2024 Semi-annual Market Outlook: Canadian equities

The Bank of Canada has expressed confidence that inflation will continue to move towards the 2% target. Canadian consumers will require further rate cuts and more time to alleviate pressure from their large debt-loads. The Trans Mountain Pipeline and LNG Canada project will create a positive backdrop for Canadian oil and natural gas.

2024 overview1

First quarter GDP grew at an  annualized rate of 1.7%, lower than the central bank’s 2.8% estimate.2 However, inflation has continued to decline, allowing the Bank of Canada to lower its key interest rate by 25 bps twice to 4.5%. This has contributed to a weakening Canadian dollar, which was down 3.2% as of June 30, 2024 relative to the U.S. dollar.

annualized rate of 1.7%, lower than the central bank’s 2.8% estimate.2 However, inflation has continued to decline, allowing the Bank of Canada to lower its key interest rate by 25 bps twice to 4.5%. This has contributed to a weakening Canadian dollar, which was down 3.2% as of June 30, 2024 relative to the U.S. dollar.

The S&P/TSX Composite TR Index was up roughly 6% year-to-date, but lagged other major indices such as the S&P 500 TR Index (+20%) and the STOXX 600 GR EUR Index(+10%). A key reason for the relative underperformance was the index’s large weight in financials, and more specifically banks, which has lagged in performance and comprises roughly 19% of the index.

The S&P/TSX Composite TR Index’s heavy commodity composition contributed to its performance, with energy, which represents around 18% of the index, up 14.1% in June and materials, which represents around 12% of the index, up 13.7% over the same period.

Key themes we will continue to monitor

Inflation and Interest Rates

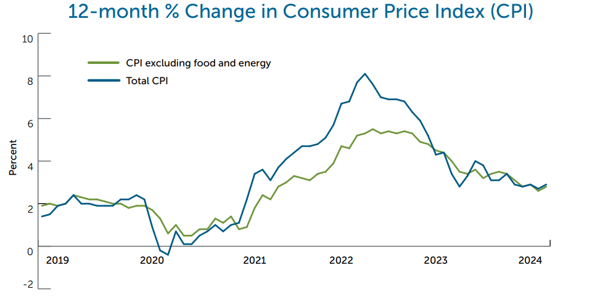

Inflation has continued to moderate in Canada, with the Consumer Price Index (CPI) reported at 2.9% in May 2024, down from 3.4% at the end of 2023.3

Source: Statistics Canada. Table 18-10-0004-01 Consumer Price Index, monthly, not seasonally adjusted.

Source: Statistics Canada. Table 18-10-0004-01 Consumer Price Index, monthly, not seasonally adjusted.

With the Bank of Canada’s recent rate cut, Bank governor Tiff Macklem expressed confidence that inflation will continue to move closer to the 2% target. We will continue to monitor this as future interest rate cuts will have broad implications on the health of the Canadian consumer, and the performance of the banking sector.

The Health of the Canadian Consumer

Consumer spending has been the main contributor to economic growth since 2015. However, as interest rates have increased, Canadian consumers have spent more servicing their debt. This is a cause for concern as Canada has the highest level of household debt to disposable income among the G7 countries at 180%, compared to 100% in the United States and Germany.4 While the Bank of Canada has initiated its first rate cuts, our view is that it will likely take more sustained cuts and extended time to alleviate pressure off the highly levered Canadian consumer.

Bank Performance

Bank Performance

Several key performance metrics have shown improvements or stabilization this year, however we have a relatively neutral view on the Canadian banking industry. The overall Bank Net Interest Margin has stabilized, but with continued weakness in U.S. operations due to higher funding costs and competition. Operating leverage has started to show positive results from prudent expense management, and capital ratios now have a healthy buffer over the regulatory minimum. However, credit metrics continue to deteriorate and loan growth remains sluggish.

Performance of commodity heavy sectors

After a strong first half of the year, we will continue to monitor the performance of commodity heavy sectors, such as energy and materials. In particular the price of oil, which is up 14% year-to-date as of June 30, and gold, which is up 13% over the same period.5 2024 is off to a strong start for Canada’s energy sector, with the Trans Mountain Pipeline beginning operations in May, bringing 300,000 barrels of oil a day to the U.S. west coast and offshore markets in Asia.6 Furthermore, LNG Canada, a liquified natural gas (LNG) joint venture, is expected to begin operations in the second half of the year.

![]() Download the full Empire Life 2024 Semi-annual Market Outlook (PDF).

Download the full Empire Life 2024 Semi-annual Market Outlook (PDF).

1 All Index data is reported in Canadian dollars as of June 30, 2024.

2 Bloomberg Economics, bloomberg.com/news/articles/2024-05-31/canada-s-economy-grew-1-7-in-first-quarter-missing-forecasts, May 31, 2024

3 Consumer Price Index, Statistics Canada, 150.statcan.gc.ca/n1/dailyquotidien/240521/dq240521a-eng.htm?indid=3665-1&indgeo=0, May 21, 2024

4 Research Insights, Statistics Canada, 150.statcan.gc.ca/n1/pub/11-631-x/11-631-x2024002-eng, February 28, 2024

5 Bloomberg, June 30, 2024

6 Transmountain, https://www.transmountain.com/fr/past-project-tmep, accessed June, 2024

This document reflects the views of Empire Life as of the date published. The information in this document is for general information purposes only and is not to be construed as providing legal, tax, financial or professional advice. The Empire Life Insurance Company assumes no responsibility for any reliance on or misuse or omissions of the information contained in this document. Information contained in this report has been obtained from third party sources believed to be reliable, but accuracy cannot be guaranteed. Please seek professional advice before making any decisions.

Empire Life Investments Inc. is the Portfolio Manager of certain Empire Life segregated funds. Empire Life Investments Inc. is a wholly-owned subsidiary of The Empire Life Insurance Company.

Segregated fund contracts are issued by The Empire Life Insurance Company (“Empire Life”). A description of the key features of the individual variable insurance contract is contained in the Information Folder for the product being considered. Any amount that is allocated to a segregated fund is invested at the risk of the contract owner and may increase or decrease in value. Past performance is no guarantee of future performance.

® Registered Trademark of The Empire Life Insurance Company. All other trademarks are the property of their respective owners.

September 2024