7 Steps to Choosing a Life Insurance Policy in Ireland

Life Insurance Advice Incoming!

Ready to shop around for a new life insurance plan but you’re thinking where in de bejaysus do you start?

I hear ya.

Choosing the right life insurance policy is a boring daunting experience.

With loads of different insurance companies, plan types, and benefits, it’s hard to know where to start.

So let’s start at the very beginning.

Where Can You Buy Life Insurance in Ireland?

Remember, you’re not meant to know anything about life insurance at this stage.

But there are a few basic life insurance concepts you need to master to protect your family.

By the way, we have a life insurance crash course that simplifies this into 5 bite-sized emails. If you don’t have time to read this whole article, you can sign up here:

1. Decide

There are three main places you can get Life Insurance Advice here in Ireland:

Bank

A bank can only sell you a policy from their tied insurer.

A bank cannot offer life insurance advice on a range of policies from various insurers.

Direct

Again, this limits your options.

If you go to Zurich Life, they will sell you a Zurich policy.

Approach Aviva and they will sell you an Aviva policy.

Savvy?

Broker

A life insurance broker can offer policies from the 5 leading providers in Ireland.

Aviva

Irish Life

New Ireland

Royal London

Zurich Life

If you feel your broker is slinging policies from just one insurer, beware!

The beauty of a broker is choice and discounted premiums compared to going through the bank or direct to the insurer.

2. Calculate

This is the tricky part.

You can do it yourself using any of the 987 life insurance calculators you can find online (I’ve counted them)

Or you can take guidance from a bank, insurer or broker (with the caveats above)/

But please, if any of them recommend €250,000 over 25 years, make your excuses and leave…

€250,000 is the same as plucking a figure out of thin air.

You could do that yourself.

How do you figure out the correct amount of life insurance?

3. Explore

Death, inability to work and serious illness are the risks that will hit us or our families right in the pocket.

Each type of life insurance policy offer protection from these risks.

Here’s a quick breakdown of the policies available

Life insurance – essential if you have kids. It leaves them a lump sum on your death to replace your income.

Income protection – for me, this is the most important policy. It pays you 75% of your income if you cannot work for over 4 weeks due to any illness.

Serious illness cover – pays a tax-free lump sum should you contract a specific illness. It gives you the head space to focus on getting better without money worries.

Mortgage protection – the most basic policy. It clears your mortgage should you die. You pay for it, the bank gets the proceeds.

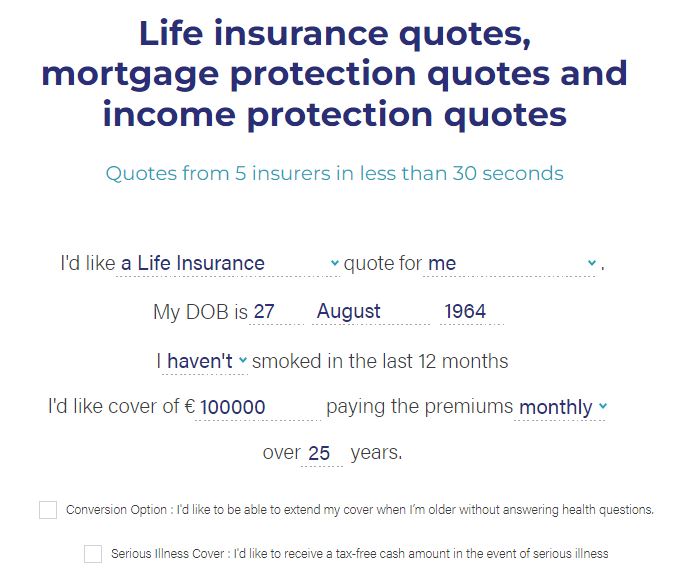

4. Quote

Yeah, not that type of quote.

This type:

Most banks, insurers and brokers have an online quote system.

The beauty of ours is we don’t force you to give us your contact details.

We know how annoying follow-up sales calls are so we don’t do them – unless you ask us to!

We give you time and space to make a decision.

If you choose us to arrange your cover.

Yey!

If not, hey-ho, can’t win ’em all, we’re jst happy we played some part in getting your and your family covered.

Click here to get an instant quote from all five life insurance providers (without providing contact details)

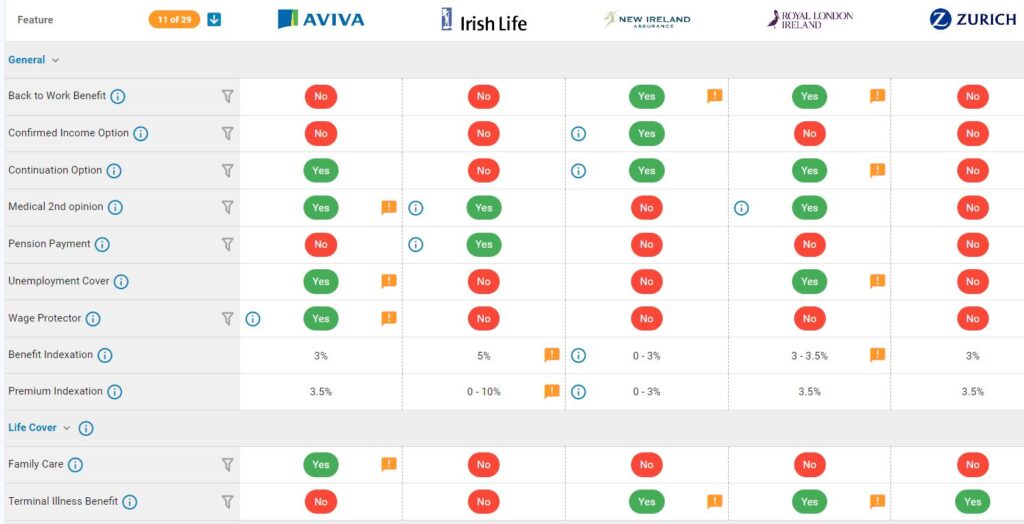

5. Choose

Which insurer should you choose?

Your options are bewildering but I can help.

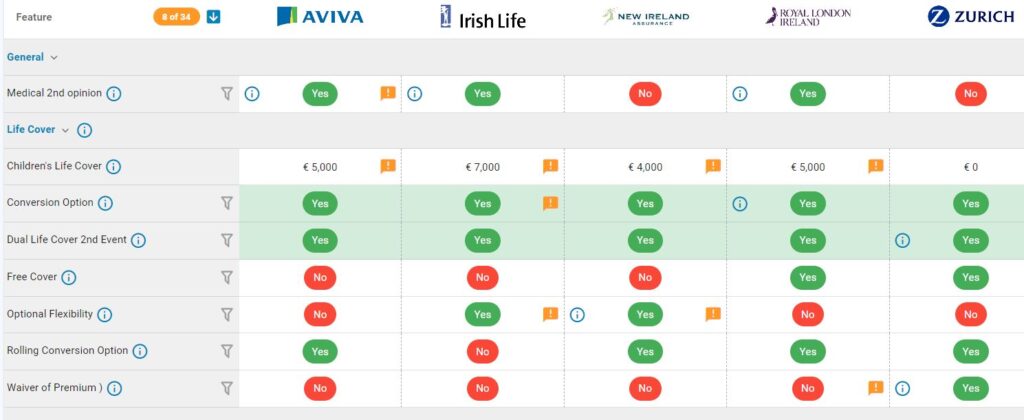

Here are some handy charts that compare what’s on offer at each insurer

Life insurance

Income Protection

Critical Illness Cover

There are too many illnesses to list but Royal London and Zurich Life are best for serious illness cover.

Mortgage Protection

Still with me?

If you have no health issues, this is the simpleton’s guide to choosing an insurer 😋

6. Discounts

When promotional discounts are available, we immediately reduce our quotes so you know you’re getting a competitive price.

Aviva, Zurich, New Ireland and Royal London offer discounts.

Irish Life don’t offer any discounts – why would they, they are creaming all that business from the banks!

Make sure your bank, broker or insurer is offering you the full discount.

We discount the prices on our quote system, no shenanigans here, what you see is what you get.

7. Health

The initial quotes you get, from a broker, bank or direct from the insurer assume you’re in perfect health.

So, if you have any current or previous health conditions, you may end up paying more than that initial quote.

Therefore, it’s important to run any health by me before you make an application so I can find the most suitable insurer for your condition.

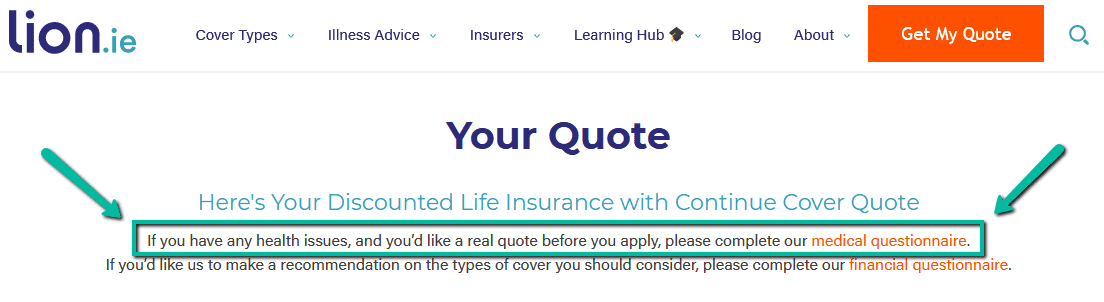

As you can see on our quote system, we highlight this fact:

We don’t give you some unrealistic quote just to get you to apply through us, and then hit you with a ludicrously more expensive quote after you answer the medical questions.

What’s the point?

You probably can’t afford the new premium so we’ve wasted your time and ours.

If you have any health issues and you’d like an accurate quote, please tell us about them upfront.

You can read more about the life insurance medical conditions we specialise in here.

Over to you…

I hope that gives you the basics of how you should choose a life insurance plan.

If it all makes sense and you’re confident you can do it yourself…fire ahead.

But if the thought of arranging your cover without getting life isnuance advice makes you do this…

We’re here for you!

Complete this questionnaire and I’ll be right back.

Thanks for reading.

Nick

lion.ie | Protection Broker of the Year 🏆