2024 Semi-annual Market Outlook: Global equities

Europe has benefited from falling inflation and positive GDP revisions. Wage increases and improved corporate governance standards are among some of the reasons we maintain a positive view of Japan heading into the second half of the year. Chinese equities maintain attractive valuations.

2024 overview

The results of the European parliamentary  elections in early June saw a surge in support for far-right parties, particularly in France and Germany. This comes after a difficult year impacted by higher costs of living, monetary tightening, and a contracting manufacturing sector. However, we are seeing a turnaround in Europe, whose GDP grew by 0.3% in the second quarter of 2024, reversing a 0.1% decline in the last quarter of 2023.1

elections in early June saw a surge in support for far-right parties, particularly in France and Germany. This comes after a difficult year impacted by higher costs of living, monetary tightening, and a contracting manufacturing sector. However, we are seeing a turnaround in Europe, whose GDP grew by 0.3% in the second quarter of 2024, reversing a 0.1% decline in the last quarter of 2023.1

The European economy could benefit further from increased tourism in the coming months, especially from China, where we are seeing an uptick in international travel.2 This contrasts with the last months of 2023, where trends seemed to point towards the preference of Chinese citizens to travel within their borders.

Wage negotiations led by the labor unions took place in Japan in March. The annual negotiations, known as Shunto, saw Japan’s’ biggest companies agree to wage increases of 5.28% in 2024, the largest increase in 33 years.3

Key themes we will continue to monitor

Europe

We will continue to monitor the impact of the French election, which saw the left-leaning alliance, the New Popular Front, rise to victory. Emmanuel Macron’s centrist alliance came in second, and the far-right National Rally finished third in the second round of voting, resulting in what many believe to be a hung parliament. The environment in the broader euro area has started to improve. Falling inflation and the resulting higher wages have contributed to positive GDP revisions for the continent, which is now expected to grow by 0.8% in 2024.4 The rate cut by the European Central Bank in early June should be supportive of growth. However, it was accompanied by slightly higher inflation projections. The annual rate fell slightly to 2.5% in June from 2.6% the prior month.5

impact of the French election, which saw the left-leaning alliance, the New Popular Front, rise to victory. Emmanuel Macron’s centrist alliance came in second, and the far-right National Rally finished third in the second round of voting, resulting in what many believe to be a hung parliament. The environment in the broader euro area has started to improve. Falling inflation and the resulting higher wages have contributed to positive GDP revisions for the continent, which is now expected to grow by 0.8% in 2024.4 The rate cut by the European Central Bank in early June should be supportive of growth. However, it was accompanied by slightly higher inflation projections. The annual rate fell slightly to 2.5% in June from 2.6% the prior month.5

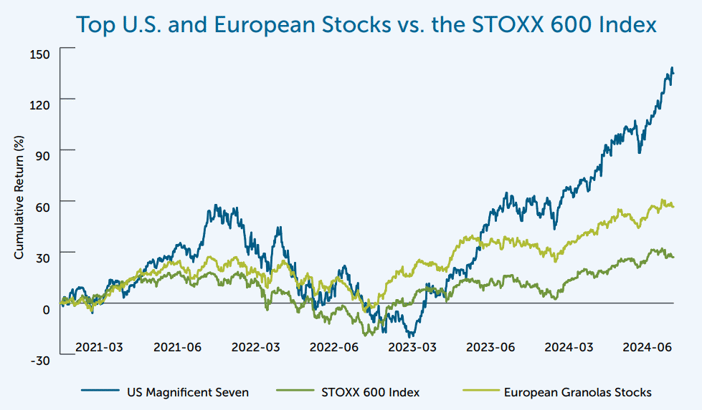

Similar to the Magnificent Seven stocks in the U.S., Europe is also seeing a group of stocks driving the returns of the STOXX Europe 600 Index. However, unlike their American peers, this group, known as the “Granola” stocks, are comprised of several large companies that are more diversified than the Magnificent Seven, and include companies that focus on advancements in medicine, health science and technology. In different capacities, these companies touch our lives on a daily basis and are expected to contribute to the returns of European equity markets.

Source: Bloomberg as of June 30, 2024. Index returns are reported gross in USD. Performance histories are not indicative of future performance. Indices are unmanaged and cannot be invested in directly. The STOXX 600 Index is a market cap weighted index. The Granola stocks and Magnificent 7 Index represent an equal weighted index.

Japan

Heading into the second half of the year, we maintain a positive view of Japan, despite the recent sell-off. The wage increases in the spring have led to optimism that higher salaries will fuel domestic demand and inflation. Japanese equities continue to be supported by changes in Japan’s corporate governance. In addition, new changes to the domestic tax-free investment scheme, also known as NISA, took effect in January and have led to an influx of retail investors into the market.6

China

We continue to see attractive opportunities to invest in select Chinese equities. After a slight rebound in the first quarter of the year, Purchasing Managers’ Index (PMI) data has started to soften once again. This has not gone unnoticed by the government, who has started to provide relief to the beleaguered property sector. There are, however, pockets of strength emerging. As a result of the geopolitical tensions and a strongly bearish view of the country by the investment community, valuations are attractive even in areas that are experiencing growth within the economy. We remain selective in our exposure to Chinese equities, and only invest in businesses that are leaders in their respective sectors with demonstrably strong corporate governance.

We continue to see attractive opportunities to invest in select Chinese equities. After a slight rebound in the first quarter of the year, Purchasing Managers’ Index (PMI) data has started to soften once again. This has not gone unnoticed by the government, who has started to provide relief to the beleaguered property sector. There are, however, pockets of strength emerging. As a result of the geopolitical tensions and a strongly bearish view of the country by the investment community, valuations are attractive even in areas that are experiencing growth within the economy. We remain selective in our exposure to Chinese equities, and only invest in businesses that are leaders in their respective sectors with demonstrably strong corporate governance.

![]() Download the full Empire Life 2024 Semi-annual Market Outlook (PDF).

Download the full Empire Life 2024 Semi-annual Market Outlook (PDF).

1 Eurostat, ec.europa.eu/eurostat/web/products-euro-indicators/w/2-30042024-bp, April 30, 2024

2 Sabre, assets.sabre.com/files/ChinaUnleashed-Sabre-report+revisedLATAMchart.pdf

3 Japan union group announces biggest wage hikes in 33 years, presaging shift at central bank”, reuters.com/markets/asia/japan-unions-will-unveil-results-wage-talks-presaging-shift-central-bank

4 European Commission, economyfinance.ec.europa.eu/economic-forecast-and-surveys/economic-forecasts/spring-2024-economic-forecast-gradual-expansion-amid-highgeopolitical-risks, May 15, 2024

5 “HICP-monthly data (annual rate of change), Eurostat, ec.europa.eu/eurostat/databrowser/view/prc_hicp_manr/default/table, June 2024

6 “Half of New NISA Investments went to Japanese stocks”, The Japan News, japannews.yomiuri.co.jp/business/economy/20240506-184315

This document reflects the views of Empire Life as of the date published. The information in this document is for general information purposes only and is not to be construed as providing legal, tax, financial or professional advice. The Empire Life Insurance Company assumes no responsibility for any reliance on or misuse or omissions of the information contained in this document. Information contained in this report has been obtained from third party sources believed to be reliable, but accuracy cannot be guaranteed. Please seek professional advice before making any decisions.

Empire Life Investments Inc. is the Portfolio Manager of certain Empire Life segregated funds. Empire Life Investments Inc. is a wholly-owned subsidiary of The Empire Life Insurance Company.

Segregated fund contracts are issued by The Empire Life Insurance Company (“Empire Life”). A description of the key features of the individual variable insurance contract is contained in the Information Folder for the product being considered. Any amount that is allocated to a segregated fund is invested at the risk of the contract owner and may increase or decrease in value. Past performance is no guarantee of future performance.

® Registered Trademark of The Empire Life Insurance Company. All other trademarks are the property of their respective owners.

September 2024