Aetna May Let Medicare Plan Enrollment Fall 10% in 2025

Executives of CVS Health, the company that owns Aetna, are giving early hints about why Medicare plan menus may shoot to the top of financial professionals’ priority lists this fall.

Tom Cowhey, the CVS chief financial officer, warned securities analysts during a conference call Wednesday that many of its 2025 Medicare Advantage plans will be a lot leaner than the 2024 plans.

Aetna now covers 4.3 million people through Medicare Advantage plans. An analyst on the conference call asked about earlier CVS warnings that 2025 changes could cut Medicare plan enrollment by 10%.

“That’s a good baseline,” Cowhey said.

In some cases, enrollment may fall because Aetna is pulling out of certain counties, he said.

In other cases, he said, Aetna may lose enrollees because it has responded to economic pressure by replacing the 2024 plans with much different sets of benefits.

When Aetna tries to persuade current enrollees to sign up for the new, leaner plans, “those resells are going to happen at a much lower rate than what we have historically experienced,” Cowey predicted.

What it means: Whether you sell life insurance, annuities or ordinary stocks and bonds, if you have clients who have Medicare Advantage plan coverage now, or who might become eligible for Medicare in 2025, you need to make sure they understand that their health coverage may be about to go through big changes.

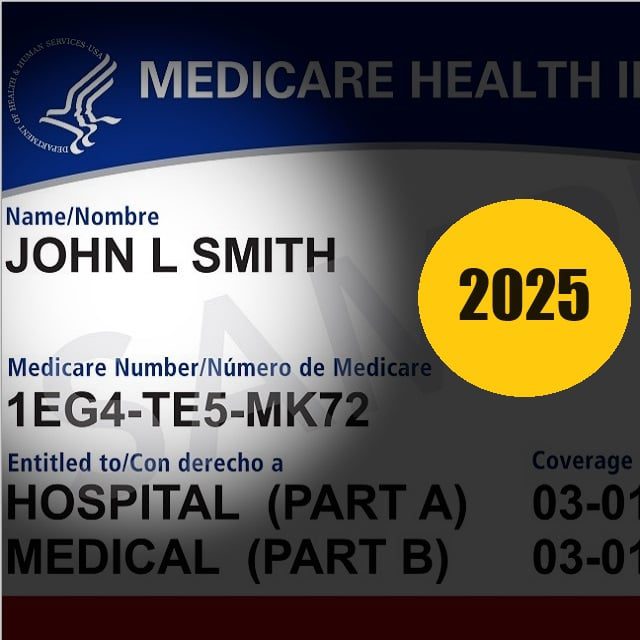

The backdrop: The original Medicare program exposes enrollees to a big, complicated system of deductibles, co-payments and coinsurance bills.

Most enrollees use Medicare supplement insurance or the newer Medicare Advantage program to fill in the original Medicare holes.

Medicare Advantage plans use a combination of money from the federal government and enrollees’ premium payments to provide what looks like an alternative to original Medicare for about 34 million of the 67 million Medicare enrollees.

The Medicare Advantage program descends from the Medicare+Choice program, a similar program that died in 2001 after insurers said unrealistic federal funding levels and operating rules made the program unsustainable.

Aetna covers 1.3 million people through Medicare supplement insurance policies. Those policies operate under different laws and regulations than Medicare Advantage and may benefit from turmoil in the Medicare Advantage program.

Medicare Advantage changes: The Medicare Advantage program has been humming along smoothly for more than a decade.

Critics have complained about high profits at Medicare Advantage programs, and rules and funding levels were starting to tighten.