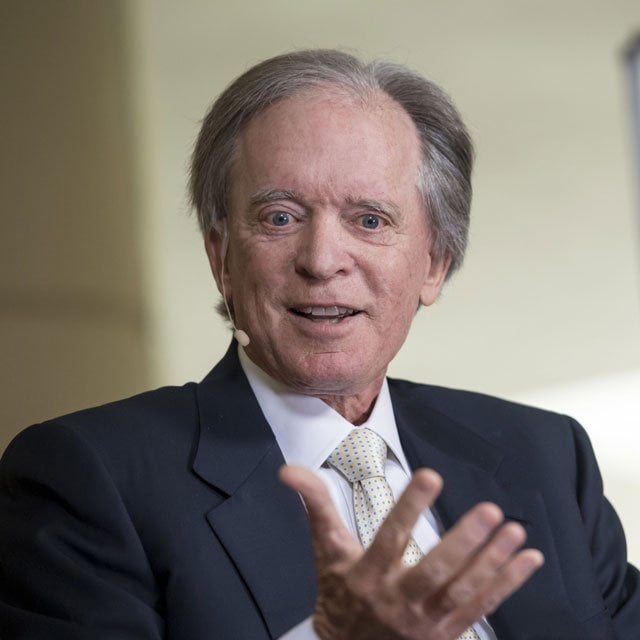

Bill Gross Casts Shade on Treasurys, Sees 10-Year 'Overvalued' at 4%

Fresh from getting a big call right on yields toward the end of last year, former bond king Bill Gross just signaled he is now steering clear of Treasurys.

Ten-year U.S. debt is “overvalued,” with similar-dated Treasury Inflation-Protected Securities at a 1.80% yield the better choice if one needs to buy bonds. “I don’t,” he wrote in a post on X.

Gross earned the moniker of “bond king” while at Pacific Investment Management Co., the firm he co-founded in the early 1970s.

He made millions late last year after a big bet the Federal Reserve would pivot toward interest-rate cuts for 2024 benefited from a sizzling bond rally.

That came after he warned in August that bond bulls were misguided, just before a two-month rout that sent yields to 16-year highs.

Global bonds rebounded on Monday, after they slid in the opening days of 2024 on concerns the late 2023 rally had gone too far, too fast.

Benchmark U.S. 10-year yields jumped 17 basis points last week, their biggest such climb since October, as robust labor-market data spurred traders to pare bets on rapid Fed easing.

“Taking a bow not only for regional bank recommendation 6 months ago but mtge REITs in December. I still like CPRI for a merger arb — target 57,” Gross said on X, formerly Twitter, Monday.