Where Can’t We Sell? The Case for Rapid Distribution Channel Expansion

Published on

August 10, 2023

In 2018, revenues for the online sales site, Craigslist, peaked at $1.03 billion and then began a rapid descent. It is still a viable company (2022 revenues were $694m) but it suffers from a case of channel calcification. Craigslist hasn’t changed much of its functionality since it started, and users find that other options offer a much better experience.

On October 4, 2016 (note the timing), Facebook Marketplace hit the scene. Even though Facebook itself is in decline, its offshoots such as Marketplace and Instagram are thriving. Marketplace is perhaps Craigslist’s most relevant competitor since it allows users to search and buy locally with ease. eBay, another competitor, does less local business, but eBay sellers benefit from integrated shipping options that make it easier for buyers and sellers. And most recently is Etsy, where sellers can offer high-quality, artisanal products and developed an amazing loyal customer base with an estimated 40% are sales from repeat buyers. I know I have bought from all of these depending on what I am looking for – I am a multi-channel buyer.

Facebook Marketplace has some clear advantages over Craigslist, most having to do with the customer experience. First, there’s security. Buyers and sellers can see each other and interact far more easily, removing some of the purchase’s uncertainty. They can comment on each other on the platform, which makes both parties responsible for completing a good and fair transaction. The seller dashboard is easy to use. Payment can be made through the platform if both parties agree to it with multiple different payment options. Sellers can also pay a premium to get “pushed” to the top of the listings.

So, the Craigslist downturn has two components to it: Lack of customer experience improvements and loss of seller preference. If sellers find that they are selling more through a better channel, they’ll move. Buyers will then move with them because the selection improves through the new channel.

There are a dozen lessons in this situation for insurers, but let’s look closely at five.

Lesson 1: Channels aren’t fixed. They are fluid.

Most insurers grasp that they need to create an ecosystem of interconnected channels, using a range of capabilities that will connect with customers when and how they want to buy. Channel development and use is a balancing act. Channel effectiveness is always in motion. Insurers need to ask themselves, “Are we treating our channels as if they are fixed in time or are we preparing to use today’s trending channels today and tomorrow’s trending channels tomorrow.” Not only are channels not fixed in place, but an insurer’s channel strategy needs to be built to flow with channel trends. The way to keep up with customer demand is to become adept at broad distribution methods and great experiences. This is where tech comes in. Many of Majesco customers are re-creating their digital distribution environment using our distribution management solutions and ecosystem of partners.

In a press release announcing our expanded capabilities, Karlyn Carnahan, head of Celent’s North American Insurance practice stated, “If a carrier wants to fully exploit the potential of its various channels, they must think very differently about distribution management, compensation, and segmentation. Distribution management platforms must continue to evolve to enable insurers to manage their distribution force with increasing sophistication.”

Lesson 2: It is crucial for insurers to understand trending channel preferences.

In Majesco’s recent thought-leadership report, Bridging the Customer Expectation Gap: Property Insurance, we look closely at customer purchase channel preferences weighed against insurance plans for channel development. Do they match up? When we visualize the data, the gaps are easy to see.

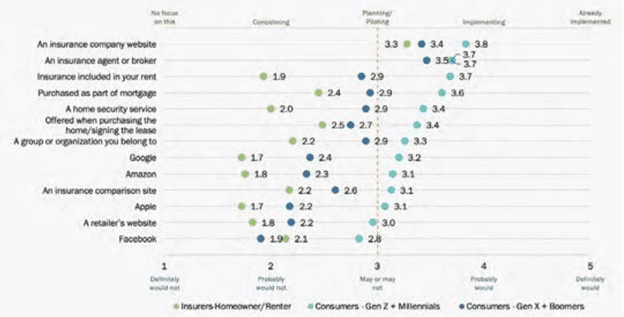

Traditional channels remain the preferred method for purchasing homeowner/renter insurance, including agents/brokers and company websites, as reflected in Figure 1. However, for all the other channels, customers’ interest is nearly twice that of insurers’ actions, particularly for the Gen Z and Millennial segment.

Figure 1: Customer-Insurer gaps in distribution channels for personal property insurance.

The younger generation reflects the desire for access through and all channels. Members of this generation are heavy renters, and they are beginning their transition to homeownership. Insurers who are offering ease of access to renters’ insurance have the opportunity to build strong customer relationships that will generate greater revenue. The digital expectations and ease of access are top priorities for this generation.

Insurers that want to capture more business through a broad-channel approach will pay attention to the larger gaps and trends as they look for opportunities. However, they will also want to pay attention to those spaces where insurers seem to be getting closer, but perhaps their company is still in the consideration phase. This is a sign that competitors may be beating them to lucrative partnerships. For example, there is a lessening gap for the channels, purchasing property insurance at the point of a home purchase or purchased as a part of a mortgage. These partnerships may be increasing in frequency.

Lesson 3: Life and business happen at the point of purchase and vice versa.

Facebook Marketplace had one distinct advantage over Craigslist right from the outset — it was placed where people were interacting, even when they weren’t shopping for anything. When looking at Majesco survey data, it’s clear that SMB commercial property insurance purchases can also happen nearly anywhere there is interaction or engagement. Insurers should be asking themselves, “Where can’t we sell?”

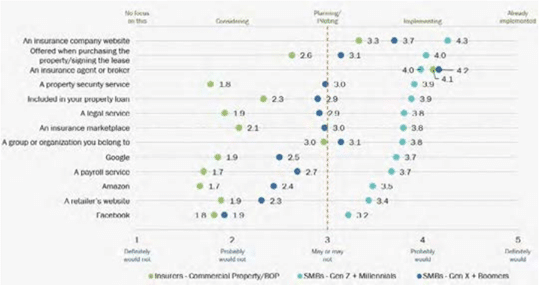

Both generational SMB segments are interested in all channels as shown in Figure 2. However, insurers are not meeting those expectations, with the exception of agents/brokers, and to some extent, company websites. The gaps are significant – up to 2 times what insurers do – particularly for the younger generation of Gen Z and Millennials, consistent with their expectations for a multi-channel world.

These gaps limit insurers’ reach and growth while putting them in a competitive hole as compared to others that are using a multi-channel strategy. While agents will continue to be important, easy access to insurance via other channels, particularly for embedded insurance, will be increasingly important for future viability.

Figure 2: Customer-insurer gaps in distribution channels for commercial property insurance.

For example, in Figure 2, look at the gap between Gen Z/Millennial SMB’s interest inpurchasing property insurance through their payroll service and insurers’ interest in providing property insurance through the payroll channel.

For an SMB owner, there is almost no business partner that is consulted more consistently than the payroll company. Payroll contact happens weekly or bi-weekly. Commercial property insurers would do well to partner with payroll companies. It’s a win/win. It makes an excellent example of the criteria insurers should consider when they are wanting to broaden their distribution. Look for places where life and business happen and those are the points where exposure can be fruitful. Payroll is a point of purchase.

Insurers can look for spots where life and business are going on, even if there may not be a specific purchase involved. Examples of these would be trade associations, community business associations, legal services, maintenance providers, or security services. Certainly, one of the greatest relationship synergies should be between property insurers and property security companies, yet this distribution channel also has one of the largest gaps.

Lesson #4: Don’t think you can wait until tomorrow for channel expansion.

The time is now for rapid multi-channel expansion, enabled by technologies that can handle the increasing pace of change. Some channels may not pan out. Some channels will pull their weight. Some will be lucrative. Like investing in mutual funds instead of individual stocks, insurance technology investments need to allow for a broad approach to distribution.

Change is faster, deeper, wider, and more powerful than we’ve ever been used to before. The result? Growing customer expectation gaps, particularly for the younger generation who are now the dominant buyers put insurers at risk of losing loyalty and stifling growth.

Forward-thinking leaders are making bold, warp-speed moves to close customer expectation gaps and position themselves for market leadership and growth. They are focusing on extended market and customer reach for people and businesses through new distribution channel options, including embedded insurance. These options meet people where they are today, not where they will be next year.

For insurers, adopting a new distribution channel philosophy will give them a stronger, more competitive market position through a growing channel ecosystem that plays to their strengths and closes gaps or weaknesses.

Lesson #5: It isn’t enough to provide a new channel. You should lend something new and improved to the experience.

Partnerships and modern distribution technology are two pieces of the same puzzle. In today’s insurance, you can’t have one without the other. Modern distribution management isn’t just about connections — it is about using data, channel experience, and channel performance to tweak, flex, and generate sales. Good digital experiences happen when the right technologies are used creatively.

Majesco’s Distribution Management and Digital360[DG1] solutions help insurers fast-forward their channel expansion plans, while instantly giving them the cutting-edge AI and machine learning tools to adapt and grow. Insurers should ask themselves questions like, “Can we use our data to anticipate next steps or anticipate additional needs? Is our distribution management feeding us insights that will help us shift in a timely manner?”

Staying at the front of the competitive pack takes an open attitude and a willingness to continually adapt. “Where can’t we sell?” The answer is, “Only where we aren’t prepared to.”

It may be hard to believe, but Craigslist was once “cutting-edge” and disruptive. It certainly shares some of the credit for hastening the demise of some daily print newspapers. Yet, it seems that it was never Craigslist’s goal to become much more than it already was.

Insurers must be different. Leaders that wish to remain on top of the competition will keep distribution technology at the forefront of their priorities. They will also return frequently to their distribution strategy and assess its alignment with individual and business customer channel trends.

For a closer look at how some insurers are aligning themselves to P&C customers, be sure to read Majesco’s thought-leadership report, Bridging the Customer Expectation Gap: Property Insurance. For more information on how today’s tech can help to expand your company’s distribution channels, contact Majesco today.

[DG1]hyperlink