Why the P&C broker talent crunch won’t end soon

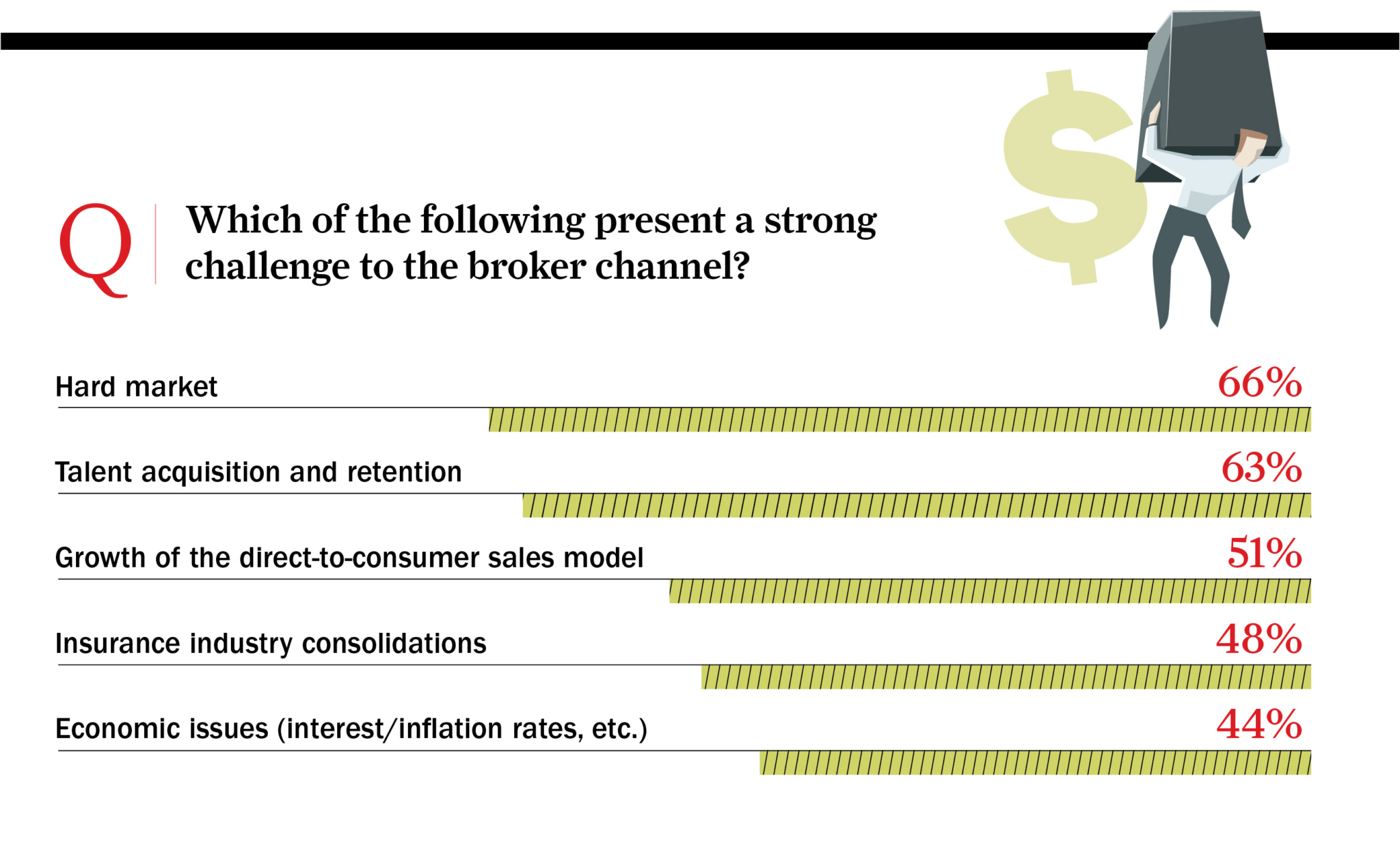

While the hard market’s still a huge challenge for Canada’s broker distribution channel in 2023, finding qualified workers was also top concern for brokers.

So said more than 150 nationwide respondents to Canadian Underwriter’s 2023 National Broker Survey. The survey, fielded in Feb. 2023, was made possible with the support of Sovereign Insurance.

It asked client-facing brokers specifically about their day-to-day challenges and 68% cited recruitment as mission-critical. That level of concern has tracked consistently since 2019 – and ranged from 62% to 69% over the most recent five years.

One comment from a broker at a smaller firm pointed to ongoing stress from the baby boom generation’s gradual retirement. “Who will take over the businesses?” he asked.

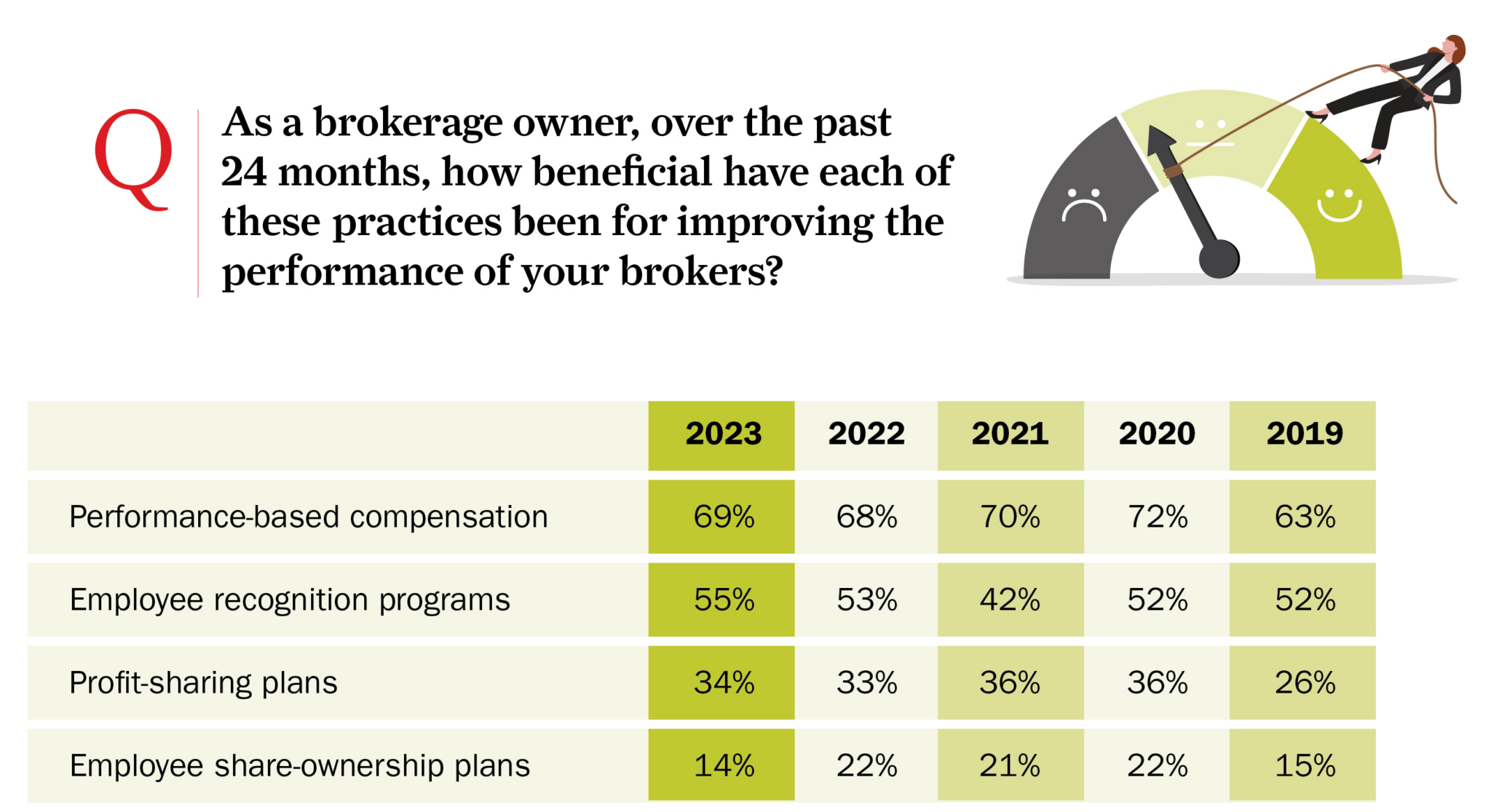

One remedy was offered by another broker who said she and her team members visit work fairs and schools to attract talent. She added her firm now offers increased compensation based on performance.

Beyond recruitment, brokers said they’re worried about employee retention.

Forty per cent of brokers surveyed listed this as a major problem in 2023. This matched 2022’s figure but is 25% higher than 2021’s low water mark of 15%. It exceeded 2020’s 36% and 2019’s pre-hybrid-work response of 27%.

Those who saw clients’ price demands as a challenge fell sharply to 40% in 2023, from 58% in 2022, and the concern tracked lower than any time over the past five years.

It’s a data point worth watching since it could be a leading indicator of how brokers have successfully educated clients to have realistic expectations in the hard market.

Another notable shift between 2022 and 2023 is reduced concern over maintaining client loyalty to 28% this year, compared with 42% in 2022. Plus, adopting new technology mattered to only 30% of brokers this year, down from 48% in 2022 — and 50% in pre-pandemic 2019.

Those numbers suggested the pandemic’s effect of showing why it’s valuable to have a broker, as well as a major tech shift that occurred when brokers first started working remotely, have solidified.

Likewise, 2023’s numbers revealed navigating clients through market disruption is only seen as a challenge by 28% of brokers, far lower than the 48% seen in 2022 and 53% in 2021.

And the need to identify new markets or expansion opportunities slipped down the priority list to 18% in 2023, from 33% in 2022 and 40% in 2021.

Beyond data on the top issues, verbatim comments showed brokers saw less definable existential threats looming for Canada’s P&C industry.

A few pointed to brokerage technologies and how they can best create efficiencies for brokers and generate returns for their businesses.

One broker said looming challenges — including artificial intelligence and directs — may be too numerous to track. What worries him is, “the uncertainty of knowing which [ones] may be game changers.”

Feature image courtesy of iStock.com/DNY59