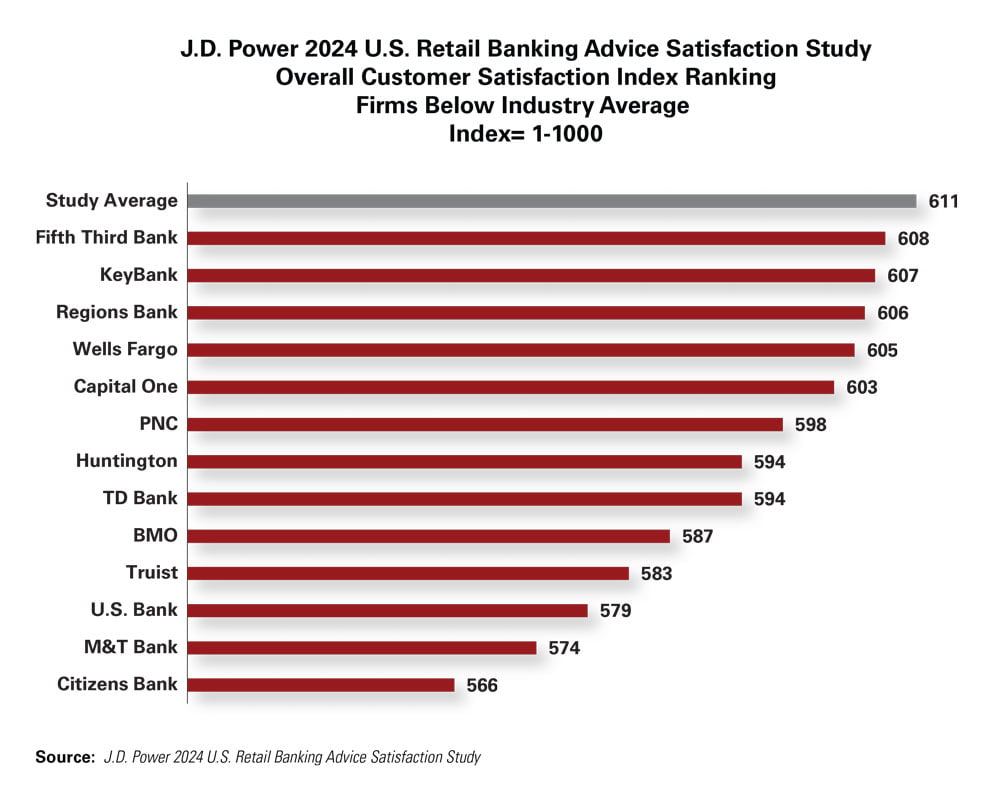

Best & Worst Banks for Advice-Seekers: J.D. Power, 2024

“Customers who act on the financial advice and guidance provided by their bank are getting not only help on how to save time or money, but also these services result in increased satisfaction and strong engagement and brand advocacy,” Jennifer White, senior director for banking and payments intelligence at J.D. Power, said in a statement.

The study found that one key variable with a significant effect on satisfaction is “received personalized banking advice/guidance.” When this criterion is met, overall satisfaction increases 195 points, and banks have been moderately successful at achieving this goal, with 63% of those customers who received advice saying it was personalized.

“As banks get increasingly savvy about how to personalize content by leveraging AI and training their staffs on how best to connect with customers, both recall and usage of financial advice is increasing, which is a very positive step forward for the industry,” White said.

J.D. Power fielded the study during the first three months of 2024, receiving responses from 7,984 retail bank customers in the United States who said they had received any advice/guidance from their primary bank regarding relevant products and services or other financial needs in the past 12 months. The study measures customer satisfaction with advice/guidance in terms of quality, concern for needs, relevancy, clarity and frequency.

See the charts below for the banks that scored above and below the industry average for customer satisfaction with advice/guidance.