4 Accredited Investor Bills Up for House Panel Vote

The House Financial Services Committee plans to mark up, and likely vote on, four accredited investor-related bills Wednesday.

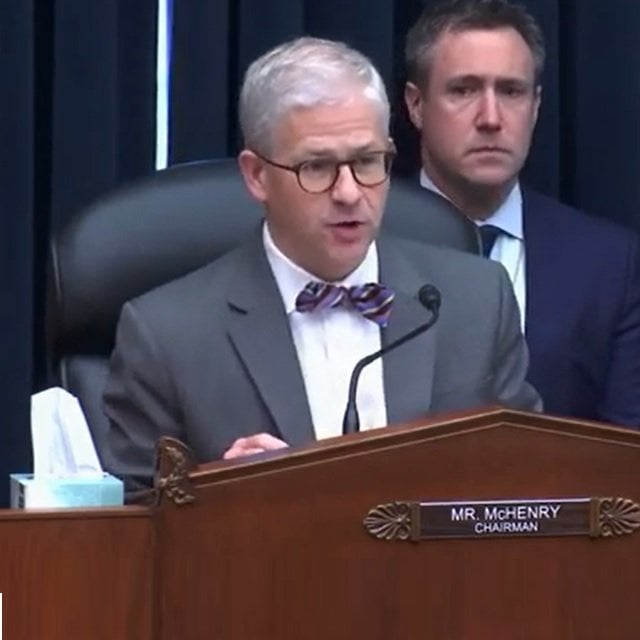

One of the bills, the Expanding Access to Capital Act of 2023, introduced by committee chairman Patrick McHenry, R-N.C., “would deem clients of investment advisors who receive individualized advice as accredited investors,” Neil Simon, vice president of government relations for the Investment Adviser Association in Washington, told ThinkAdvisor Monday.

IAA “strongly supports” the bill, Simon said.

The Accredited Investor Definition Review Act, H.R. 1579, would broaden the accredited investor definition to include those holding certain designations, certifications and credentials. That bill was introduced by Rep. Bill Huizenga, R-Mich.

A third bill, the Fair Investment Opportunities for Professional Experts Act, H.R. 835, introduced by Rep. French Hill, R-Ariz., would lower the annual income and net worth thresholds. It would also expand the accredited investor definition to include advisors and brokers, as well as those who have relevant education or job experience to qualify as “having professional knowledge of a subject related to a particular investment, and whose education or job experience” as verified by the Financial Industry Regulatory Authority or an equivalent self-regulatory organization.