Which regions have the biggest insurance price increases?

It’s no secret that insurance has been more expensive in recent months. We know from speaking with you each and every day how distressing big price jumps can be, and how confusing and stressful navigating through all the rogue advice online is.

Motor premiums were the big headline, but home insurance has been steadily rising too. And there are certain areas of the UK where prices are increasing more than others. So why does where you live impact your premium price, and what can you do about it?

Is insurance getting more expensive?

Unfortunately, home insurance has got much more expensive. Consumer Intelligence’s latest report shows that the average quote price of home insurance rose by 41.6% in the 12 months till April, the highest annual increase in a decade.

Read: Building Insurance vs Home Insurance | Howden Insurance

Homeowners were most likely to receive quotes of between £150-£199. But if you’ve made claims, you could face steeper costs.

For example, the report revealed that those who had made theft claims within the last five months experienced a 13.8% rise in quoted premium price over the past three months. But some of the largest increases were for those who had buildings claims – 50.3% – and water-related damage, at 49.8%.

It’s a similar story for motor insurance; quote premiums climbed 67.2% between November 2022-November 2023 – also a record-breaking rise. The most common quote was between £500-£749. Drivers aged under 25 have faced the worst of the increases, with a 73.1% premium price hike, but it’s still high for older age groups too. Those aged 25-49 have had their quote premiums rise by 63.9%, while over 50s face rises of 57.2%.

Does where I live affect the price of my insurance?

Where you live, both in terms of the bricks and mortar of the building you call home, and the locality has an impact on the price of your home and motor premium. Insurers can deduce a lot from your postcode; the crime levels in your area, traffic trends, how many uninsured drivers live nearby, and whether your home is prone to flooding. All this helps inform your risk profile and therefore calculate your premium.

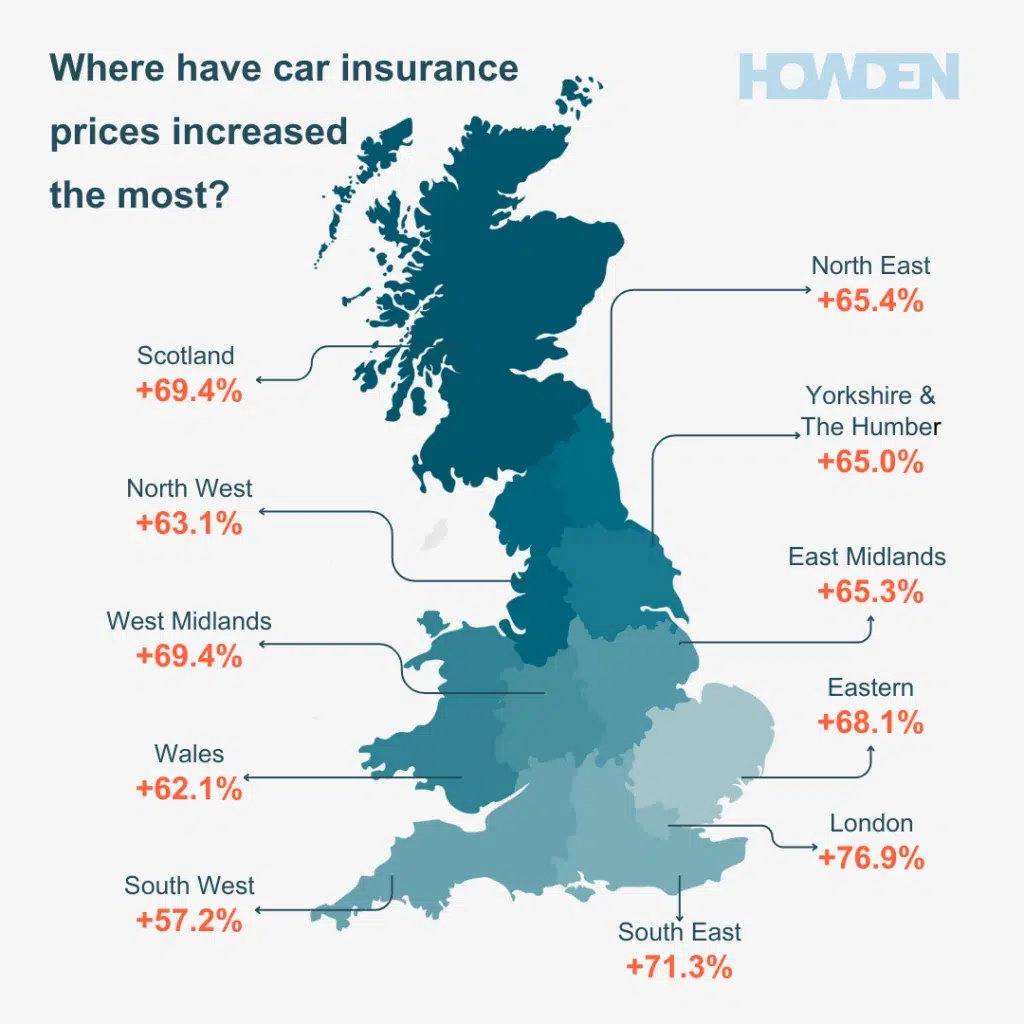

And in the past 12 months, quote insurance premiums have risen across all regions. But it’s worse in some areas compared to others.

Why is insurance so expensive?

The price of insurance has been a hotly debated topic recently, and rightly so. These sharp increases have had a huge impact on your finances, whether you pay annually or by direct debit. As a broker, we’ve not only felt the effects ourselves, but have worked extremely hard to help out our clients.

Unfortunately, the insurance market has been incredibly turbulent. 2023 was marked by bad weather, with the worst weather-related home insurance claims on record thanks to storms Babet, Ciaran and Debi. These struck in the final three months of last year, causing £352m worth of damage to homes.

Claims have also risen in frequency, and in costs to insurers. Car theft has worryingly increased, as cars become more costly to purchase, and more expensive to repair. Even second-hand cars are more expensive than ever before, and since more cars are back on the road since the pandemic, the number of overall claims has risen. You can read more about why here.

Will insurance prices get better?

There are reasons to hope that price rises might be easing. While these annual totals are alarming, looking at more recent trends provides interesting insights.

February-April 2024 saw an increase of 7.6% in quoted home insurance premiums compared with 8.5% and 9.9% for the previous two quarters. Motor premium inflation is also showing signs of slowing. The quarterly increase to the end of November dropped to 10.6% compared with 22% in the previous quarter.

Some insurers already believe that car insurance has now peaked, and we could start to see costs reduce now over the next year. However, some still feel that it’s too early to tell when things will change for the better.

How can I find a lower insurance quote?

In this day and age, we’re all on the look out for great value. And when it comes to your insurance, that means a fair price for a policy that properly protects you. Navigating this period with an expert broker by your side, really can make the whole process easier.

An insurance expert will help you understand the various types of cover available, from Third Party to Comprehensive, or Social Domestic Pleasure versus Business Use, and establish the right level for your lifestyle.

A broker, such as our Howden team, can then use their strong relationships with insurers to find and compare cover that’s specifically tailored to you and your needs. What’s more, we take a no-limits approach to caring for our clients. Whether that’s the little things, from enjoying a cup of tea in branch while we sort your cover, to stepping up when disaster strikes, ready to sort whatever emergency accommodation, transport, or support you may need.

So if that sounds like a service that suits you, why not find your nearest Howden Insurance branch, and pop in to see the team or give them a call?

Sources: Consumer Intelligence, Association of British Insurers