Will the Internet be the death of local insurance agents?

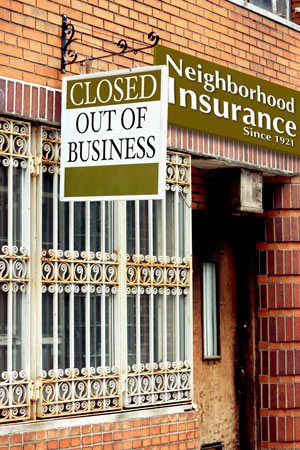

Could the rapidly emerging direct-to-consumer business model be the death of local insurance agents near me? Travel agent offices, bookstores and video rental shops were once local landmarks. Not long ago it was unimaginable these businesses would disappear. Will consumers soon look at the office currently occupied by their local insurance agents and wonder why insurance used to be so expensive and so complicated?

The answer to this question lies partially in the quality of the insurance people buy. Start by finding out how good your insurance is with a ValChoice rating. You will likely be shocked. The direct marketers talk a lot about how they’re cheaper. Maybe there’s a good reason why the advertisements rarely talk about how they’re better. Just click the buttons below to find out how your insurance company rates.

What Consumers Don’t Know About Insurance Agents

Possibly the most surprising, little-known fact about insurance is that nearly all of the best insurance companies almost all sell through independent agents. To prove this point, check out the best insurance companies in your state. ValChoice lists the five best companies in each state. In almost every case, these companies sell through independent agents.

Can local agents near me survive in the age of the internet?

ValChoice, an insurance data analytics company, has data that shows that many local insurance agents are not faring well. The statistics below summarize the analysis. For each of the three primary distribution channels of insurance, the analysis shows the percentage of insurance (writing) companies that sell primarily through each channel. The analysis also shows the percentage of insurance companies offering high-value products sold through the same channel.

Independent agents represent 66% of all auto insurance companies, but only 33% of the high-value products.

Captive agents represent 11% of auto insurance companies, totaling 14% of the high-value products.

Direct-to-consumer represents only 15% of car insurance companies, but 52% of the high-value products.

It is a certainty that consumers always find, and find quickly, a good value. Reality is that the price of insurance has been increasing faster than median family income. This forces consumers to find lower prices for their insurance. The alternative of paying more of the monthly budget on insurance is unacceptable to most consumers.

How can local insurance agents near me survive?

Consumers are shifting to buy insurance from companies that spend large amounts of money on advertising. These companies typically do not provide the best insurance. However, the promise of the lowest price is enticing. As this trend grows, the lifestyle of local insurance agents becomes more difficult to maintain. Eventually, they may be forced to retire early, sell their agency or change careers. For insurance companies, the cost is loss of marketshare as a result of not embracing the direct-to-consumer sales channel.

That’s not the way it has to be though. Insurance companies and local insurance agents need to focus on selling a differentiated product. This includes focusing on selling value and quality and not getting trapped into selling on price.

Consumers are currently benefiting from price competition largely created by the direct-to-consumer model. However, that benefit will reverse. The reversal comes once industry consolidation is complete enough that the large carriers no longer need to win business based on the best price.

If you would like to find a local insurance agent in your area, click the button below.

Consumers and Insurance Agents are in this Together

Both consumers and local insurance agents need tools that help them decipher the good products from the bad. Agents need to find new ways of retaining their clients by proving the products they are offering provide the value expected. Consumers need shopping tools that help them understand what they are buying since the migration to a more self-service model could leave them with a lower price, but also less protection.

What options are available for insurance companies?

Some companies will look for alternatives to changing channel strategies, including reducing the commission rates paid. While this approach helps the insurance company, it’s a tactic, not a strategy. Instead, companies and agents must focus on offering differentiated products with more value for the consumer. Differentiated products will become the new frontier in insurance sales. Companies competing to gain marketshare can compete on this basis. Companies offering good products and working to maintain market position will also use this approach to hold their clientele while adapting their channel strategy to fit the new consumer buying pattern.

Differentiated products does not necessarily mean new products. In many cases, the products are already differentiated based on the quality of their claims handling. What’s different is that agents need to tools to prove these differences. Agents also need to be trained on how to incorporate these tools into their sales process.

Would you like an estimate of what your insurance should cost? Just click the buttons below to find out.

Note: ValChoice does not receive compensation from insurance companies for analyzing their performance.

![]()

About Dan Karr

Dan has been a CEO or Vice President for high-technology companies for over 20 years. While working as a Senior Vice President of Marketing and Sales for a technology company, Dan was seriously injured while commuting to work. After dealing with trying to get insurance companies to pay his significant medical bills, or to settle a claim so Dan could pay the medical bills, he became intimately aware of the complexity of insurance claims. Dan founded ValChoice to pay forward his experience by bringing consumers, insurance agents and financial advisors easy-to-understand analysis needed to know which insurance companies provide the best price, protection — claims handling — and service.