Berkshire Cuts Apple Stake by Almost Half

What You Need to Know

Berkshire Hathaway sold $75.5 billion worth of stock on a net basis in the second quarter, it said Saturday.

The conglomerate has also been significantly paring its stake in Bank of America.

Apple reported last week that sales to China fell 6.5% to $14.7 billion in the third quarter.

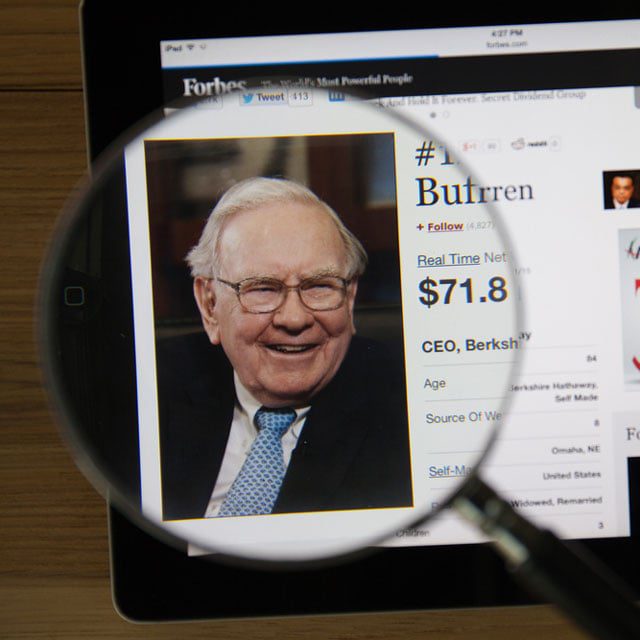

Berkshire Hathaway Inc. slashed its stake in Apple Inc. by almost 50% as part of a massive second-quarter selling spree that sent billionaire Warren Buffett’s cash pile to a record $276.9 billion.

In all, Berkshire sold $75.5 billion worth of stock on a net basis in the period, the Omaha, Nebraska-based conglomerate reported Saturday. Operating earnings rose to $11.6 billion, up from $10 billion for the same period a year ago.

Buffett was unloading shares as the S&P 500 stock index rallied, setting a record high in mid-July, though the index has declined in each of the past three weeks on concern that artificial intelligence euphoria had gotten overdone.

On Friday, weak labor data underscored the risk of an economic downturn, and the S&P dipped 1.8%.

“You could conclude this is another sell signal,” said Jim Shanahan, an analyst at Edward Jones who covers Berkshire. “This was a far higher level of selling activity than we were expecting.”

Buffett’s Berkshire has also been significantly paring its Bank of America Corp. stake, its biggest bank bet. Berkshire has trimmed that position by 8.8% since mid-July, according to a filing late Thursday.

Berkshire has struggled to find ways to deploy its mountain of cash as share prices soared and deal activity stagnated. At the firm’s annual shareholder meeting in May, Buffett said he wasn’t in a rush to spend it “unless we think we’re doing something that has very little risk and can make us a lot of money.”

Berkshire has more recently used stock buybacks as one way to deploy the cash, but even that’s become tougher in recent months with its stock hitting records. Berkshire repurchased about $345 million of its own shares during the quarter, the least since the company changed its buyback policy in 2018.

Since Berkshire first disclosed its Apple stake in 2016, Buffett has ridden the gains to accumulate a massive paper profit. Berkshire had spent just $31.1 billion for the 908 million of Apple shares it held through the end of 2021. Now his roughly 400 million shares of Apple were valued at $84.2 billion at the end of June.

Buffett said at the May shareholder meeting that Apple was an “even better” business than two others it owns shares in, American Express Co. and Coca-Cola Co. He said at the time that Apple would likely remain its top holding, indicating that tax issues had motivated the sale, “but I don’t mind at all, under current conditions, building the cash position,” he said.