World in Flux: Can Insurance Fill the Stability Gap in 2022?

Let’s try some word association. Maybe we could begin with the word “change.” What does the word change mean to you? You can tell a lot about people (and about companies) by their responses to the concept of change. Does change cause excitement or dread or both? Of course, much of this depends upon what is changing. Do we have reason to be excited? Can we embrace a little of the unknown to grab hold of the positive side of change?

For our customers, change often means instability. Instability is a threat to families, businesses, employers of all sizes and all of the organizations that insurers serve. Insurance needs to fill the stability gaps by adapting itself to grow new foundations to mitigate risk and support stable lives and businesses. When insurers adapt to a rapidly changing world, they are the ones who even out the risks and normalize life and work.

Insurance’s opportunities have always circled around risk and instability because long-term stability is a necessity. Modern challenges, however, require today’s innovations and technologies to create products and services that engender new areas to manage risk. Yesterday’s insurance products couldn’t anticipate cyberattacks, pandemic loss, climate change, and new lifestyles.

As risk changes, one thing that never changes is a person’s or business’ need to have security and stability. Risk avoidance and control over the future is a visceral motivator. There is almost no stress as debilitating as risk, uncertainty and lack of stability. So, Majesco has sought to find out how today’s and tomorrow’s customer lifestyles and business changes will impact both the perceived need for insurance (by customers) and the perceived types of products and services supplied (by insurers). Are these aligned?

If today’s market trends are any indicator, the level of change has never been greater, and insurance’s opportunities have never been more numerous. People and businesses need insurance and they can look at the world right now and see every motivation to protect their interests.

Last week, Majesco released its 2022 Consumer Report, Your Insurance Customers: A Crystal Ball of Big Changes in a Small Window of Time. The report is both an overview of real insurance trends, as captured by our customer survey, and an analysis of what those trends mean to insurer adaptability and overall opportunity. If you’re looking for insights and specific trends that will impact your organization today and tomorrow, be sure to download the full report. In today’s blog, we’re going to look at two related segments of the report: individual and family changes that are impacting life and health insurance and numerous demographic trends that will impact life, health and voluntary benefits.

Which trends are most likely to drive insurance purchases?

Family changes will boost life and health products

Insurers have commonly looked at the points of family change for opportunities to sell insurance. Today, however, insurers have the opportunity to improve products and placement. In the Majesco report, Gen Z & Millennials’ have high expectations that their families will change in the near future. This undoubtedly helped raise the importance of insurance to them, with 25% planning to have children and 22% expecting to be caring for an aging parent or relative (Figure 1). Furthermore, 15% expect to get married. Among the older Gen Z and Millennials, 14% expect to have a child in college or tech school, reflecting the transition into later family life stage changes, and subsequently the opportunity for insurers to offer life and health insurance, both as individual and as voluntary benefits.

In contrast, the older generation is entering their later life stages with retirement and will focus on maximizing their income through life, annuity and other investments as well as retaining coverages they want once they leave full-time employment. The ability for insurers to help them retain their money and manage their income, while also providing insurance to manage the increasing risk of age, is becoming a significant market opportunity that will require new products, services and partnerships to deliver.

Figure 1: Expected family-related changes in the next 3 years

Life insurance takes an unexpected turn

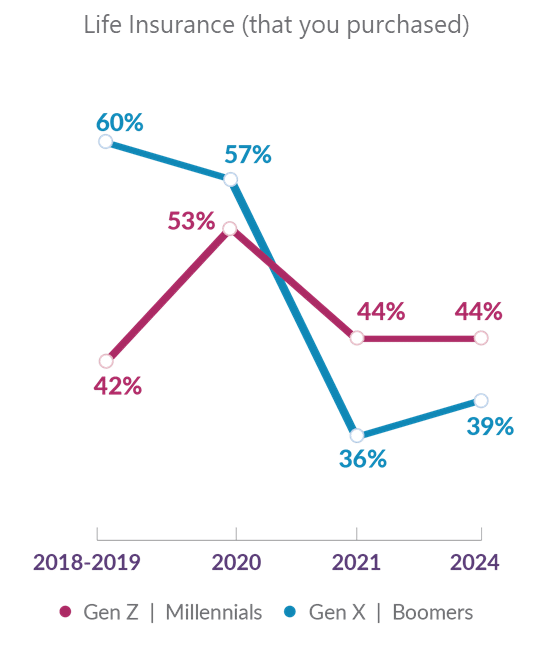

Interest in life insurance in 2021 and beyond made an intriguing dip. (See Figure 2). Majesco’s 2020 survey responses were received as the pandemic was heating up, explaining the jump in individual life insurance among Gen Z & Millennials, something we saw play out in the market and media. Gen X & Boomers remained largely unchanged.

What is less understood is the anticipated drop in individual life insurance between 2021 and 2024. A number of factors could be influencing this decline, including not needing any additional purchases, a shift in employment where insurance may not be available, retirement, a lack of life policy portability from employee benefits, or even a lack of affordability, since life insurance is a discretionary purchase.

Insurers will need to continue to innovate with digital life products and look at new channels to capture customers and retain growth in this insurance segment. They will also need to continue to track customer sentiment that might be related to the pandemic and consider how the pandemic has, at the very least, exposed areas of family vulnerability. Is life insurance one of the first expenses to get dropped when home budgets get squeezed? Is there a way for insurers to “protect the protection,” and give customers a better feeling about all that their coverage supplies? Are the right channels being used to buy insurance? Is the product easy to buy?

Once again, stability is the core motivator. If insurers can isolate those portions of the population who need improved stability and meet them at the easiest points of entry, there will be an overall improvement in coverage and an uptick in policy purchasing.

Figure2: Households with purchased individual life insurance

Interest in value-added services is high for life and health benefits

As I mentioned in last week’s blog, Game-Changing Trends in 2022 for the Future of Insurance, there is an increased desire for value-added services within insurance. Value-added services offered within life, health or voluntary benefits received very high marks of 73%-87% for Gen Z & Millennials. (See Figure 3.) While there was lower interest of 44%-67% for Gen X & Boomers, these numbers still suggest specific demographics within this segment would be interested. Together these numbers reflect a strong opportunity for insurers to experiment with new offerings, such as a fitness tracker program that would encourage healthy lifestyles, provide alerts on potential health issues, and assist with financial wellness planning. These offerings would provide a new level of engagement with customers and develop trusting relationships that can ensure retention, but more importantly they can uncover potential new sales opportunities.

Figure3: Interest in life, health, voluntary benefits value-added services

Sales channel insights for Life/Health/Accident insurance

Both generational segments strongly agree that traditional insurance company and agent channels deliver the best purchase experience for this insurance segment, while they split interest for the new and high-tech channels (a pattern for other types of insurance, as we’ll see later) as reflected in Figure 4. Pay special attention to the New and High Tech segments of Figure 4 and the gaps between the generations. Gen Z & Millennials are significantly interested in these newer channels. They use them regularly, building loyalty and trust.

Insurers should rapidly embrace a multi-channel environment with innovative partnerships if they are to capture and retain the business of this younger generation, as they begin to evolve their lives and have increased insurance needs.

Figure 4: Interest in life, health, accident insurance purchase channels

Real premiums based on real life tracked in real time

Overwhelmingly, basing life, health, and accident insurance premiums upon digital real-time data is popular with Gen Z & Millennials on a range of 71%-78%. While popularity among Gen X and Boomers is not nearly as high, they still have a solid interest of over 50%. Over our annual surveys, we have seen the younger generation open to using personal and other data as long as they get value. These numbers reflect that perspective.

The use of a fitness tracker for that data is popular and will likely grow given the focus on wellness by both generational groups.

Stability in motion

People love to travel, but they would like the stability of knowing they are covered without the inconvenience of having to sign up for insurance on every trip. There is a high interest in accident insurance coverage triggered when a mobile phone senses traveling. This will require insurers to utilize new data sources, but it will result in the convenience, ease and stability sought by customers. Both generations are interested, but when you consider the 79% interest level of Gen Z & Millennials (see Figure 5) combined with their plans for increased travel in the next three years, this offers a potential new on-demand product and market opportunity.

Figure 5: Interest in ways to activate and determine the cost of life, health, or accident insurance

Stability through the employer: Are group and voluntary products staying relevant?

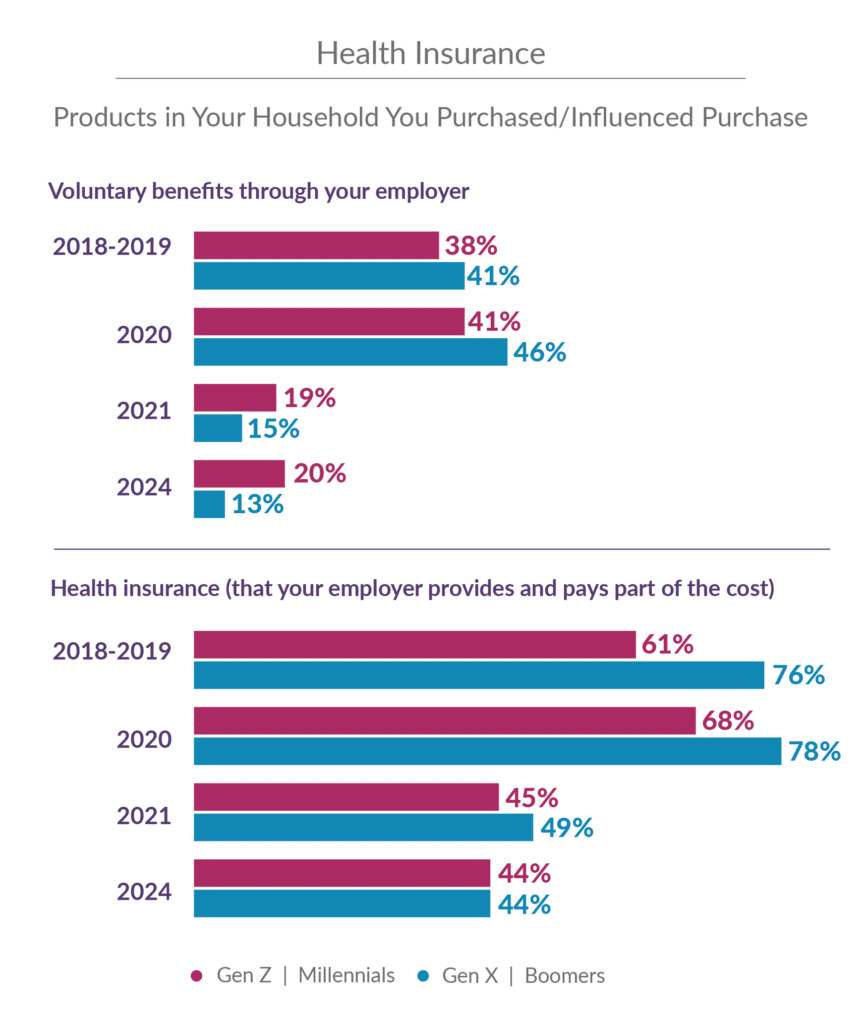

Use of employee health and voluntary benefits showed sharp declines in our current survey, and surprisingly low expected levels of usage in the next three years as highlighted in Figure 6. The decline is another indicator of COVID-driven job loss and the “Great Resignation.” We speculate that the low expectations for the future are driven by the changing nature of work among Gen Z & Millennials described above, and Gen X & Boomers retiring and leaving the workforce in increasing numbers.

It’s clear that group and voluntary benefits companies must innovate around their products with coverages for a younger generation who have different lifestyle needs as well as for on-demand workers who are estimated to be an increasing part of the workforce. Innovative new plans and insurance options such as pet, cyber and identify theft insurance as well as portability will become increasingly important for employers to attract and retain employees, but also for insurers to keep customers as they change jobs. In addition, offering individual insurance products as part of a benefit plan that allows people to keep the insurance if they leave their employer is increasingly important. Portability of group underwritten policies do not always do well because of the higher premiums, whereas offering individual products as a part of a benefit plan avoids that issue. In a roundtable we did late last year, this was a key topic of discussion and interest.

Figure 6: Households with employer and voluntary benefits

Within voluntary benefits, Majesco took a deeper dive into which benefits would be most desirable in the future. It’s important to note, however, that even niche products are showing the potential for growth and some common “traditional” products are showing interest growth through the employer channel. (See Figure 7.)

Traditional benefits for health, dental, vision and life garner the highest interest from both generation segments, with health particularly important to Gen X & Boomers (76%). Accident, disability income, critical illness and long-term care has a medium level of interest, with disability income exceptionally higher for Gen X & Boomers (73%) as compared to Gen Z & Millennials (46%). Newer, non-traditional voluntary benefits averaging 15%-20%, reflecting potential growth opportunities. These products can be significant differentiators for employers to attract and retain talent with the younger generation. For example, homeowners insurance and student loan assistance have strong appeal with Gen Z & Millennials, while others in this group like identity theft and auto insurance appeal to both generation segments.

Figure7: Breakdown of anticipated/expected Voluntary Benefits

Portability is rising in importance

Offering these benefits as part of different plans for different employee demographics and making them portable offers employers an opportunity to strengthen employee satisfaction and address the ongoing fight for talent that will continue. As the older generation moves into retirement or semi-retirement, the desire to retain valued benefits via portability is also high, given that Medicare does not cover all their needs. For portability, the key is for the product to be individually underwritten versus group underwritten, where the premium becomes too expensive. In our research last year, 64% of Gen Z & Millennials and 57% of Gen X & Boomers said this would be valuable to them. This jumped significantly for Gen X & Boomers this year, to 70%. (See Figure 8.)

Figure 8: Importance of Voluntary Benefits portability

Seize the future

Stability, for customers, is about seeing into the future and anticipating where issues might crop up that would adversely impact their lives. As Majesco’s report shows, insurers can’t go wrong if they are making every effort to meet these current and future demands for security. The formula is simple: Offer the products desired in the places needed with the convenience of seamless experience. The follow-through is more complicated: Bring systems and processes into line with the customer’s lifestyle and demands. Every day, Majesco helps insurers to re-envision and redesign business models that meet future needs by leveraging our market leading insurance platforms. For more information on Majesco’s revolutionary approach to technology and cloud-based insurance enablement, contact us today. For a thorough look at the consumer trends that will impact your future, be sure to download Your Insurance Customers: A Crystal Ball of Big Changes in a Small Window of Time.