Addison’s Disease and Life Insurance

Can you get life insurance and mortgage protection if you have Addison’s Disease?

Getting life insurance or mortgage protection if you have Addison’s Disease should be fairly straightforward.

The only time our clients have had an issue is when they have been recently diagnosed (less than six months ago).

In such a case, the insurer is likely to postpone offering cover until the six months are over.

Please complete this questionnaire if you would like us to discuss your case in confidence with Aviva, Irish Life, New Ireland, Royal London and Zurich Life.

Although all the insurers will offer cover, some will add a higher loading than others.

We will make sure you apply to the provider that will offer you the lowest price. In fact, we’ll get you an indicative quote before you make a formal application.

How’s that for service!

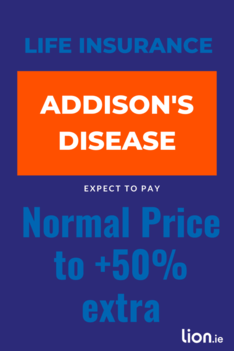

How much will your cover cost?

Assuming it’s well-controlled primary Addison’s Disease with no complications, and your diagnosis was over six months ago:

You’re looking at a final premium of between standard and +50% extra for mortgage protection and life insurance with one of our insurers.

For income protection, the loading may be a little higher.

If you have had a crisis in the last three years, you can expect to pay more but complete that questionnaire, and I’ll check it out for you.

Will you need to do a medical exam?

Nope, at worst, the insurer will request a PMA from your GP, but in most cases, the insurer will be happy to offer cover based on an application form only.

How long will it take to get covered?

We should have approval from our preferred insurer within 72 hours of receiving your fully completed application.

However, suppose the insurer requests a report from your GP. In that case, this will add several weeks (another reason to make sure you apply to the insurer that is most understanding of Addison’s Disease).

Case Study:

This client, let’s call her Sam, had a difficult time when diagnosed, but she had been stable since.

After being declined through a different broker, she came to us in despair, meaning her house purchase was about to fall through.

34 yo old

Diagnosed three years previously

Experienced symptoms twice, including an Addisonian crisis pre-treatment.

Symptoms: Feeling tired and ultimately in an Addisonian crisis where the blood pressure drops and vomiting.

Any hospital care: 4 weeks at the time of diagnosis

Meds: 20mg Hydrocortisone (10mg in the morning, 5mg in the afternoon and 5mg in the evening) and 0.1mg fludrocortisone daily.

Non-smoker

We managed to get her mortgage protection insurance with a loading of 50%.

Sam bought her house, and she lived happily ever after, as a satisfied client of lion.ie

Over to you

If you or someone you know has Addison’s Disease and is concerned about applying to the wrong insurer, let us help, that’s what we do!

Please complete this short questionnaire giving as much detail as possible, and I’ll discuss your case with Aviva, Irish Life, New Ireland, Royal London and Zurich Life on a no-name basis.

Thanks for reading!

Hopefully, we’ll talk soon.

Nick